Retail analytics has become a core revenue engine as global retailers shift toward data-driven operations, unified commerce, and predictive decision-making.

The global retail analytics market is projected to exceed USD 25–31 billion by 2030 (The Business Research Company), driven by enterprises prioritizing real-time data to optimize pricing, demand forecasting, and customer experience.

Yet, despite rising investment, operational gaps persist: recent market reports place retail analytics at roughly USD 10.2–13.2 billion (2024–2025) and repeatedly highlight inventory management and shelf-space allocation as top use cases, indicating much spending is focused on fixing availability and assortment problems rather than purely exploratory analytics (Fortune Business Insights).

For businesses, the challenge is no longer gathering data but converting analytics into precise operational decisions that protect margins and drive growth.

In this guide, Kyanon Digital examines the 7 retail analytics decisions that most directly influence revenue, separating vanity metrics from true strategic levers.

Key findings

Quick overview table

|

Decision |

One-line impact | Typical ROI window |

Primary risk if ignored |

|

Demand forecasting & inventory planning |

Fewer stockouts / lower holding costs | 6–18 months |

Lost sales/cash tied in inventory |

|

Price optimization & dynamic pricing |

Margin and revenue uplift | 3–9 months |

Margin erosion/pricing errors |

|

Customer segmentation & personalization |

Higher CLV and conversion | 6–12 months |

Low retention/wasted marketing spend |

|

Assortment planning |

Better sell-through per SKU | 6–12 months |

Dead stock / poor SKU productivity |

|

Marketing attribution & campaign management |

Better channel ROI | 1–3 months (measurement); 6–12 for optimization |

Wasted ad budget |

|

Store layout & in-store analytics |

Increased sales per m² | 3–9 months |

Low physical conversion |

|

Supply chain optimization |

Lower logistics cost, faster fulfilment | 6–18 months |

Fulfillment failures/customer churn |

Further readings:

- AI Predictive Analytics in Ecommerce in the SEA

- Building an Enterprise Data Warehouse for Commerce

- Top 10 Big Data Analytics Companies in Vietnam

What is retail analytics?

Retail analytics is the structured process of transforming operational data, including inventory levels, supply chain activity, and customer demand, into actionable intelligence that improves procurement, pricing, marketing, and revenue decisions (Oracle).

Retail analytics converts real-time and historical retail data into predictive and prescriptive insights that help enterprises optimize inventory, pricing, and customer engagement to increase revenue and efficiency.

In 2026, the industry is shifting toward agentic AI, where analytics systems move beyond reporting and begin executing decisions across digital and physical retail operations. According to McKinsey & Company, autonomous decision intelligence systems can accelerate decision cycles by 5–10×, enabling faster responses to demand and pricing changes.

