Apple Pay and its impact on E-commerce in Vietnam have been creating a buzz for both businesses and consumers since its launch in 8 August. The launch is a major milestone for the Vietnamese E-commerce market as it makes it easier and more secure for consumers to shop online. Customers in Vietnam can now use Apple Pay on iPhone, Apple Watch, iPad, and Mac.

Vietnam has a fast-growing E-commerce market and one of the highest smartphone and internet penetration rates worldwide. As a result, the country has seen accelerated growth on many digital fronts, including digital payment. Formally one of the most cash-reliant countries in Asia, the adoption rate for cashless payments in Vietnam rose to 95 percent a year into the COVID-19 pandemic, one of the highest rates in Southeast Asia.

1. What is Apple Pay?

Apple Pay replaces your physical cards and cash with an easier, safer, more private and secure payment method. It works by using near-field communication (NFC) technology to transmit payment information from the device to a payment terminal. You can use it online, in apps, and in stores. It’s the simple way to pay every day.

Apple Pay – NFC Technology

2. Vietnam Mobile Payments Market

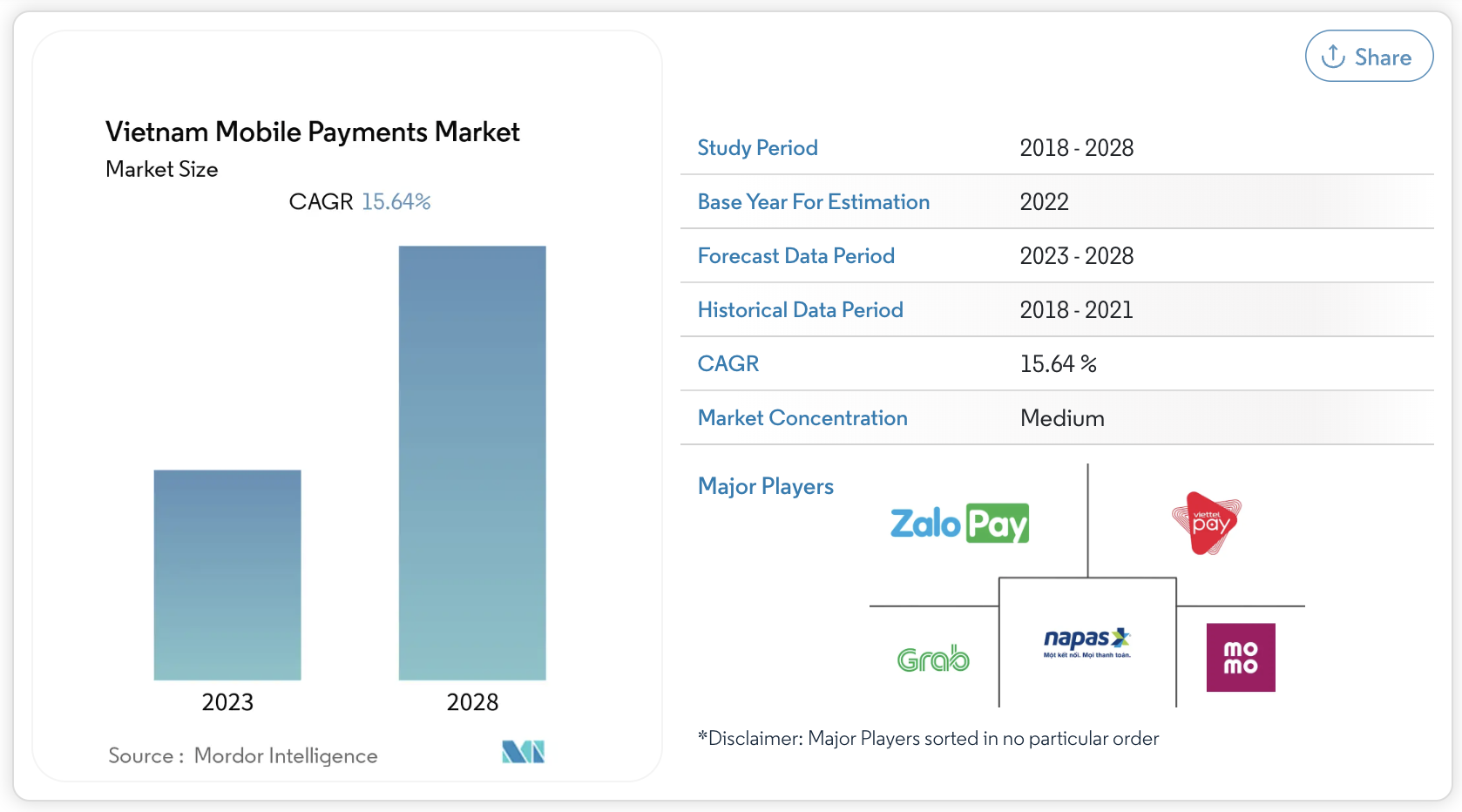

The Vietnamese E-commerce market is growing rapidly, and mobile payments are becoming increasingly popular. The Vietnam mobile payments market for mobile payments is anticipated to expand at a CAGR of 15.64 percent over the projected period (2022 – 2027). The use of mobile payment systems like M_Service, Viettel Digital Services, ZaloPay, National Payment Corporation of Vietnam, and GrabPay by businesses and services nationwide is progressing quickly. This trend is anticipated to persist during the projection period due to rising internet usage and the rapid expansion of online shopping.

Vietnam Mobile Payments Market

Source: Mordor Intelligence

3. Impact of Apple Pay on E-commerce in Vietnam

3.1. Increased adoption of E-commerce

There are several reasons why Apple Pay makes it easier and more convenient for consumers to shop online. First, Apple Pay does not require consumers to enter their credit or debit card information manually. This can save consumers time and effort, as they can simply tap their device on the merchant’s point-of-sale terminal to complete the payment. Second, Apple Pay is more secure than traditional credit or debit cards. When consumers use Apple Pay, their card information is not stored on their device or transmitted to the merchant’s website. This means that their card information is less likely to be stolen. Third, Apple Pay is accepted by a growing number of online merchants. This makes it easier for consumers to use Apple Pay to shop online, even if they are not familiar with the merchant.

