Data Governance has become a critical element in the financial sector as more organizations face severe consequences due to poor data management.

In 2020, Goldman Sachs was hit with a record-breaking fine of $2.9 billion due to criminal charges in its financial reporting. Similarly, Deutsche Bank, Germany’s largest bank, was also fined $186 million for similar reasons.

This article will help businesses understand the importance of Data Governance in finance and how to manage financial data for your organization.

1. What does Data Governance mean in the financial sector?

Data Governance in finance (financial data management) is a framework and process established to ensure financial data’s quality, accuracy, and security throughout its lifecycle. Critical components of Data Governance include data ownership, quality management, regulatory compliance, and risk management. The main goal is to ensure that financial data is reliable, secure, and compliant with internal and external regulations.

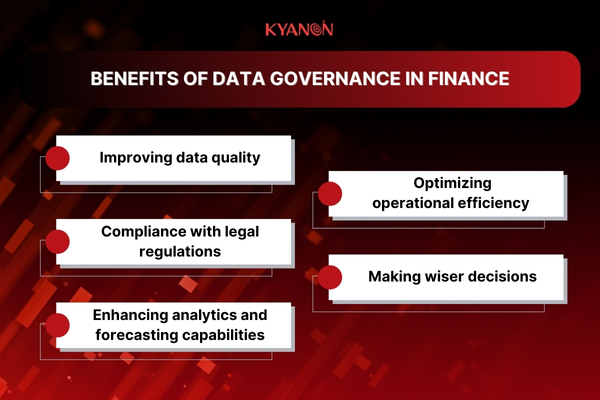

2. Benefits of Data Governance in finance

2.1. Improving data quality

In financial institutions, data often comes from various sources, including customer transactions, internal management systems, and external sources like market information. Data Governance ensures that this vast amount of data remains accurate, consistent, and integral, creating a solid foundation for important decisions.

2.2. Compliance with legal regulations

The financial sector must comply with numerous stringent regulations regarding security and privacy, such as GDPR, Basel III, anti-money laundering regulations, or requirements from governmental regulatory agencies. Implementing Data Governance helps businesses manage data properly, protect personal information, and avoid legal violations.

2.3. Enhancing analytics and forecasting capabilities

With a solid data foundation, financial institutions can deploy more effective analytics and forecasting tools, helping to predict market trends and customer demands and optimize investment portfolios.

2.4. Optimizing operational efficiency

Data is managed systematically through the standardization of data collection and storage methods, making internal processes smoother thereby saving time and resources. Activities such as financial reporting, profit analysis, or risk management are carried out more quickly and accurately.

2.5. Making wiser decisions

When data is managed systematically, every collection, processing, and storage process is clear about the data’s origin, validity, and consistency. This means that when managers or financial analysts review the data to make decisions, they can fully rely on accurate, undistorted, or incorrect figures.

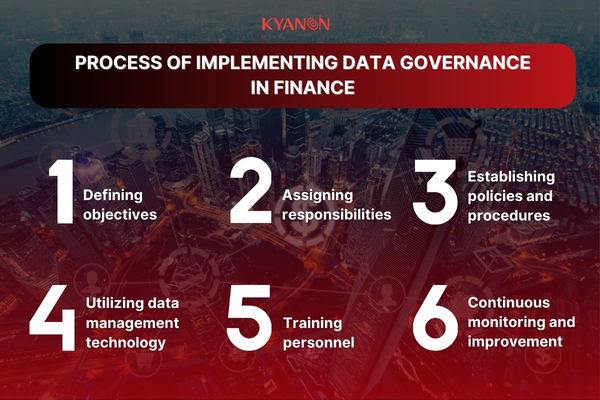

3. Process of implementing Data Governance in finance

Implementing financial data management is necessary to ensure data accuracy and security within financial organizations. To build a strong Data Governance framework, the following basic steps should be taken:

– Defining objectives: The organization needs to clearly define the objectives of data governance, including data quality, regulatory compliance, and risk management.

– Assigning responsibilities: Next, determine who is responsible for each data type, such as Data Managers, Data Owners, and the Data Governance Board. Clear assignments will help ensure data is managed consistently and responsibly.

– Establishing policies and procedures: Data management policies and procedures must be developed and widely disseminated within the organization so that all employees are aware.

– Utilizing data management technology: Businesses should use appropriate tools for financial data governance, including data management platforms, analytics, and reporting systems to ensure transparency and data traceability.

– Training personnel: Training programs can be organized for the finance department and related departments to ensure that employees fully understand data governance principles and create a data-conscious culture.

– Continuous monitoring and improvement: Establish monitoring mechanisms to track the effectiveness of data governance processes and improve them based on feedback and changes in the business environment.

4. Success stories of implementing Data Governance in fiance

Citibank is a typical example of successfully applying Data Governance in the financial sector. To address data-related issues, Citibank developed a centralized data management system. This system allows the bank to track and control all customer-related data from various sources, including bank transactions, credit history, and personal information. By unifying data on a single platform, Citibank can ensure that all information is up-to-date and consistent, helping to minimize errors in financial reporting.

Another example is AIG (American International Group) – one of the world’s largest insurance corporations. Operating in many countries, AIG must handle vast amounts of data from multiple sources, including customer information, insurance contracts, and claims history. By establishing data management standards, AIG ensures data integrity and consistency, helping to minimize errors in decision-making processes. Additionally, applying data quality management measures helps AIG build accurate financial reports, meeting requirements from global financial regulatory agencies.

Visa Inc. is also an outstanding example of successfully applying Data Governance. With millions of credit card transactions processed daily, Visa uses a data analysis model to monitor and identify unusual activities, such as transactions exceeding the user’s usual spending or occurring in locations inconsistent with their habits. This helps minimize financial losses while ensuring customer trust and maintaining transparency in financial operations.

5. Conclusion

Data Governance plays a key role in ensuring the quality and accuracy of financial data, thus optimizing critical decisions. By implementing effective data management and protection processes, businesses enhance transparency and legal compliance, discover opportunities, and reduce risks. This is a solid foundation for the financial sector to grow sustainably in a highly competitive market.

Kyanon Digital offers suitable solutions to help businesses ensure accuracy, security, and regulatory compliance, making financial data governance easier. With our experience and expertise, Kyanon Digital supports businesses in optimizing data management processes effectively and sustainably.

Contact Kyanon Digital for consultation on financial data governance from leading experts in the field.