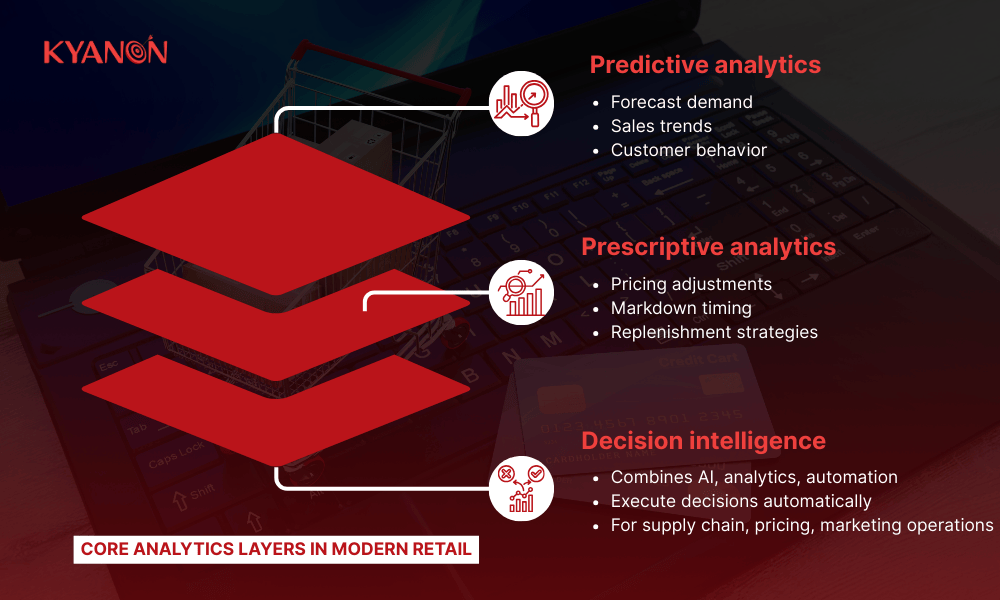

Core analytics layers in modern retail

- Predictive analytics: Uses historical and real-time data to forecast demand, sales trends, and customer behavior, helping enterprises anticipate demand spikes and inventory needs.

- Prescriptive analytics: Recommends optimal actions such as pricing adjustments, markdown timing, or replenishment strategies to maximize margin and sell-through.

- Decision intelligence: Combines AI, analytics, and automation to execute decisions automatically across supply chain, pricing, and marketing operations.

Main types of retail analytics used by enterprises

Quick overview table

|

Type |

Purpose |

Example use case |

|

Descriptive analytics |

Understand what happened |

POS dashboards, sales trend reports |

|

Diagnostic analytics |

Understand why it happened |

Root-cause analysis of margin decline |

|

Predictive analytics |

Forecast what will happen |

Demand forecasting, churn prediction |

|

Prescriptive analytics |

Recommend what to do |

Dynamic pricing, automated replenishment |

Tools & stacks that businesses must check

- Data layer: cloud data warehouse, event stream, MDM.

- Analytics: feature store, forecast engines, optimization solvers.

- Serving: API layer, CDP/CMS integration, price engines.

- Observation: A/B test platform, experiment tracking.

Transform your ideas into reality with our services. Get started today!

Our team will contact you within 24 hours.

Top 7 retail analytics decisions that impact revenue most

Based on recent retail data, the following seven analytics-driven decisions have the highest impact on revenue by optimizing operations, enhancing customer experience, and improving margins:

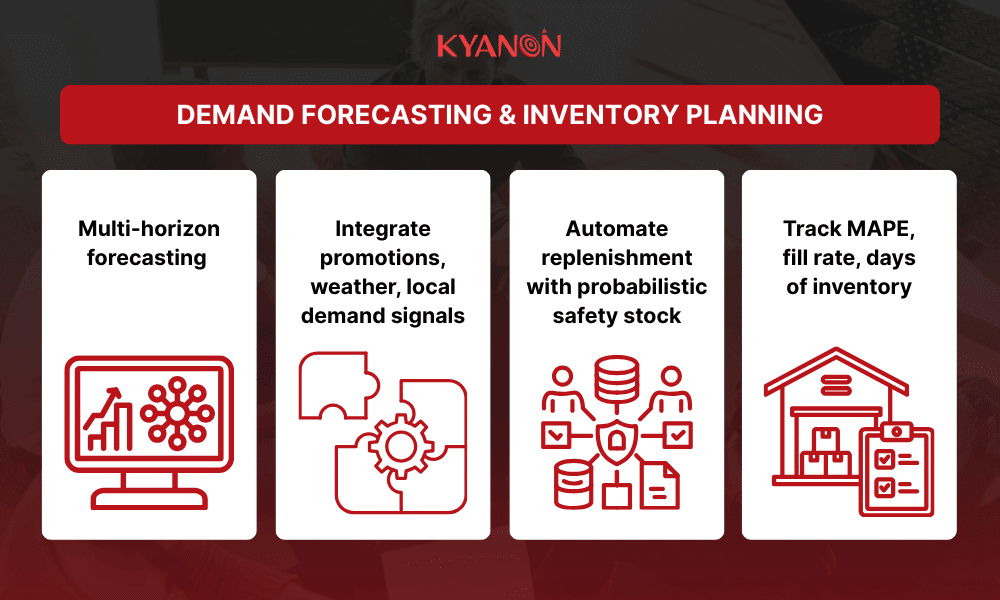

Demand forecasting & inventory planning

Traditional forecasting often fails to account for nonlinear market signals, leading to the bullwhip effect, where inventory levels mismatch actual demand.

