Client Overview

A leading financial institution in Southeast Asia with over 90 years of heritage and operations across multiple key markets. As one of the region’s largest banks, the client offers comprehensive financial services including retail banking, corporate banking, wealth management, and insurance. Known for customer-centric innovation and digital transformation leadership, the institution consistently ranks among the world’s safest and most sustainable banks, serving millions of customers across diverse markets.

Business Challenge

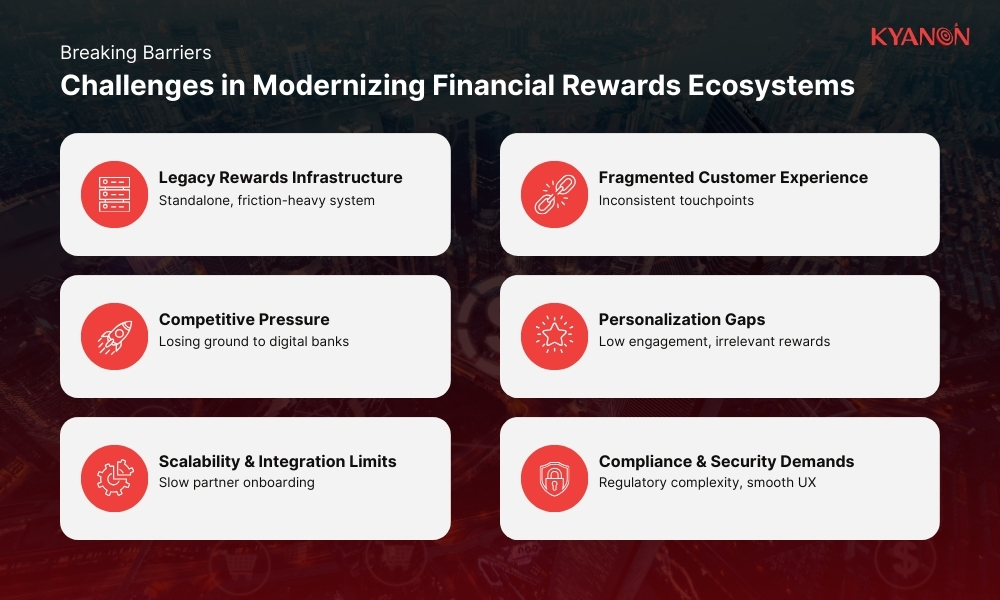

The financial services industry faces unprecedented pressure to enhance customer engagement and loyalty in an increasingly competitive digital landscape. Our client encountered several strategic challenges with their existing rewards ecosystem:

Legacy Rewards Infrastructure Limitations

The traditional points-based rewards system operated as a standalone program disconnected from core banking services. Customers experienced friction when attempting to redeem rewards, often requiring separate logins, manual point calculations, and complex redemption processes that discouraged engagement and reduced program effectiveness.

Fragmented Customer Experience Across Touchpoints

Digital and physical banking interactions provided inconsistent rewards experiences. Mobile banking apps, online portals, branch visits, and partner merchant interactions each had different interfaces and capabilities, creating confusion and reducing the perceived value of the rewards program.

Competitive Pressure from Fintech & Digital Banks

Emerging fintech companies and digital-native banks were attracting customers with sophisticated, gamified rewards platforms that provided instant gratification and personalized experiences. The client needed to modernize their approach to retain existing customers and attract digitally-savvy demographics.

Personalization & Relevance Gaps

The existing system offered generic rewards without leveraging the rich customer data available through banking relationships. This resulted in low engagement rates, poor redemption patterns, and missed opportunities to strengthen customer relationships through relevant, timely offers.

Scalability & Partnership Integration Challenges

Expanding the rewards program to include new merchant partners, service providers, and co-branded opportunities required extensive manual integration work. The inflexible architecture limited the bank’s ability to quickly respond to market opportunities or customer preferences.

Regulatory Compliance & Security Requirements

Banking regulations require stringent security measures and compliance protocols for any customer-facing financial platform. The rewards system needed to meet these requirements while maintaining an intuitive, friction-free user experience.

Transform your ideas into reality with our services. Get started today!

Our team will contact you within 24 hours.

Our Solution

Kyanon Digital architected and delivered a comprehensive digital rewards ecosystem that transforms customer engagement through seamless integration, personalization, and innovative payment experiences:

Unified Rewards & Payment Integration Platform

- Seamless Checkout Experience: Engineered a sophisticated payment integration that allows customers to seamlessly combine rewards points with traditional payment methods (Visa, Mastercard, bank transfers) during any transaction. The system automatically calculates optimal point-to-cash ratios and presents customers with personalized redemption options in real-time.

- Cross-Channel Consistency: Developed a unified API layer that ensures consistent rewards experiences across mobile banking apps, web platforms, in-branch kiosks, and partner merchant systems. This approach eliminates the traditional silos between rewards and core banking services.