As a result, Apple Pay is expected to lead to an increase in E-commerce adoption in Vietnam. Consumers will be more likely to shop online if they have a convenient and secure way to pay. This will benefit both consumers and merchants, as it will create new opportunities for businesses to sell their products and services to a wider audience.

Apple Pay ensures security.

3.2. Improved customer experience

The launch of Apple Pay marks a significant milestone in the advancement of cashless payments in Vietnam. Customers can now use Apple Pay with their Visa card and experience a seamless and secure payment method, further enhancing the convenience of digital transactions. This eliminates the need for consumers to carry cash or credit cards, and it makes it easier and more convenient to shop online.

Apple Pay provides a number of benefits for consumers, including:

- Fast checkout: Apple Pay allows consumers to complete a purchase with just a few taps on their device. This can save consumers time and frustration, as they no longer have to wait in line to pay for their purchases.

- Convenience: Apple Pay is a convenient way to pay for purchases online. Consumers do not need to carry cash or credit cards, and they can make payments from anywhere with an internet connection.

- Security: Apple Pay is a secure way to pay for purchases online. When consumers use Apple Pay, their payment information is not stored on their device or transmitted to the merchant’s website. This means that their payment information is less likely to be stolen.

Apple Pay offers convenience.

3.3. Reduced fraud

Apple Pay uses advanced security features to protect consumers’ payment information, which is expected to reduce fraud in the Vietnamese E-commerce market.

According to Apple, some significant features of the app may include:

- Tokenization: Apple Pay issues a merchant token when a customer initiates a purchase using Apple Pay in your app or on your website. When your app or website creates a payment request for a recurring payment or an automatic-reload payment, it passes your server’s notification URL in the tokenNotificationURL parameter.