Better demand forecasting reduces lost sales and excess stock; advanced models combine POS, web, promotions, local events, and supply lead times. Inventory analytics and AI in distribution use cases have shown inventory reductions in the 20–30% range when fully embedded into operations (McKinsey).

Best practices

- Best practices of demand forecasting & inventory planning.

- Apply multi-horizon forecasting (store × SKU × channel)

- Integrate promotions, weather, and local demand signals

- Automate replenishment using probabilistic safety stock

- Track core metrics: forecast accuracy (MAPE), fill rate, days of inventory

Risks

- Poor data integration (channel islands) yields biased forecasts.

- Over-reliance on black-box models without guardrails causes stocking mistakes.

Price optimization & dynamic pricing

Manual pricing is no longer viable in an environment where competitors use automated algorithms to adjust prices thousands of times per day.

Real-time price optimization combines elasticity, competitor moves, inventory state, and margin targets to capture incremental revenue; implementations often report mid-single to low-double digit revenue/profit uplifts in empirical studies (SSRN).

Best practices

- Best practices of price optimization & dynamic pricing

- Start with controlled pilots on selected SKUs or channels

- Use elasticity modeling and A/B testing to validate pricing impact

- Set guardrails for brand positioning, compliance, and customer trust

Risks

- Customer trust is at risk if personalization feels unfair.

- Operational complexity: price propagation and reconciliation errors.

Customer segmentation & personalization

Segmentation that leverages behavior, value, and propensity models increases conversion and CLV; top personalization performers generate notably more revenue from these activities.

Best practices

Best practices of customer segmentation & personalization.

- Build a unified customer profile (1:1 identity graph where possible).

- Prioritize segments by revenue opportunity (CLV, margin).

- Use recommendations and targeted offers, and measure incremental revenue via holdouts.

Risks

- Privacy/regulatory constraints (consent, data residency).

- Siloed loyalty and e-commerce data reduce personalization lift.

Assortment planning

Assortment planning uses retail analytics to determine which products should be sold in each store, region, and channel. A data-driven assortment strategy improves sell-through, reduces markdown dependency, and maximizes revenue per SKU.

Traditional assortment decisions based on historical sales alone often ignore regional demand shifts, seasonality, and omnichannel behavior. Advanced retail analytics combines transaction data, local demand signals, and margin performance to build high-performing product mixes.

Best practices for enterprises

- Use cluster-based store segmentation: Group stores or channels by similar demand patterns and customer behavior to localize assortment decisions instead of using a single national assortment.

- Combine macro trends with local data: Balance global trends and brand strategy with localized sales and demand signals to determine product breadth vs. depth.

- Track SKU productivity continuously: Monitor revenue per SKU, sell-through rate, and inventory turnover to identify high-performing and underperforming items early.

- Manage lifecycle and markdown analytics: Analyze markdown curves and product lifecycle data to optimize timing for promotions, replenishment, or discontinuation.

Common risks if done poorly

- Overstocking slow-moving SKUs

- Missing high-demand local products

- Margin erosion due to heavy markdowns

- Inefficient use of shelf and warehouse space

Marketing attribution & campaign management

Retail analytics enables accurate marketing attribution by identifying which channels and campaigns generate real incremental revenue. In a cookie-less environment, enterprises must rely on first-party data and server-side tracking to measure performance reliably.

Traditional last-click attribution no longer reflects the full customer journey. Modern attribution combines cross-channel data, experimentation, and AI models to optimize marketing spend and conversion.

