Mobile app development for restaurant in Singapore is increasingly viewed as operational infrastructure rather than a marketing channel, as the local F&B sector navigates growth alongside structural margin pressure.

Singapore’s F&B sector continues to show demand resilience, with total sales reaching around S$1 billion monthly and recording ~2.5% year-on-year growth in late 2025, driven mainly by fast food and quick-service formats (Singstat). However, restaurant-segment turnover has remained fragile, with some months showing flat or negative growth, reflecting rising operating costs and changing consumer behavior.

At the same time, digital ordering is now embedded in consumer habits, with online channels accounting for roughly 24–26% of total F&B sales in Singapore, a structural shift toward mobile and platform-based ordering (The Straits Times).

The implication for operators is clear:

- Demand is stable, but profitability is volatile.

- Online sales are rising, but a significant share flows through third-party platforms.

- Restaurants without direct digital channels risk losing customer data, pricing control, and repeat-purchase visibility.

For founders and CTOs, building a mobile platform is no longer a discretionary branding investment. It has become a defensive layer against margin erosion and a mechanism to regain control over customer relationships and order economics. The strategic question has shifted from “Should we build an app?” to “What type of mobile app architecture best protects margins and supports scale?”

Kyanon Digital highlights how mobile app development for restaurants in Singapore is evolving from an optional digital presence to a strategic control layer for first-party data ownership, cost optimization, and long-term profitability.

Key findings

- Mobile apps are now a margin protection infrastructure, not marketing tools

- SaaS platforms optimize speed and short-term cost control

- Custom platforms optimize data ownership, integration, and long-term profitability

- First-party customer data is becoming the primary strategic driver

- Multi-outlet chains typically outgrow SaaS due to operational complexity

- Custom platforms show stronger ROI over a 3–5 year total cost of ownership

- Government grants support adoption, but do not fund full transformation

- The right choice depends on scale, growth strategy, and digital maturity

Further reading:

- Mobile App Development Services

- Mobile App Engineering Trusted by Singapore Brands

- Best iOS App Development Companies in Singapore

- Top Android App Development Companies in Singapore

The two paths restaurant owners usually take

Restaurant operators choosing mobile app development for restaurants in Singapore typically follow two paths: deploy SaaS apps for speed and cost control or build custom platforms for data ownership, integration, and long-term margin protection.

The right choice depends on outlet scale, digital maturity, and growth strategy.

Quick comparison table

|

Criteria |

SaaS restaurant app platforms | Fully custom restaurant apps |

|

Time to launch |

2–6 weeks typical |

3–9+ months depending on scope |

|

Upfront cost |

Low subscription-based |

High initial investment |

|

Data ownership |

Often platform-controlled or shared |

Fully owned by operator |

|

Integration |

Limited to supported POS/ERP |

Built around existing stack |

|

Scalability |

Suitable for single/few outlets |

Designed for multi-brand, regional growth |

|

Long-term ROI |

Plateau after early efficiency gains |

Compounds with data + automation |

| Strategic role | Operational support tool |

Core digital infrastructure |

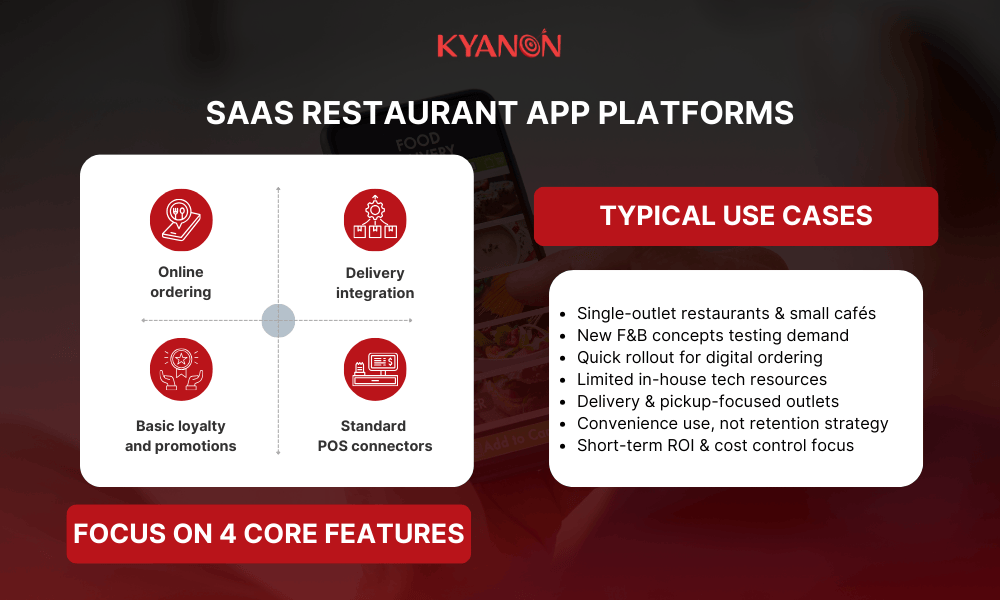

Option 1: SaaS restaurant app platforms (ready-made)

SaaS platforms are tools that centralize the application lifecycle, automate workflows, and optimize cost from a single console (Gartner).

In this context, SaaS restaurant apps are built for rapid deployment and operational efficiency, not deep differentiation.

