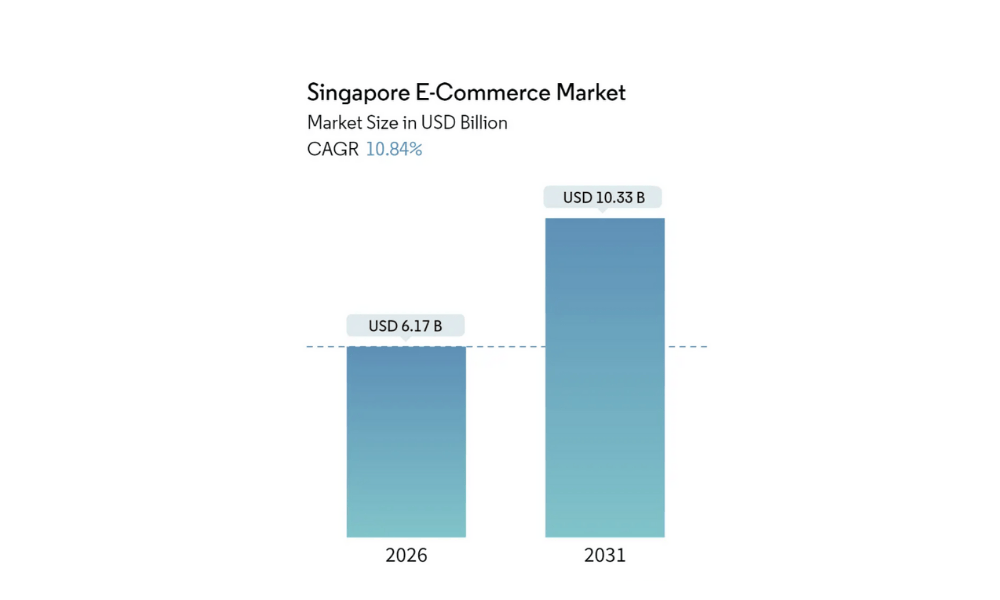

Digital commerce transformation in Singapore is entering a new strategic phase as the country’s e-commerce market moves beyond early adoption toward integrated, enterprise-scale operations. According to Mordor Intelligence, Singapore’s e-commerce market is expected to grow at a CAGR of over 10% between 2026 and 2031, driven by high digital penetration, cross-border trade, and rising enterprise investment in omnichannel infrastructure.

Singapore’s e-commerce market is reaching a new maturity stage, where competition is no longer about launching digital channels but about operational speed, integrated data, and seamless customer experience across markets. As the country strengthens its role as a regional digital commerce hub, enterprises must modernize legacy commerce architecture while scaling across multiple markets, regulatory frameworks, and increasingly complex B2B and B2C models.

This shift is accelerating demand for end-to-end digital commerce transformation strategies that connect customer data, supply chain visibility, and real-time personalization without increasing operational risk.

In this article, Kyanon Digital highlights the 2026 landscape of digital commerce transformation in Singapore, key market shifts, emerging risks, and how enterprises can structure scalable commerce ecosystems for long-term regional growth.

Key findings

- Shift to integration and scale: Digital commerce transformation in Singapore now focuses on unified data, real-time operations, and regional expansion.

- Low-risk transformation environment: Government grants (PSG, EDG), Smart Nation, and IMDA standards support enterprise digital commerce investment.

- Unified commerce becomes standard: Enterprises are building single customer and inventory views across all B2B and B2C channels.

- Core technology enablers: Mobile payments, AI-driven analytics, and cloud ERP platforms now form the foundation of scalable commerce.

- Clear business impact: Automation and unified data improve fulfillment speed, efficiency, retention, and cross-border growth.

- Execution remains complex: Legacy systems, integration challenges, and internal change management are still the biggest transformation risks.

Further readings:

- Omnichannel eCommerce Solutions for Business Growth

- E-Commerce Trends in Southeast Asia: What Global Brands Miss

- Singapore 10 Best Ecommerce Website Development Companies

- Top 9 iOS Developers for E-commerce & Retail Apps in Singapore

Key drivers powering digital commerce transformation

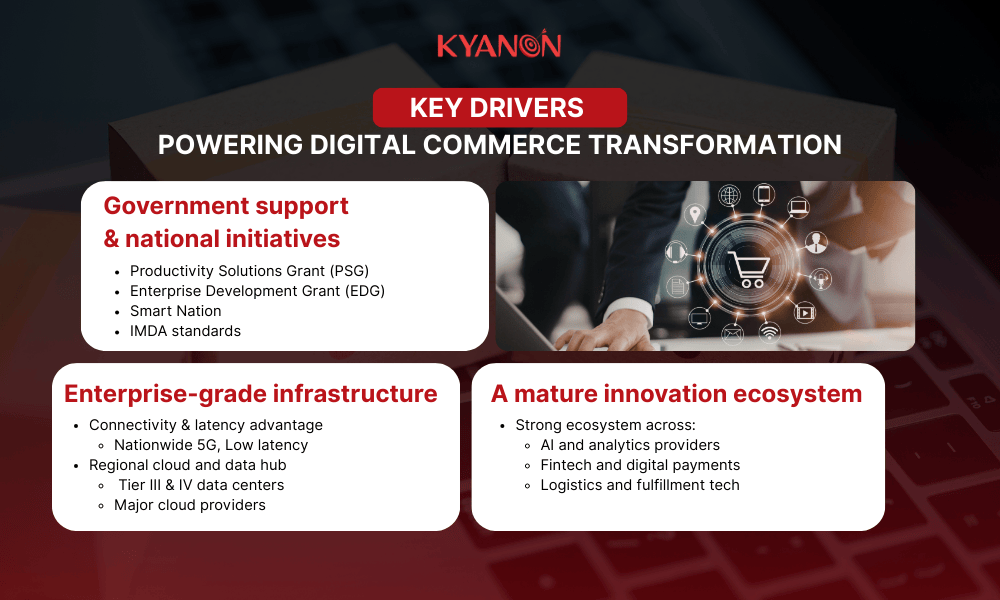

Singapore has effectively positioned itself as the digital commerce hub for Southeast Asia, supported by a convergence of government policy, infrastructure, and corporate density.

Government support & national initiatives

- Productivity Solutions Grant (PSG): Covers up to ~50% of costs for approved digital, automation, and integration solutions (Enterprise Singapore).

- Enterprise Development Grant (EDG): Supports deeper transformation, such as platform modernization, sustainability, and overseas expansion, with up to ~70% support for sustainability initiatives until March 2026 (Enterprise Singapore).

- Smart Nation: Drives digital identity, e-payments, AI adoption, and data exchange frameworks.

- IMDA standards: InvoiceNow for nationwide e-invoicing; CorpPass and Singpass for secure digital identity and transactions.

Enterprise-grade infrastructure

Singapore provides one of Asia’s most stable digital commerce operating environments.

- Connectivity & latency advantage

- Nationwide 5G and high-speed broadband support real-time commerce, live selling, and instant payments.

- Low latency is critical for inventory sync, payment authorization, and cross-border transactions.

- Regional cloud and data hub

- Singapore hosts one of Asia’s highest concentrations of Tier III & IV data centers.

- Major cloud providers (AWS, Azure, and Google Cloud) operate regional hubs here.

- Enables multi-country commerce architecture with strong uptime and compliance.

A mature innovation ecosystem accelerates enterprise capabilities

Enterprises can plug into specialized capabilities instead of building everything internally

- Strong ecosystem across:

- AI and analytics providers

- Fintech and digital payments

- Logistics and fulfillment tech

- Enables a composable commerce architecture using specialized partners.

- Shortens time-to-market for new digital commerce capabilities.

Transform your ideas into reality with our services. Get started today!

Our team will contact you within 24 hours.

Core enterprise digital commerce trends in Singapore

Quick overview table

|

Trend |

Core risk/challenge |

Strategic action |

|

Omnichannel at scale |

Data duplication & conflicting inventory |

Deploy an Identity Resolution Service to create a single customer view before further UI rollouts. |

|

Mobile-first flows |

High abandonment on non-native websites |

Build native mobile checkout flows and integrate PayNow/Wallets directly into the PDP (Product Detail Page). |

|

AI & analytics |

Pilot purgatory (low ROI on AI) |

Focus on closed-loop pilots: Forecasting $\rightarrow$ OMS/WMS orchestration $\rightarrow$ Measure stockout reduction. |

|

Social commerce |

High operational complexity |

Treat live streams as a sales channel, not marketing. Enforce real-time inventory sync. |

|

Sustainability / ESG |

Regulatory non-compliance |

Integrate provenance fields into product data to automate carbon tracking and invoice reporting. |

|

Cloud ERP modernization |

Legacy systems slowing regional scale |

Migration to Cloud ERP to enable real-time API access for cross-border logistics and finance. |