Best practices for enterprises

- Use experiment-driven attribution: Apply geo testing, holdout groups, or controlled experiments to measure true incremental revenue from campaigns.

- Apply multi-touch attribution models: Use multi-touch and contribution models to understand channel influence across the customer journey, but treat them as decision support tools rather than the absolute truth.

- Prioritize incrementality and ROAS: Measure actual revenue lift and return on ad spend instead of relying only on impressions or clicks.

- Build strong first-party data foundations: Unify CRM, e-commerce, and customer interaction data to maintain attribution accuracy as third-party cookies decline.

Common risks

- Overfitting attribution models to historical channel performance

- Fragmented measurement across multiple platforms and vendors

- Inaccurate ROI insights due to weak data integration

- Over-reliance on vanity metrics rather than revenue impact

Store layout & in-store analytics

Retail analytics uses footfall data, heatmaps, POS insights, and computer vision to optimize store layout and product placement. This helps increase conversion, cross-selling, and revenue per square meter.

Modern in-store analytics connects physical behavior with digital data to create a unified view of customer journeys across channels.

Best practices for enterprises

- Integrate online and offline behavior: Combine e-commerce clickstream data with in-store footfall and POS insights to align promotions and product placement.

- Use experiment-driven layout optimization: Test product placement, fixtures, and adjacencies through controlled experiments to measure sales uplift.

- Track core store performance metrics: Monitor sales per square meter, dwell time, conversion rate, and basket size to evaluate layout effectiveness.

- Leverage computer vision and sensors carefully: Deploy in-store analytics technologies with clear data governance and privacy compliance.

Common risks

- Privacy and regulatory concerns around in-store tracking

- High implementation cost of sensors and computer vision

- Data latency between capture and analytics systems

- Poor integration between the store and digital analytics

Supply chain optimization

Retail analytics enables end-to-end supply chain visibility and predictive logistics, helping enterprises reduce stockouts, lower logistics costs, and improve fulfillment speed.

By combining demand forecasts, supplier data, and real-time logistics signals, businesses can move from reactive operations to predictive and automated supply chain decisions.

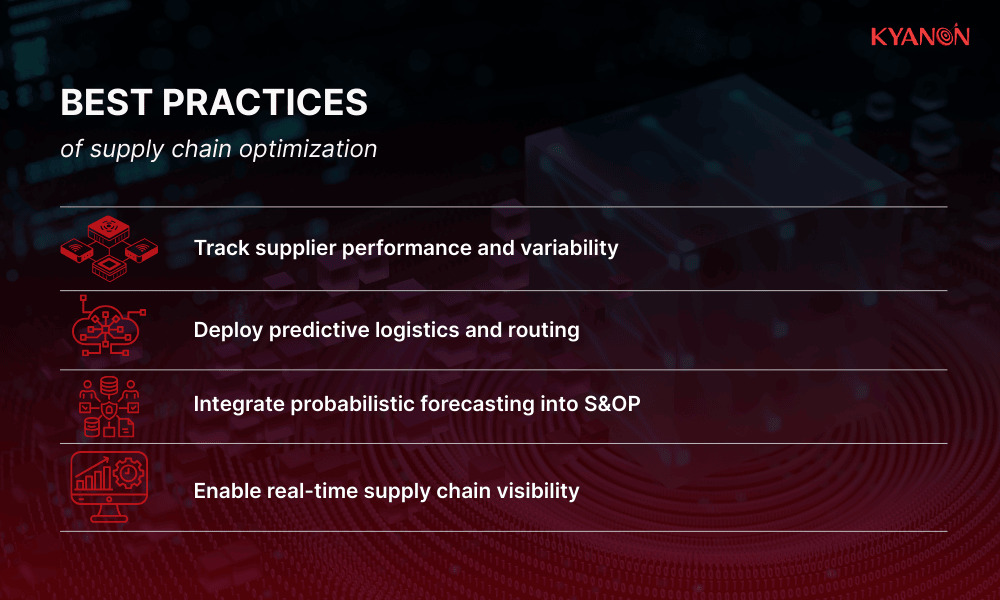

Best practices for enterprises

- Track supplier performance and variability: Monitor lead times, fill rates, and supplier reliability to anticipate risks and adjust sourcing decisions.