- Standardised cloud-based ordering and loyalty systems

- Designed for quick launch with minimal technical setup

- Vendor-managed hosting, updates, and security

- Focus on core functions: ordering, payments, and delivery integration

Typical use cases in Singapore

SaaS adoption in Singapore is driven by speed-to-market and manpower constraints.

- Single-outlet restaurants and small café groups

- New F&B concepts validating demand

- Operators needing digital ordering live within weeks

- Businesses use apps mainly for convenience, not retention

Operational drivers:

- High labor costs are pushing self-service ordering

- Need for immediate delivery and pickup integration

- Limited in-house tech capability

- Focus on short-term ROI and cost control

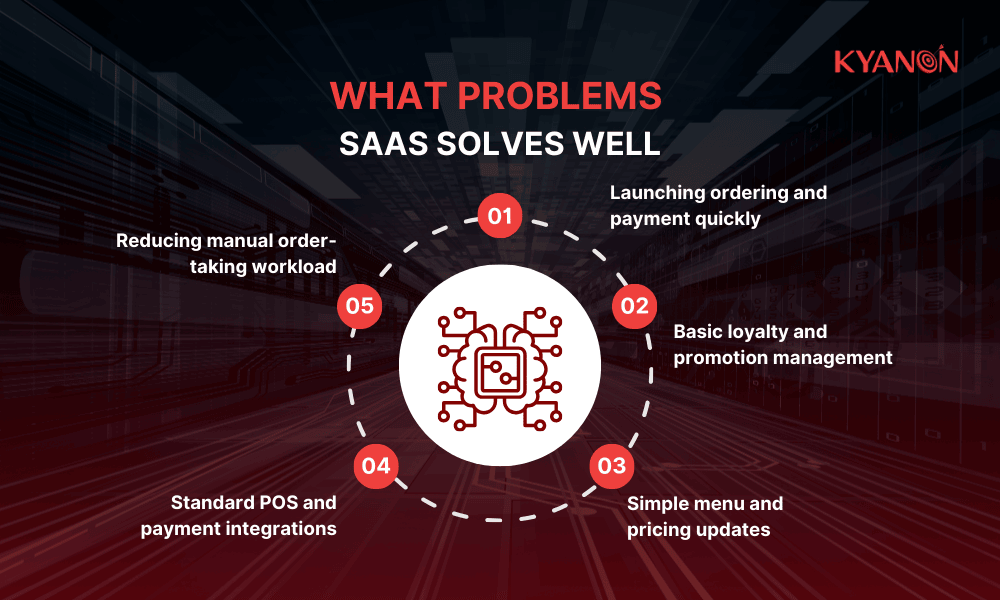

What problems SaaS solves well

- Fast launch: SaaS enables restaurants to deploy ordering and payment channels within weeks, reducing time to market.

- Basic loyalty & promotions: Built-in loyalty and promo tools help operators run simple retention campaigns without custom development.

- Easy menu updates: Centralized dashboards allow quick changes to menu items, pricing, and availability.

- Standard integrations: Prebuilt POS and payment integrations simplify setup and reduce technical effort.

- Operational efficiency: Automated ordering reduces manual order-taking and staff workload.

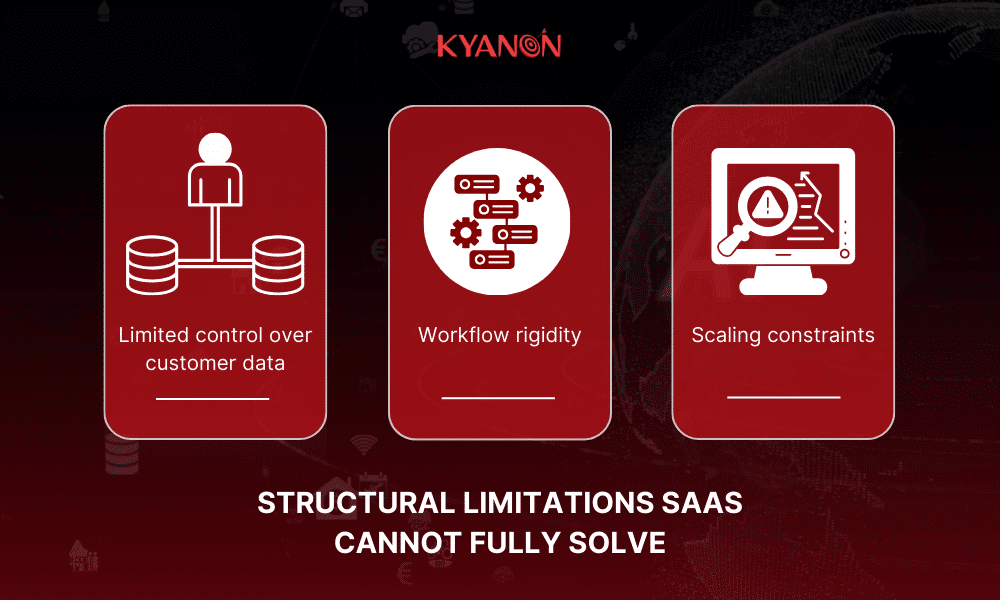

Structural limitations SaaS cannot fully solve

- Limited control over customer data

- Customer insights often remain within the vendor ecosystem

- It’s hard to build a unified CRM across channels

- Constrains advanced retention or personalization strategies

- Workflow rigidity

- Fixed checkout logic and promotion rules

- Limited support for complex fulfillment or multi-brand bundles

- Difficult to customise reporting for management decisions

- Scaling constraints

- Multi-outlet loyalty and analytics are often fragmented

- Subscription and transaction fees scale with order volume

- Integration with ERP, inventory, and advanced analytics is limited

Business implication: SaaS is effective for operational convenience but rarely becomes a long-term competitive advantage or margin protection tool.