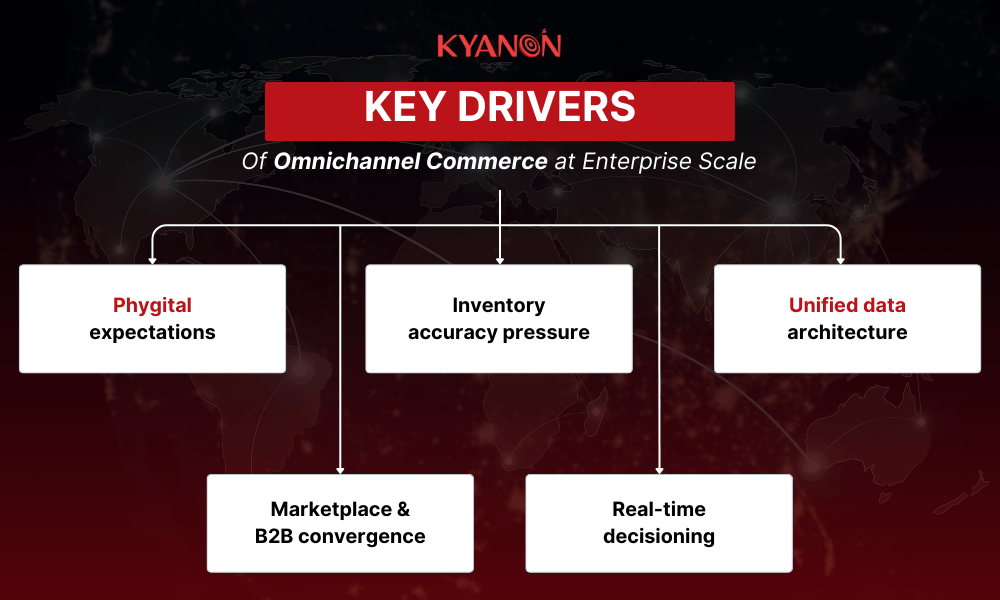

Omnichannel commerce at enterprise scale

True omnichannel in 2026 means a real-time, single view of inventory and customers across POS, web, apps, and B2B portals, eliminating the “siloed” experience of the past.

Key drivers:

- The phygital expectation: Singaporean consumers now expect cart continuity, adding an item on mobile and finishing the purchase in-store or via a B2B portal.

- Inventory friction: The biggest complaint in 2025 was phantom inventory, items showing as available online but out-of-stock in the warehouse due to batch-processed updates.

- Unified data models: Leading enterprises are moving away from channel-specific databases to a canonical customer and product model that feeds all frontends simultaneously.

Recommended response

- Build a canonical customer and product data model.

- Implement unified OMS and real-time inventory visibility.

- Integrate POS, marketplaces, and e-commerce into one data layer.

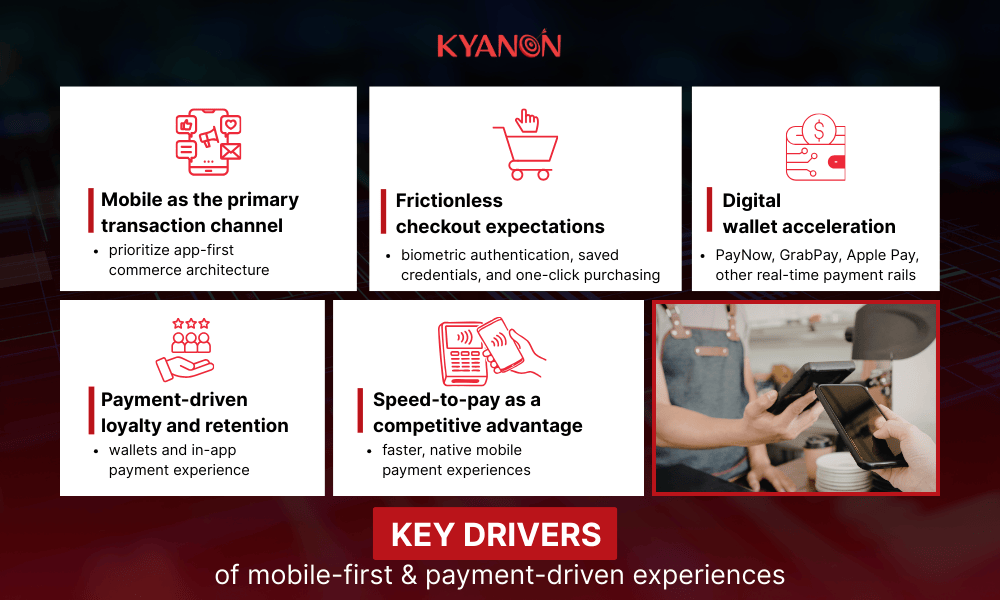

Mobile-first & payment-driven experiences

With mobile apps now dominating the conversion curve, the checkout experience must be native, biometric, and integrated instantly with local payment rails like PayNow.

Key drivers:

- App dominance: In Singapore, mobile apps are not just for browsing; they are the primary transaction engine, securing 78.13% of online orders in 2024.