- Deploy predictive logistics and routing: Use predictive ETA models and dynamic routing to improve delivery speed and reduce transportation costs.

- Integrate probabilistic forecasting into S&OP (sales & operations planning): Embed demand uncertainty and scenario planning into sales and operations planning for more resilient decisions.

- Enable real-time supply chain visibility: Connect warehouse, transportation, and inventory data into a unified analytics platform

Common risks

- Limited visibility into supplier data and upstream operations

- Integration challenges across logistics systems

- Over-automation without human escalation and control

- Inaccurate forecasts leading to fulfillment issues

Key impact metrics that matter for businesses

Enterprises should evaluate the success of their analytics investments using these core KPIs:

Quick overview table

|

Metric |

What to watch |

How to measure |

|

Fill rate/stockouts |

Lost sales risk |

% orders fulfilled from stock |

|

Forecast accuracy |

Inventory efficiency |

MAPE, RMSE by SKU/store |

|

Gross margin % |

Pricing effectiveness |

Revenue minus COGS/revenue |

|

AOV |

Upsell effectiveness |

Average order revenue |

|

Conversion rate |

CX and channel health |

Visits → transactions |

|

CLV |

Long-term value |

Cohort revenue over time |

| Logistics cost/order | Supply chain efficiency |

Total logistics/orders shipped |

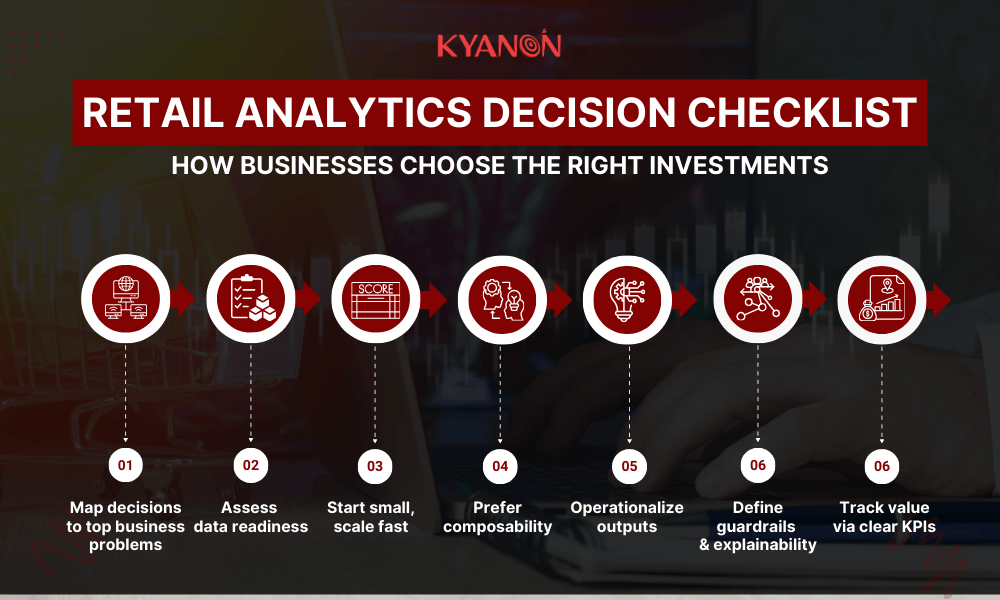

Decision checklist for businesses

- Map decisions to the top 2 business problems: For example, stockouts -> invest in forecasting; margin pressure -> pricing.

- Assess data readiness: Can you join POS, inventory, promotions, web events, and supplier data?

- Start small, scale fast: Pilot narrow use cases with strong measurement (A/B or hold-out).