Option 2: Fully custom (bespoke) restaurant mobile apps

Fully custom restaurant apps are proprietary digital platforms built around operations, data ownership, and scalability. Unlike SaaS, they are designed to become long-term business infrastructure and margin-control tools.

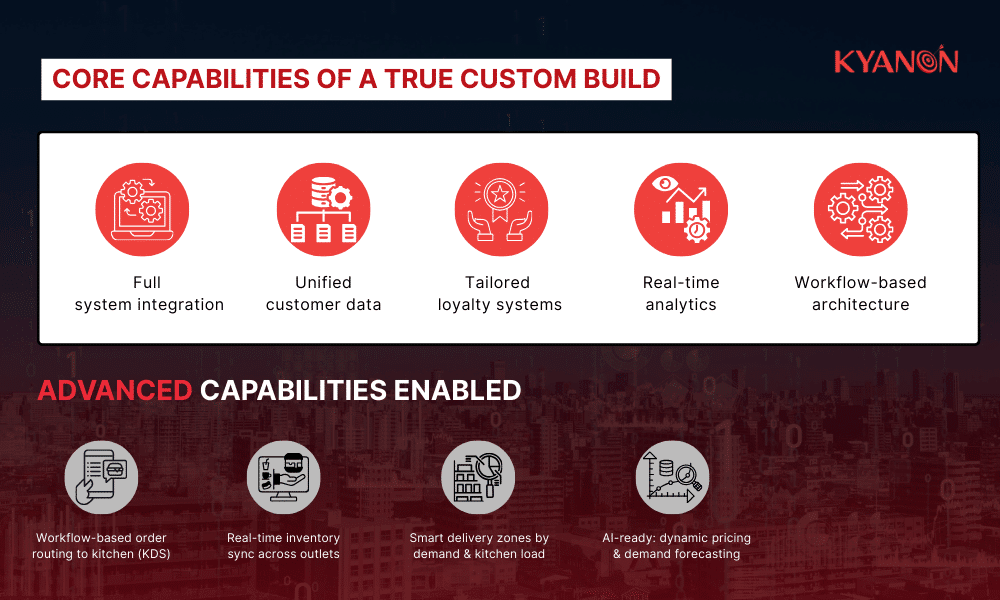

What a truly custom restaurant app includes

Custom apps are built around your operations and systems, not just redesigned UI.

True custom development includes:

- Full system integration: Connects POS, CRM, inventory, finance, and delivery systems into one ecosystem

- Unified customer data: Centralised first-party database across outlets and channel

- Tailored loyalty systems: Membership tiers, subscriptions, and cross-brand rewards

- Real-time analytics: Dashboards for revenue, repeat rate, and outlet performance

- Workflow-based architecture: Designed around kitchen, fulfillment, and operational processes

Advanced capabilities enabled:

- Workflow-based order routing to kitchen/KDS

- Real-time inventory sync across outlets

- Smart delivery zones based on demand and kitchen load

- AI-ready foundation for dynamic pricing and demand forecasting

Business implication: Custom apps function as owned infrastructure that improves efficiency, data visibility, and automation across operations.

When custom apps become a business asset, not a cost

Custom development becomes strategic when digital channels drive revenue, retention, and operational efficiency.

- High upfront CAPEX but declining cost per order as volume scales

- Lower reliance on third-party delivery commissions

- Stronger retention through owned customer data

- Proprietary source code and data increase enterprise value

- Reusable infrastructure for new outlets and markets

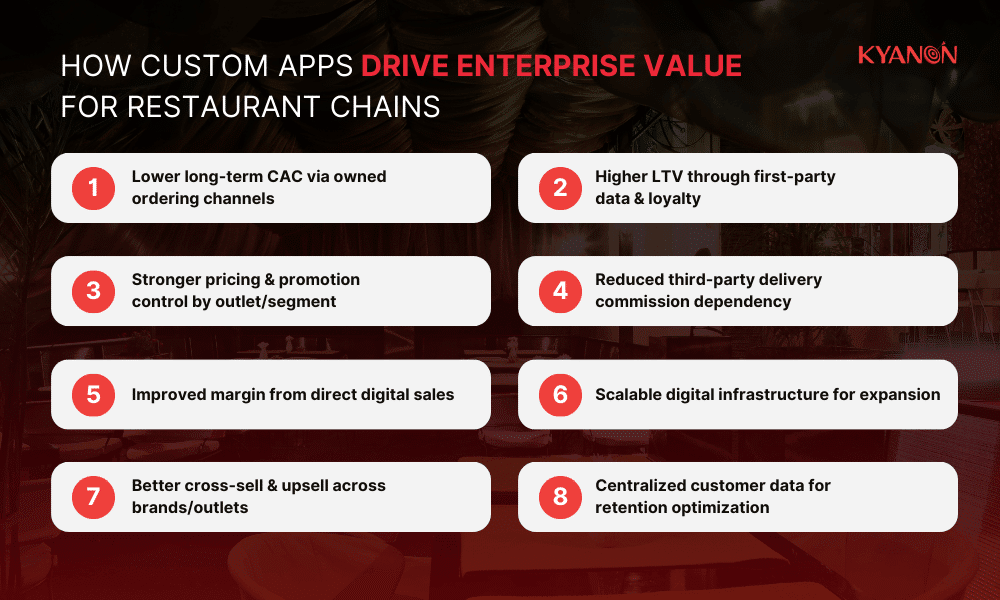

Enterprise impact:

- Lower long-term customer acquisition cost (CAC)

- Higher lifetime value (LTV) from owned channels

- Greater pricing and promotion control

- Reduced commission dependency

Why multi-outlet and chain operators think differently

Multi-outlet groups treat mobile apps as infrastructure for control, data, and scalability.