- Wallet consolidation: The digital payments market in Singapore is projected to grow at an 18.3% CAGR, reaching USD 480.6 billion by 2030 (PwC), driven by rapid adoption of digital wallets and real-time payment systems (PayNow, GrabPay, Apple Pay) over traditional credit card entry.

- One-click mandate: For B2B re-ordering, “one-click” checkout is becoming the standard to reduce procurement time.

Recommended response

- Design mobile-native checkout journeys.

- Support PayNow, wallets, and one-click payments.

- Continuously A/B test checkout UX and payment flows.

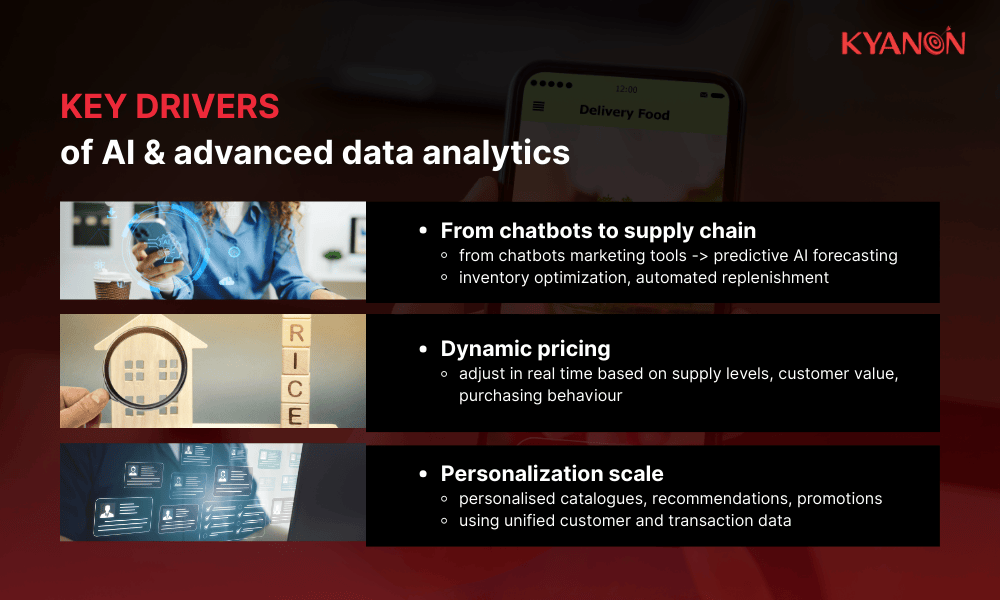

AI & advanced data analytics

AI is moving from generative marketing experiments to predictive operational engines that automate pricing, forecasting, and stock replenishment.

Key drivers:

- From chatbots to supply chain: The investment focus has shifted from customer service bots to operational intelligence, using AI to predict demand spikes before they happen.

- Dynamic pricing: B2B sectors are adopting AI-driven dynamic pricing models that adjust based on real-time supply levels and customer loyalty tiers.

Personalization scale: Aggressive AI spending by market leaders is now focused on hyper-personalizing the B2B catalog view, showing buyers only relevant products.

Recommended response

- Start with pilot use cases (forecasting, personalization).

- Integrate AI outputs into OMS and supply chain workflows.

- Measure impact on conversion, inventory turns, and GM%.

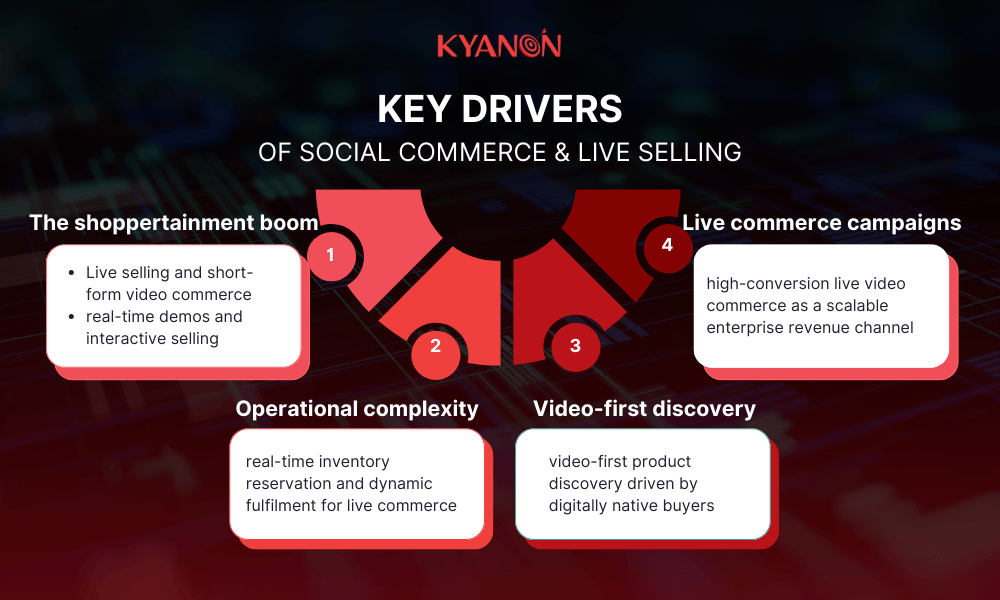

Social commerce & live selling

Live commerce is evolving from a consumer trend into a high-LTV sales channel that requires enterprise-grade backend integration for instant order processing.