Intelligent Personalization Engine

- Behavioral Analytics Integration: Built an advanced recommendation engine that analyzes customer banking patterns, transaction history, and preferences to deliver highly personalized deal recommendations. The system continuously learns from customer interactions to improve relevance and engagement over time.

- Dynamic Offer Optimization: Implemented machine learning algorithms that optimize offer timing, value propositions, and presentation based on individual customer profiles and real-time context, significantly increasing conversion rates and program engagement.

Enhanced Security & Compliance Framework

- Multi-Layer Security Architecture: Designed a comprehensive security framework incorporating end-to-end encryption, tokenization for sensitive data, and multi-factor authentication that meets stringent banking security standards while maintaining user convenience.

- Regulatory Compliance Integration: Built-in compliance monitoring and reporting capabilities ensure all rewards transactions meet local banking regulations and international standards, with automated audit trails and risk management protocols.

Scalable Partnership Ecosystem

- Flexible Integration Framework: Created a modular, API-first architecture that enables rapid onboarding of new merchant partners, service providers, and co-branded opportunities. This approach reduces integration timelines from months to weeks and supports diverse partnership models.

- Real-Time Settlement System: Developed automated settlement and reconciliation processes for multi-party transactions involving rewards points, merchant payments, and bank settlements, ensuring accurate and timely financial processing.

Technology Approach & Strategic Architecture

Customer-Centric Design Philosophy

Rather than building another rewards application, we created a comprehensive customer engagement platform that seamlessly integrates rewards into the customer’s financial journey. The mobile-first design prioritizes intuitive navigation and instant gratification while maintaining the security and reliability expected from a leading financial institution.

Real-Time Processing & Decision Engine

The platform processes rewards calculations, eligibility verification, and payment authorization in real-time, ensuring customers receive immediate feedback and confirmation. This approach eliminates the traditional delays associated with points-based systems and creates a more satisfying user experience.

Omnichannel Integration Strategy

Beyond mobile and web interfaces, the platform integrates with existing core banking systems, merchant point-of-sale systems, and third-party service providers through standardized APIs. This comprehensive integration approach ensures customers can access and redeem rewards across any touchpoint in their banking relationship.

Data-Driven Optimization Platform

Advanced analytics capabilities provide the bank with detailed insights into customer preferences, program performance, and market opportunities. This intelligence enables continuous optimization of offers, partnerships, and platform features to maximize customer value and business outcomes.

Results & Business Impact

The transformed rewards platform delivered significant improvements across customer experience, operational efficiency, and business growth metrics:

Enhanced Customer Engagement

The seamless integration of rewards into everyday banking experiences dramatically increased program participation and customer satisfaction. The personalized approach to offers and deals created more meaningful customer interactions and strengthened relationships with the bank’s services.

Operational Excellence

Automated processes and real-time settlement capabilities reduced manual overhead and processing errors while improving the speed and accuracy of rewards transactions. The platform’s scalability enabled rapid expansion of partnership opportunities without proportional increases in operational complexity.

Competitive Differentiation

The sophisticated rewards experience positioned the bank as an innovation leader in the financial services market, helping retain existing customers and attract new demographics seeking modern, convenient banking relationships.

Strategic Platform Foundation

The flexible, API-driven architecture created a foundation for future innovation, enabling the bank to quickly launch new services, partnerships, and customer experiences as market opportunities emerge.

Security & Compliance Excellence

The platform maintained the highest standards of financial services security while delivering consumer-grade user experiences, demonstrating that regulatory compliance and customer convenience can coexist effectively.

Industry Applications & Use Cases

This rewards platform architecture addresses critical needs across various financial services sectors:

Retail Banking

Transform traditional loyalty programs into integrated customer experience platforms that strengthen primary banking relationships and increase product cross-selling opportunities.

Credit Card Services

Enhance credit card rewards programs with real-time redemption, personalized offers, and seamless integration with merchant ecosystems to drive card usage and customer lifetime value.

Digital Banking & Fintech

Provide established financial institutions with modern, competitive customer engagement capabilities that match or exceed digital-native challengers.

Corporate Banking

Adapt the platform for B2B customers with expense management integration, employee rewards programs, and corporate partnership benefits.

Why This Matters

In the evolving financial services landscape, customer loyalty is increasingly driven by experience quality rather than just product features. This integrated rewards platform demonstrates how traditional banks can leverage their existing customer relationships and data assets to create compelling, personalized experiences that build deeper engagement and competitive differentiation.

Ready to transform your customer loyalty program? Contact Kyanon Digital to discover how our proven approach can revolutionize your rewards strategy and strengthen customer relationships.

________________________________________________________________________________________________________

Results based on post-implementation analysis. Individual outcomes may vary based on specific business requirements, existing system complexity, and implementation scope.