Key needs for chains (5–50+ outlets)

- Unified loyalty across brands and locations

- Centralized customer and performance data

- Cross-outlet promotions and pricing control

- Integration with supply chain and finance

- Automation to offset labour shortages

Transform your ideas into reality with our services. Get started today!

Our team will contact you within 24 hours.

SaaS vs custom app: A decision framework for chain owners

For restaurant groups in Singapore, the SaaS vs. custom app decision is a capital allocation and control strategy. SaaS optimizes for speed and predictable cost. Custom platforms optimize for long-term margin control, data ownership, and multi-outlet scalability.

Quick comparison table

|

Decision factor |

SaaS platform | Custom development |

|

Financial model |

OPEX: Low entry, but costs scale linearly with revenue (success tax) |

CAPEX: High entry, but marginal costs decline as volume grows |

|

Data strategy |

Aggregated: You rarely own the full customer graph |

First-party: 100% ownership; essential for retention & PDPA |

|

Speed to market |

Weeks: Plug-and-play standard workflows |

Months: Built to mirror your specific operations |

| Scalability | High friction: Struggles with complex multi-outlet logic |

Low friction: Architected for cross-brand/multi-region scale |

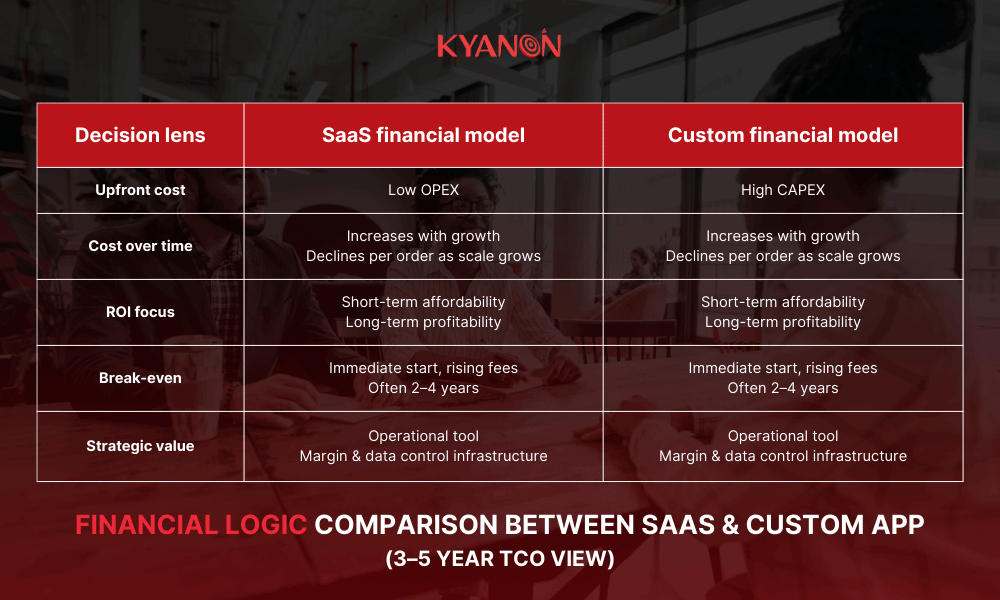

Financial logic

The real decision is the total cost of ownership over 3–5 years, not the initial build cost.

SaaS financial model

- Subscription- or transaction-based OPEX keeps entry costs low but creates recurring long-term spending.

- Costs scale with order volume and outlet expansion, turning growth into higher platform fees

- 58% of restaurant operators are increasing IT budgets toward digital ordering and POS ROI (The 2025 Restaurant Technology Study).

- Restaurant tech spending can reach 7–10% of revenue, making SaaS fees a growing cost line over time (Bank of America).

Custom financial model

- Higher upfront CAPEX but stable maintenance costs over time

- Cost-per-transaction declines as order volume and outlets scale

- Digital ordering and automation can increase check size and improve sales, strengthening long-term ROI from owned channels

- Integrated digital platforms report 55% operational efficiency gains and 52% higher customer retention, supporting sustained margin improvement and profitability (IBM Newsroom).

Break-even logic for chains

- High-volume or multi-outlet groups often reach break-even within 2–4 years

- Beyond that point, custom platforms typically deliver stronger margin control

Business implication

- SaaS optimizes short-term affordability.

- Custom optimizes long-term profitability.