Key drivers:

- The shoppertainment boom: Platforms like TikTok Shop have normalized live selling, which is now bleeding into B2B sectors (e.g., live product demos for industrial goods).

- Operational complexity: The speed of live selling breaks traditional inventory systems; stock must be reserved in milliseconds to prevent overselling.

- Video-first discovery: Younger B2B buyers increasingly use video content for product discovery rather than reading long-form specs.

- Live commerce campaigns recorded 95% live-video completion rates and up to 20 shop clicks per second, proving strong real-time conversion potential (IMDA).

Recommended response

- Treat live commerce as a core sales channel.

- Ensure real-time inventory synchronization.

- Integrate instant payment confirmation and fulfillment tracking.

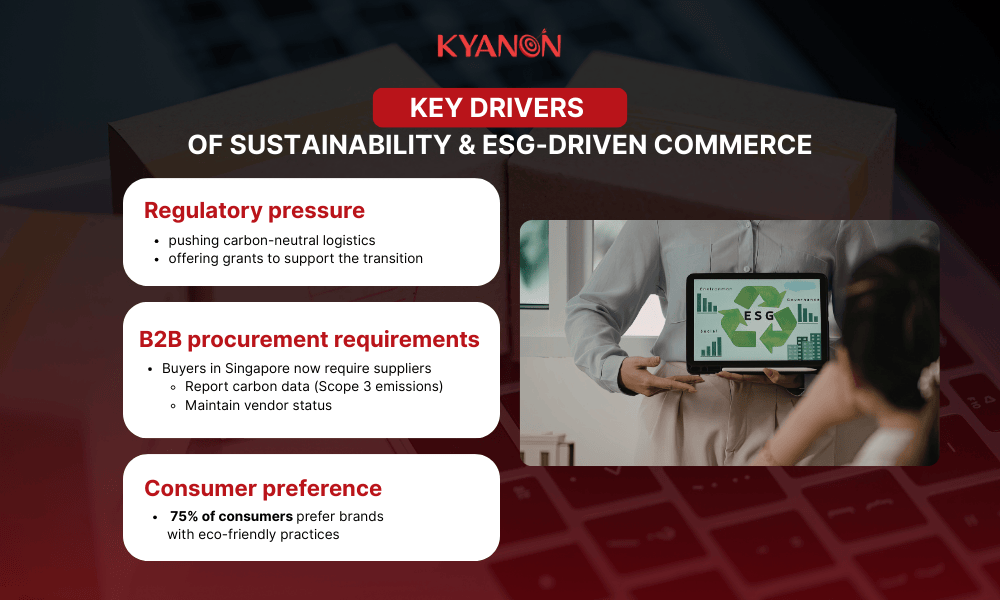

Sustainability & ESG-driven commerce

Sustainability is no longer just PR; it is a data requirement, with regulators and B2B buyers demanding traceability and carbon reporting on invoices.

Key drivers:

- Regulatory pressure: The Singapore government is actively pushing for carbon-neutral logistics, offering grants to support the transition.

- B2B procurement requirements: Multinational buyers in Singapore now require suppliers to report carbon data (Scope 3 emissions) to maintain vendor status.

- Consumer preference: 75% of consumers in Singapore prefer brands with eco-friendly practices, making transparency a conversion factor (Accenture).

Recommended response

- Add product and supplier traceability data.

- Track carbon and sustainability metrics.

- Surface ESG information in digital channels and reporting.