- Prefer composability: Use best-of-breed modules for forecasting, pricing, and CDP rather than rip-and-replace.

- Operationalize outputs: Ensure the model outputs connect to replenishment, price engines, and campaign systems.

- Define guardrails and explainability: For pricing and personalization, add business rules and audit trails.

- Track value via clear KPIs: Set a baseline and compare incremental revenue, margin, or cost reduction.

Short vendor evaluation rubric

|

Criterion |

What to require |

Why it matters |

|

Data connectors |

Pre-built connectors to POS, e-comm, CDP |

Faster time to insight |

|

Forecasting method |

Probabilistic, not just point forecast |

Better safety-stock decisions |

|

Explainability |

Feature importance, scenario analysis |

Trust, audit, cross-functional buy-in |

|

Deployment |

Real-time API for pricing/replenishment |

Operational impact |

|

Security & compliance |

Data residency, consent management |

Legal/regulatory risk |

|

Commercial model |

Outcome-aligned pricing options |

Align incentives |

Why choose Kyanon Digital as your partner?

Enterprises implementing retail analytics require more than dashboards. They need scalable data architecture, AI-driven decision systems, and integration across commerce, supply chain, and customer platforms.

Kyanon Digital supports enterprises in building scalable retail analytics and AI-driven decision systems aligned with revenue, margin, and operational KPIs.

- Data & analytics foundation

- Design and implement a unified data architecture across POS, e-commerce, CRM, and supply chain

- Build real-time dashboards and decision intelligence systems

- Enable predictive and prescriptive analytics for revenue and margin optimization

- AI and automation integration

- Apply machine learning to forecasting, pricing, and customer analytics

- Embed analytics outputs into operational systems (ERP, commerce, marketing automation)

- Support automation-driven decision execution, not just reporting

- Retail & commerce domain experience

- Omnichannel analytics across online and offline retail

- Customer behavior and conversion analytics

- Inventory, demand, and supply chain data optimization

Case study: Building a scalable retail analytics foundation for real-time revenue decisions by Kyanon Digital

A leading retail enterprise partnered with Kyanon Digital to modernize its fragmented data ecosystem and enable real-time, AI-driven business intelligence.

The goal was to unify multi-channel data sources, improve reporting speed, and empower leadership with predictive insights for faster, data-backed decisions.

Challenges

- Disconnected data across POS, eCommerce, ERP, and CRM systems

- Slow manual reporting cycles with limited real-time visibility

- Inconsistent data quality and lack of centralized governance

- Difficulty forecasting demand and customer behavior

- Limited scalability to support expansion and omnichannel growth

Solution

Kyanon Digital designed and deployed a scalable AI-driven BI and data warehouse platform that centralized enterprise data and automated analytics workflows.

Key initiatives included:

- Building a unified cloud data warehouse integrating all retail data sources

- Implementing automated ETL pipelines for real-time data processing

- Developing AI-powered analytics models for demand forecasting and customer insights

- Creating executive dashboards with real-time KPI monitoring

- Establishing data governance and role-based access control

Technology stack

- Cloud-based data warehouse architecture

- AI/ML models for predictive analytics

- Data integration and ETL automation tools

- Interactive BI dashboards and visualization platforms

Business impact

- Faster decision-making with real-time, unified reporting

- Improved forecast accuracy and inventory planning

- Enhanced customer segmentation and campaign targeting

- Reduced manual reporting workload and operational costs

- Scalable data foundation supporting future digital initiatives

Read more: AI-Driven BI & Data Warehouse For A Leading Retail Corporation

In conclusion

For enterprises in 2026, retail analytics is no longer a separate department but the core driver of operational resilience and growth. By focusing on high-impact decisions, specifically demand forecasting, dynamic pricing, and hyper-personalization, businesses can protect their margins and capture new revenue in an increasingly complex global landscape.

Ready to modernize your retail analytics strategy? Contact Kyanon Digital today to evaluate your current data maturity and build a scalable roadmap for the future.