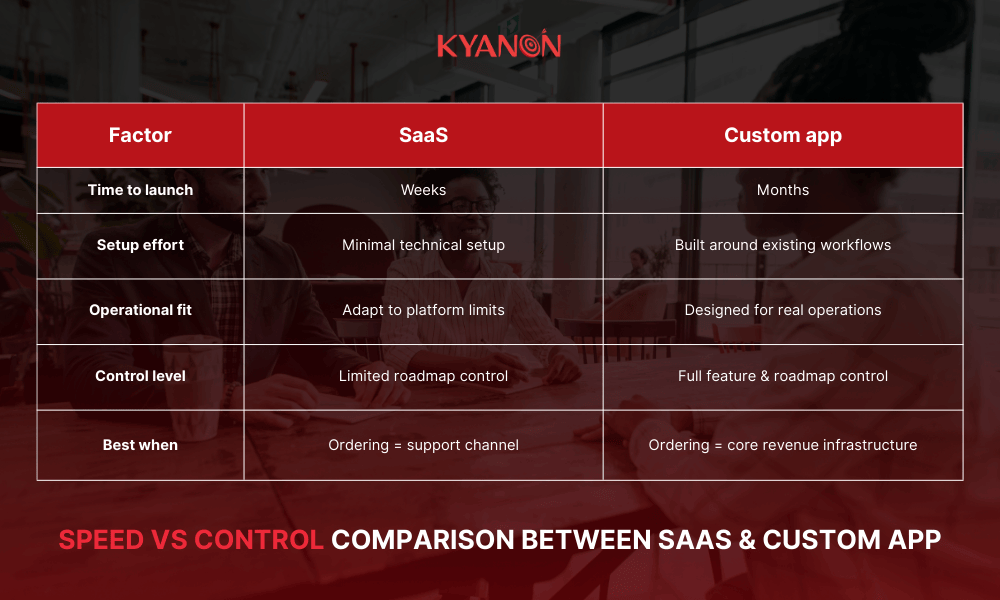

Speed vs control

Speed benefits early-stage operators; control benefits scaling chains.

SaaS platform

- Launch in weeks

- Minimal technical setup

- Operations must adapt to platform constraints

Custom development

- Slower initial rollout

- Built around actual workflows

- Full control over roadmap and features

Decision lens:

- If digital ordering is a support channel → speed matters.

- If digital ordering is core revenue infrastructure → control matters.

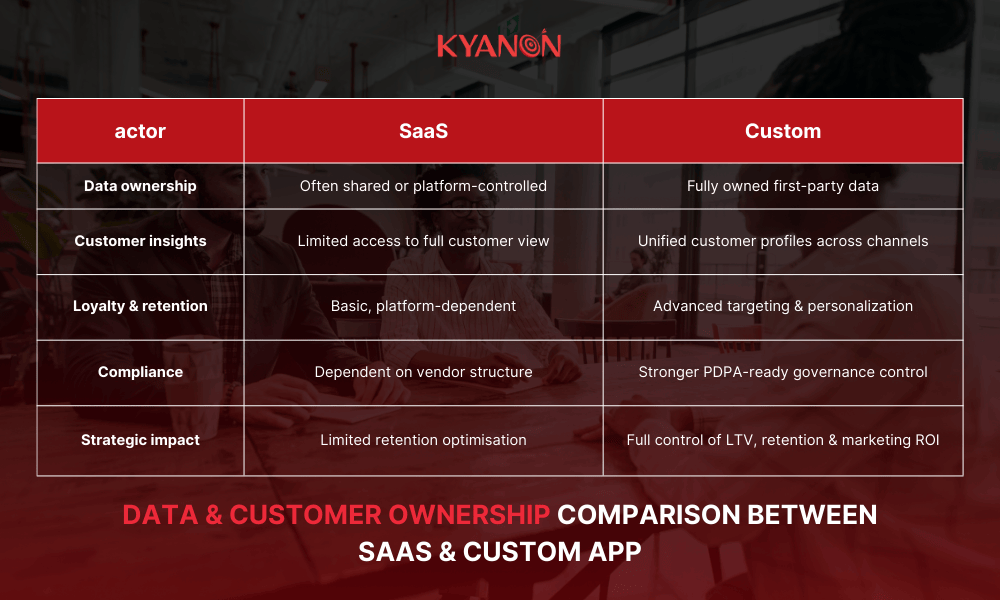

Data & customer ownership

First-party data ownership is becoming the primary strategic driver behind custom app investment.

Key questions for operators:

- Who owns customer profiles and order history?

- Where is loyalty and behavioral data stored?

- Can data be unified across outlets and channels?

Why it matters

- Enables targeted promotions and retention

- Improves lifetime value and repeat purchase

- Supports PDPA-compliant data governance

- Reduces reliance on aggregator platforms

Business implication: Operators without first-party data control cannot fully optimize retention or marketing ROI.