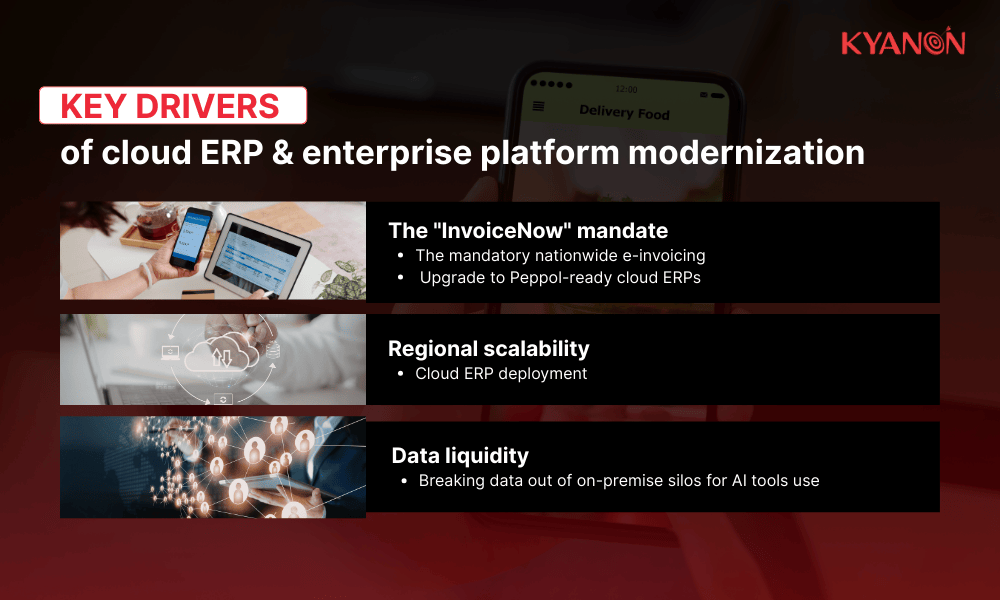

Cloud ERP & enterprise platform modernization

The backbone of 2026 commerce is the Cloud ERP, enabling real-time API connectivity between finance, logistics, and sales channels that legacy on-premise systems cannot support.

Key drivers:

- The “InvoiceNow” mandate: The Singapore government’s push for mandatory nationwide e-invoicing for B2B is forcing companies to upgrade to Peppol-ready cloud ERPs.

- Regional scalability: Cloud ERPs allow Singapore HQs to instantly roll out processes to subsidiaries in Vietnam or Indonesia without physical infrastructure.

- Data liquidity: Breaking data out of on-premise silos so AI tools and e-commerce frontends can use it.

Recommended response

- Migrate to cloud-based ERP and composable commerce platforms.

- Implement API-first and event-driven architecture.

- Enable real-time data visibility across business units.

Business impact of digital commerce transformation

Quick overview table

|

Area |

Key change |

Enterprise value |

|

Operational efficiency |

Automation and real-time supply chain visibility replace manual workflows. |

Faster fulfillment, fewer errors, better inventory turnover and cost control. |

|

Customer & revenue growth |

Unified commerce enables seamless omnichannel and B2B experiences. |

Higher retention, shorter buying cycles, stronger lifetime value. |

|

Regional scalability |

Centralized data and cloud platforms support multi-market operations. |

Consistent customer experience and faster SEA expansion. |

|

Retail & FMCG |

O2O and instant delivery models scaling. |

Better inventory use and improved customer convenience. |

| Finance & healthcare | Secure digital payments and automated procurement adoption rising. |

Faster transactions, compliance readiness, and more resilient operations. |

Productivity & operational efficiency gains

Automation shifts the focus from manual order entry to “management by exception,” significantly reducing overhead.

- Fulfillment speed: Automated order routing reduces cycle times, increasing inventory turnover and freeing up working capital.

- Workflow automation: Removing manual data entry between sales and ERP systems minimizes human error and accelerates “order-to-cash” cycles.

- Resilience: Real-time supply chain visibility allows businesses to pivot logistics providers instantly during disruptions.

Customer experience & revenue growth

In a saturated market, revenue growth depends on unified commerce, delivering a seamless experience that caters to sophisticated buyer demands.

- The digital mandate: With Singapore nearing 96% Internet penetration, the baseline expectation for seamless digital experiences is non-negotiable (Asian Business Review).

- B2B expectations: Over 84% of B2B buyers expect suppliers to support multiple sales channels, making unified commerce critical for retaining enterprise contracts (Shopify).

- Regional scale: Centralized data visibility allows Singapore HQs to manage customer experiences consistently across expansion markets like Vietnam and Indonesia.

Sector-specific momentum in Singapore

- Retail & FMCG: Digitizing O2O (Online-to-Offline) flows to support “Click and Collect” and instant delivery models.

- Finance (BFSI): Adopting secure, compliant platforms to embed B2B payments and financing directly into checkout flows.

- Healthcare: Modernizing legacy procurement to automate the restocking of medical supplies for hospitals and clinics.