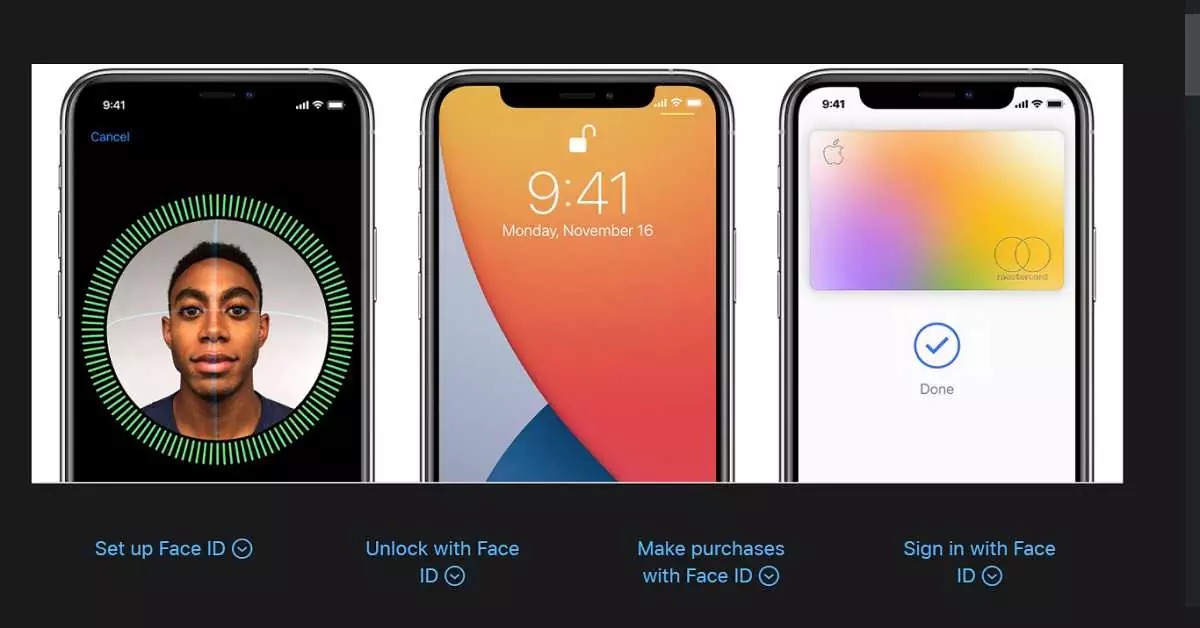

- Biometric authentication: Apple Pay requires biometric authentication for each transaction. This can be Touch ID or Face ID, depending on the device. This means that consumers must use their fingerprint or facial recognition to authorize each payment. This makes it much more difficult for hackers to make unauthorized purchases with Apple Pay.

- Encryption: Apple Pay uses end-to-end encryption to protect consumers’ payment information. This means that their payment information is encrypted when it is stored on their device, transmitted to the merchant, and processed by the payment processor. This makes it virtually impossible for hackers to steal consumers’ payment information.

Biometric authentication on Apple Pay

3.4. Increased competition in the E-commerce market

The launch of Apple Pay is likely to increase competition in the Vietnamese E-commerce market. This is because merchants will compete to offer the best mobile payment experience to their customers. Merchants who offer Apple Pay will be more likely to attract customers, as Apple Pay is a convenient and secure way to pay for purchases online. This will ultimately benefit consumers, as they will have more options to choose from and lower prices.

E-commerce merchants increase their competitiveness when offering Apple Pay to customers.

E-commerce merchants increase their competitiveness when offering Apple Pay to customers.

4. Conclusion

The launch of Apple Pay in Vietnam is a positive development for the country’s E-commerce market. It is expected to boost adoption of E-commerce, improve customer experience, reduce fraud, and increase competition in the E-commerce market.

The Vietnamese E-commerce market is expected to continue to grow rapidly in the coming years. Among one of the fastest-growing internet economies within the Southeast Asian region, Vietnam’s E-commerce market value was forecast to reach 39 billion U.S. dollars by 2025, ranking second only after Indonesia.

With the current digital population, rising internet penetration, and the launch of new technologies, Vietnam’s e-commerce landscape provides fertile ground for E-commerce businesses to thrive. Kyanon Digital is a leading provider of E-commerce consultation services and solutions. If you want to penetrate this growing market, contact us now for expert advice.