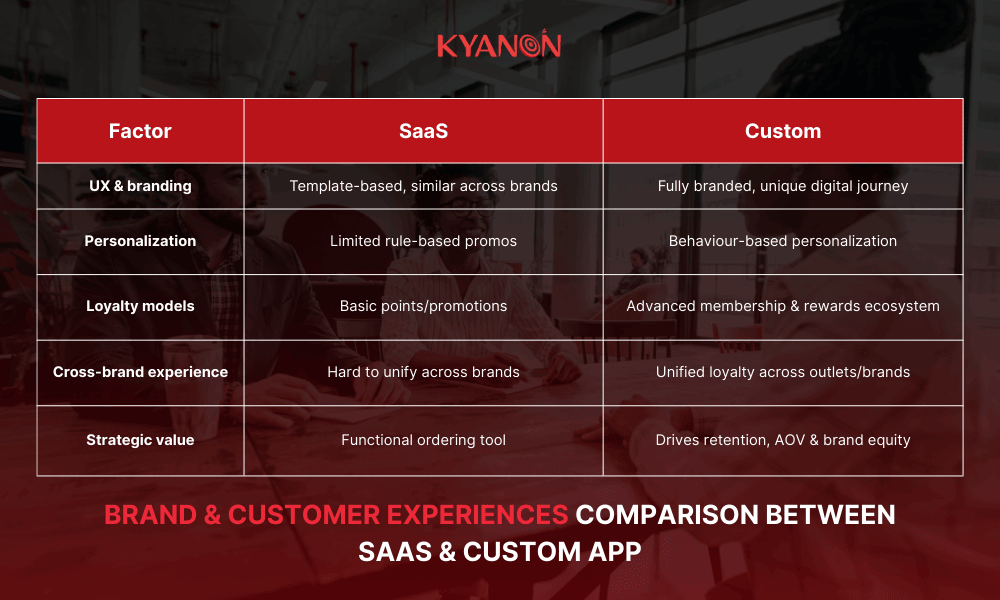

Brand & customer experience

Mobile apps are increasingly part of brand infrastructure, not just ordering tools.

SaaS experience:

- Template-based UI and journey

- Limited personalization

- Similar UX across competing brands

Custom experience

- Fully branded digital journey

- Advanced loyalty and membership models

- Personalization based on behaviour and spend

- Cross-brand ecosystem capabilities

Strategic value: Differentiated experience improves retention, AOV, and brand equity.

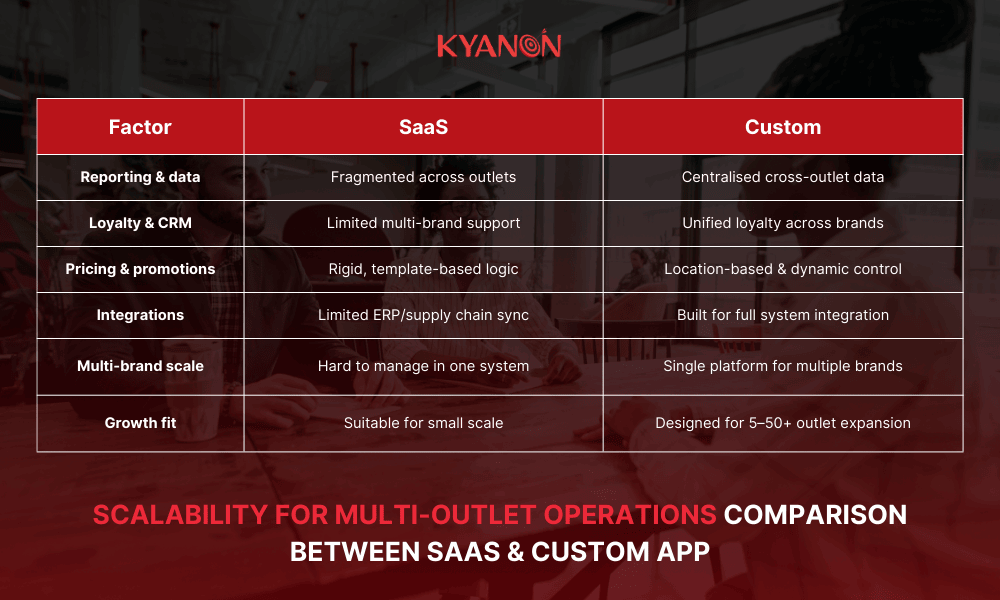

Scalability for multi-outlet operations

Most restaurant groups outgrow SaaS once operational complexity increases.

Scaling challenges with SaaS

- Fragmented reporting across outlets

- Limited multi-brand loyalty support

- Inflexible promotion and pricing logic

- Integration gaps with ERP and supply chain

Custom scalability advantages

- Centralised data across all outlets

- Location-based pricing and promotions

- Real-time menu and inventory sync

- Single platform for multiple brands

Growth reality: Many chains outgrow SaaS gradually, not because it fails, but because operational complexity surpasses the capabilities of the template.