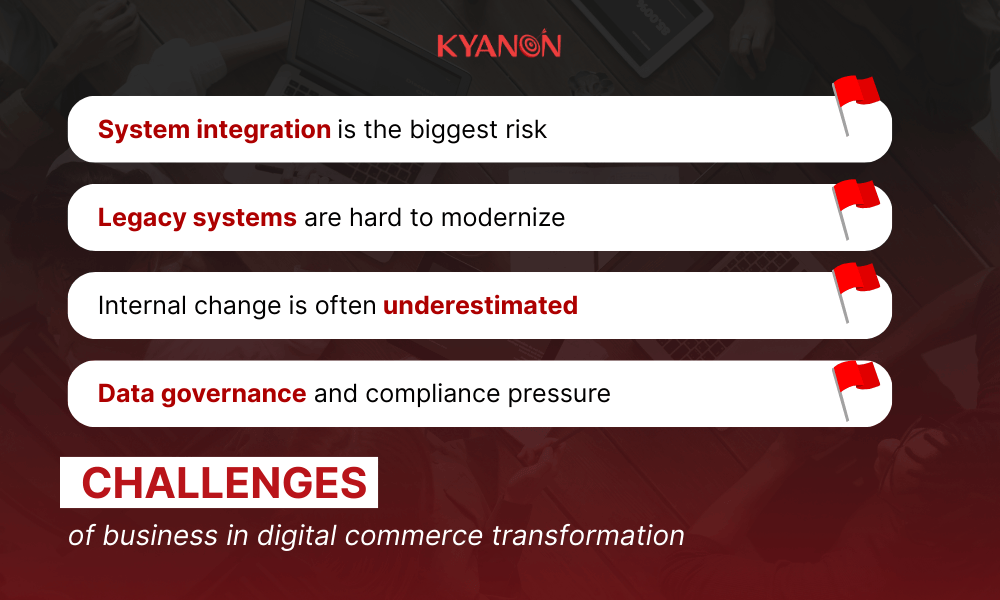

Enterprise challenges in digital commerce transformation

Many enterprises understand the value of digital commerce transformation, but execution is difficult due to legacy systems, integration issues, and internal change barriers.

Legacy systems are hard to modernize

- Many enterprises still run on old ERP or backend systems not built for real-time commerce.

- These systems often cannot connect easily with modern platforms, requiring complex middleware and high upgrade costs.

System integration is the biggest risk

- Connecting ERP, CRM, warehouse systems, e-commerce platforms, and payment gateways is complex.

- Data mismatches between systems can cause inventory errors, pricing issues, and failed orders.

- Integration failure is one of the main reasons large transformation projects go over budget or delay.

Internal change is often underestimated

- Teams used to manual processes must shift to digital workflows and automation.

- This requires training, new KPIs, and strong executive alignment.

- Without internal adoption, new platforms fail to deliver value.

Data governance and compliance pressure

- Enterprises must comply with Singapore’s PDPA and cross-border data regulations.

- At the same time, they need a unified customer and product data view across markets.

- Balancing compliance with real-time data usage is a growing challenge.

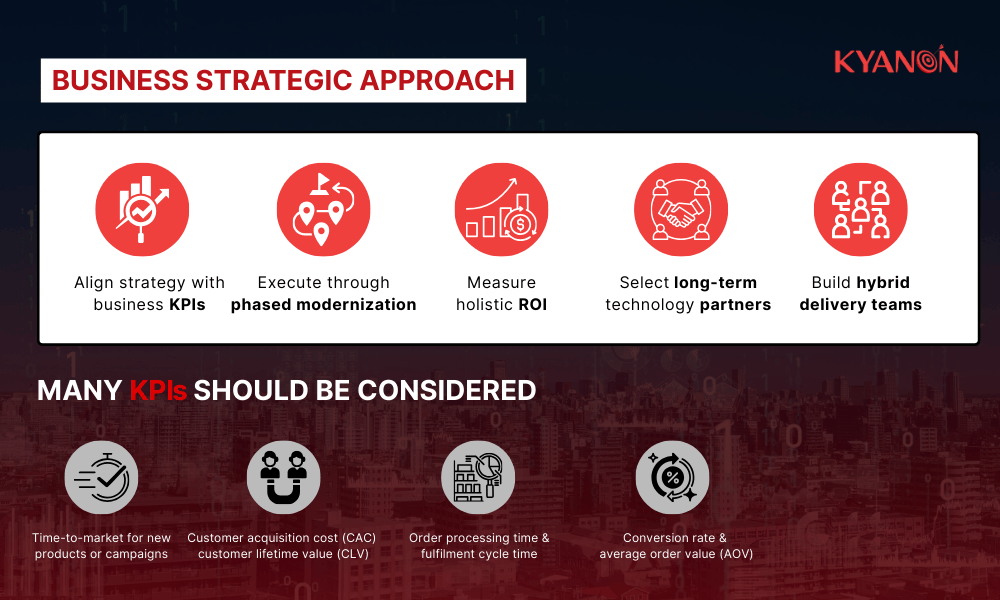

How enterprises approach digital commerce transformation

Successful CTOs and founders view transformation as a continuous capability-building exercise, not a one-off IT project.