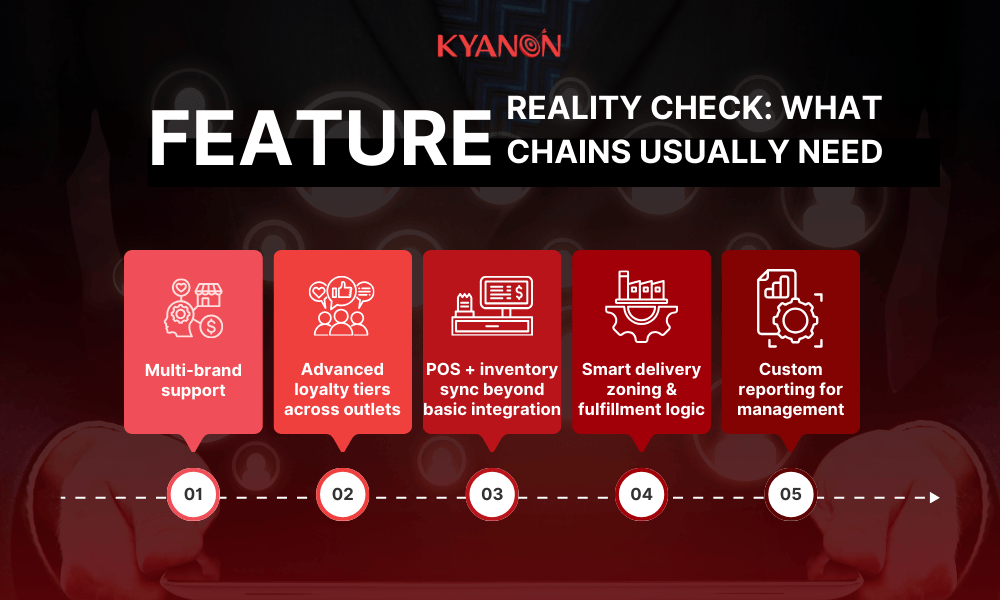

Operational must-haves for multi-brand restaurant groups

Multi-brand/multi-concept support

For restaurant groups managing a portfolio of brands (e.g., a holding company with a QSR chain, a fine dining bistro, and a cafe brand), SaaS platforms typically force a fractured customer experience. Each brand requires a separate app, splitting your user base and diluting brand equity.

- The custom advantage: A custom architecture enables a parent app or super app strategy. Customers log in once and can order from any of your brands within a single interface.

- Business impact: This drastically lowers customer acquisition costs (CAC). Businesses can cross-pollinate traffic, migrating a loyal coffee customer to try your new burger concept via an in-app prompt, leveraging a shared user base rather than building from scratch.

Advanced loyalty tiers across outlets

In 2025, loyalty is no longer about simple discounts; it is about emotional connection. The EY Loyalty Market Study reveals that 92% of consumers are enrolled in loyalty programs; however, many feel disengaged with transactional-only models.

- SaaS limitation: Most platforms offer basic “earn & burn” mechanics that apply equally to every store.

Enterprise requirement:

- Cross-brand currency: A point earned at Outlet A (casual dining) should be redeemable at Outlet B (quick service), creating a walled garden economy that keeps spending within your group.

- Smart segmentation: Custom algorithms can identify at-risk customers (e.g., regulars who haven’t visited in 30 days) and trigger personalized re-engagement offers automatically, a capability that increases retention rates by up to 5x compared to generic blasts.

POS + inventory sync beyond basic integration

Integration is a buzzword that often masks fragility. Many SaaS apps rely on menu pushes that update every few hours, leading to the nightmare scenario of accepting orders for out-of-stock items.

- Live decrementing: When a steak is sold in the dining room via the POS, it must instantly decrement from the mobile app’s available inventory to prevent digital overselling.

- Variance tracking: Advanced setups track theoretical vs. actual usage in real-time, flagging potential waste or theft immediately rather than at end-of-month audits.

Smart delivery zoning & fulfillment logic

Standard platforms typically use a static radius (e.g., “We deliver to everyone within 5 km”). This is inefficient for operations with fluctuating kitchen capacity.

- Load balancing: If the kitchen at the Orchard Road outlet is at 110% capacity, a custom algorithm can automatically shrink its delivery zone to 2 km and route border-zone orders to a nearby outlet with spare capacity.

- Rain mode: The system can automatically adjust delivery fees or zones based on real-time weather APIs to account for driver scarcity during storms, protecting delivery reliability.

Custom reporting for management

SaaS dashboards usually provide descriptive analytics (gross sales, top sellers). Enterprise leaders need prescriptive analytics to protect margins.

What businesses need:

- Channel profitability: A unified view comparing net profit margins across GrabFood, Foodpanda, and your white-label app, factoring in different commission structures and delivery costs.

- Labor vs. revenue: Real-time sales per labor hour metrics that help area managers optimize staffing levels before a shift spirals out of control.

- Cohort analysis: Understanding the lifetime value (LTV) of customers acquired via Instagram ads vs. walk-ins, allowing for data-backed marketing budget allocation.

Cost expectations in Singapore (2026)

For restaurant operators evaluating mobile app development for restaurants in Singapore, cost is not just a build decision. It is a long-term total cost of ownership (TCO) decision across build, maintenance, integrations, and scaling.

Quick overview table

|

Scope |

Typical use case | Estimated cost (USD) |

Timeline |

|

MVP |

Single brand, basic ordering & loyalty | $18,000 – $45,000 |

2–3 months |

|

Mid-tier |

Multi-outlet, POS & CRM integration | $45,000–$110,000 |

3–6 months |

|

Enterprise-grade |

Multi-brand, advanced loyalty, analytics, automation | $110,000–$300,000+ |

6–12+ months |

Note: These figures are indicative benchmarks for reference only. Actual costs vary based on integration depth, architecture complexity, and business requirements. Source: Clutch; Goodfirms

Ongoing maintenance: realistic expectations

Custom apps require ongoing investment but stabilize over time; they are not one-off builds.