From strategy to scalable execution

- Alignment: Mapping platform architecture directly to business KPIs (e.g., “reduce order processing time by 40%”) rather than just feature lists.

- Phased vs. big bang: Leading enterprises prefer phased modernization (Strangler Fig pattern) to de-risk migration, versus risky “rip-and-replace” rewrites.

- Holistic ROI: Measuring success beyond conversion rates, tracking customer acquisition cost (CAC), inventory turnover, and time-to-market for new products.

Choosing the right technology partner

- Long-term value: Moving away from project-based vendors to strategic partners who stick around for the multi-year journey of optimization.

- Regional nuance: Selecting partners with deep experience in Southeast Asian logistics, payments, and consumer behaviors.

- Staffing models: Balancing internal core teams with specialized external partners (hybrid model) to fill skill gaps in AI and cloud architecture.

Why Singapore enterprises work with Kyanon Digital

Kyanon Digital is a strategic technology partner for enterprise commerce in Singapore, helping brands and B2B leaders modernize legacy systems into unified, scalable digital commerce engines.

- 13+ years of digital commerce expertise: Deep experience delivering high-volume, enterprise-grade commerce platforms across Retail, FMCG, and distribution sectors.

- End-to-end partner: Strategy, build, scale, and optimization. Deep experience delivering high-volume, enterprise-grade commerce platforms across Retail, FMCG, and Distribution sectors

- Award-winning innovation: Recognized by VINASA and the Asian Technology Excellence Awards for delivering robust, scalable software solutions that solve critical business challenges.

- Outcome-driven commerce architecture: Focus on increasing Gross Merchandise Value (GMV), optimizing inventory turnover, and automating workflows, rather than just delivering features.

- Strong regional presence and scale: 500+ experts with delivery teams across Singapore and Southeast Asia, ensuring cross-border expansion capabilities and deep local market understanding.

- Enterprise-grade integration mastery: Proven success in untangling legacy technical debt and securely integrating complex backend systems (ERP, OMS, WMS) for real-time data visibility.

For Singapore enterprises navigating complex transformation, Kyanon Digital bridges the gap between legacy infrastructure and modern, unified commerce, ensuring your platform is scalable, secure, and ready for regional growth.

Case study: Retail transformation for an iconic Singaporean retailer from Kyanon Digital

A legacy Singaporean retailer renowned for premium fashion, beauty, and lifestyle products, with a multi-generational customer base and a strong physical footprint.

The challenge:

- Legacy debt: An outdated, custom-built e-commerce platform limited flexibility and speed-to-market.

- O2O friction: Disconnected systems created gaps between online browsing and in-store experiences (e.g., inability to handle cross-channel returns).

- Data silos: Fragmented CRM and inventory data prevented real-time personalization and accurate stock visibility.

The solution: Kyanon Digital delivered a 360° omnichannel transformation, moving from ad-hoc fixes to a unified enterprise architecture.

- Platform modernization: Migrated from legacy custom code to a scalable enterprise e-commerce platform to support high-volume regional growth.

- Unified commerce: Integrated Mobile POS (mPOS) and fulfillment systems to bridge the gap between store staff and digital orders.

- Operational backbone: Connected CRM, PIM (Product Information Management), OMS (Order Management), and WMS (Warehouse Management) into a single data layer.

The business impact:

- True omnichannel: Successfully launched BOPIS (Buy Online, Pick Up In-Store) and cross-channel returns, driving foot traffic to physical stores.

- Operational speed: Automated fulfillment workflows significantly improved order cycle times and inventory accuracy.

- Customer lifetime value: Unified CRM data now powers personalized marketing, increasing engagement and retention across touchpoints.

Read more: Retail Transformation For An Iconic Singaporean Retailer

Future outlook: Enterprise digital commerce in Singapore

- B2B acceleration: The B2B sector will continue to outpace B2C growth, driven by the consumerization of corporate procurement.

- AI supply chains: Decision-making regarding stock replenishment and logistics routing will become increasingly autonomous.

- Cross-border growth: Commerce platforms will become the primary engine for Singaporean enterprises expanding into ASEAN.

- Democratization: Government grants (PSG, EDG) and low-code platforms will make enterprise-grade tech accessible to mid-market challengers.

In conclusion

Don’t just adapt, lead! Contact Kyanon Digital today for a comprehensive assessment of your digital commerce maturity.

Let’s build a transformation roadmap that turns your technical complexity into a competitive advantage!