Typical annual maintenance:

- Hosting and infrastructure

- Security and OS updates

- Feature iteration and improvements

- Performance monitoring

- Integration maintenance (POS, payment, delivery APIs)

Business reality:

- SaaS model: OPEX rises as order volume, outlets, and users grow; subscription, transaction, and integration fees compound over time

- Custom model: Higher upfront investment, but maintenance stabilises; cost per order declines as digital volume scales

Strategic outcome: SaaS supports short-term operational efficiency; custom platforms support long-term margin optimisation and data ownership

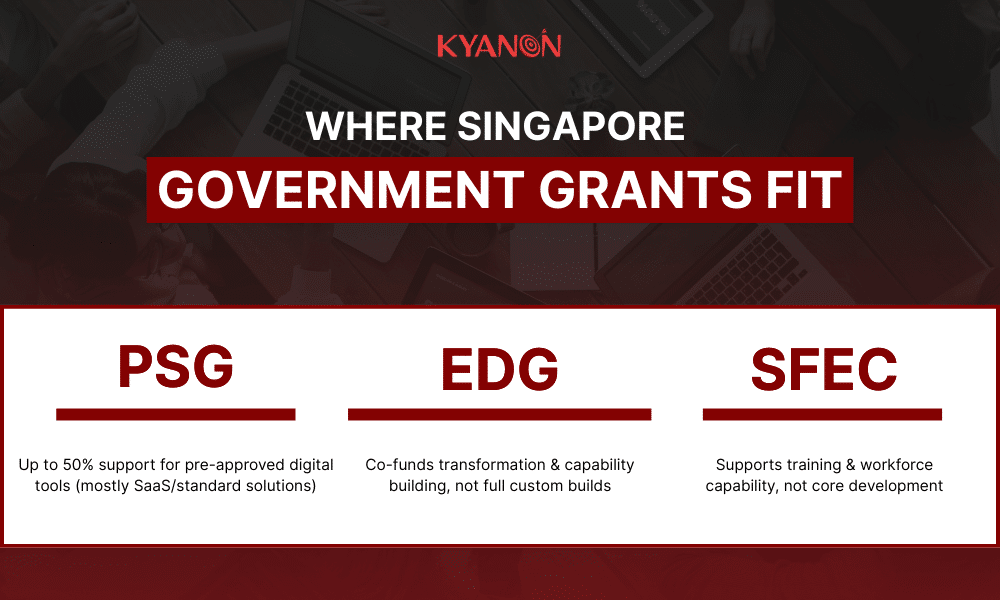

Where Singapore government grants fit, and don’t

Grants reduce initial burden but rarely fund full transformation.

Common applicable grants:

Grants reduce entry cost but rarely fund full transformation: Most schemes support partial digital adoption, not full enterprise platform ownership or long-term product development

- PSG (Productivity Solutions Grant): Covers up to 50% of pre-approved digital tools for SMEs (Enterprise Singapore), typically suited for SaaS or standard solutions rather than complex custom platforms

- EDG (Enterprise Development Grant): Supports broader transformation and capability building, but usually co-funds specific project components instead of full end-to-end custom builds

- SFEC (SkillsFuture Enterprise Credit): Offsets training and workforce capability costs rather than core software development

Where grants help most:

- Early-stage digitalisation or MVP rollout

- Process redesign, automation planning, and capability building

- SME technology adoption and vendor implementation support

Where grants do NOT typically apply

- Full enterprise-grade custom mobile platforms

- Long-term maintenance, iteration, and product scaling

- Ongoing infrastructure, hosting, and product ownership costs

Policy reality: Singapore’s enterprise grants focus on productivity and capability uplift, not full technology ownership. Co-funding reduces initial CAPEX but does not remove long-term investment responsibility.

Business implication: Grants should be treated as cost offsets, not primary decision drivers. Technology strategy should be based on long-term TCO, scalability, and data ownership rather than grant eligibility.

A simple self-assessment for restaurant chain owners

Businesses are likely SaaS-ready if

- Single outlet or early-stage concept

- Need fast launch and minimal differentiation

- Limited internal tech capability

- Digital ordering is a support tool, not a core strategy

- Short-term cost control is a priority.

Businesses should seriously consider custom if

- Multiple outlets or expansion planned

- Direct ordering and retention drive revenue

- Want to reduce aggregator dependency

- Need unified loyalty and customer data

- Operations require integration across systems

How Kyanon approaches restaurant app strategy

Kyanon approaches restaurant mobile app development as a long-term digital infrastructure decision, aligning technology with revenue growth, operational efficiency, and customer data ownership, not just feature delivery.

- Business-first discovery: Clarifies growth model, outlet expansion plans, and digital revenue goals before defining app scope. Helps operators decide whether to build custom or optimize existing platforms.

- Architecture aligned with operations: Designs apps around real restaurant workflows, integrating POS, CRM, loyalty, payments, and backend systems into a unified ecosystem.

- Built for multi-outlet scalability: Ensures performance, security, and flexibility for chains expanding across locations, brands, or regions.

- Data & automation focus: Structures first-party data, analytics, and automation to support retention, personalization, and cost control.

- End-to-end delivery: Strategy, UX/UI, development, and post-launch optimization to ensure the app evolves as a long-term business asset rather than a one-off project.

In conclusion

Custom mobile app development for restaurants in Singapore has shifted from a marketing enhancement to core digital infrastructure. Rising aggregator commissions, labor constraints, and the need for first-party customer data are pushing restaurant groups to reassess how they control ordering, loyalty, and operations.

For smaller operators or early-stage concepts, SaaS platforms remain effective for speed and short-term cost control. For multi-outlet and growth-focused restaurant groups, however, custom platforms increasingly function as long-term margin protection and data ownership infrastructure.

The right decision is not SaaS vs custom by default; it is which model aligns with your growth stage, operational complexity, and long-term cost structure.

Looking to build or modernize your mobile app?

Contact Kyanon Digital to plan and deliver your next enterprise-grade restaurant mobile platform with clarity and confidence.