The digital imperative for Singapore’s food and beverage (F&B)

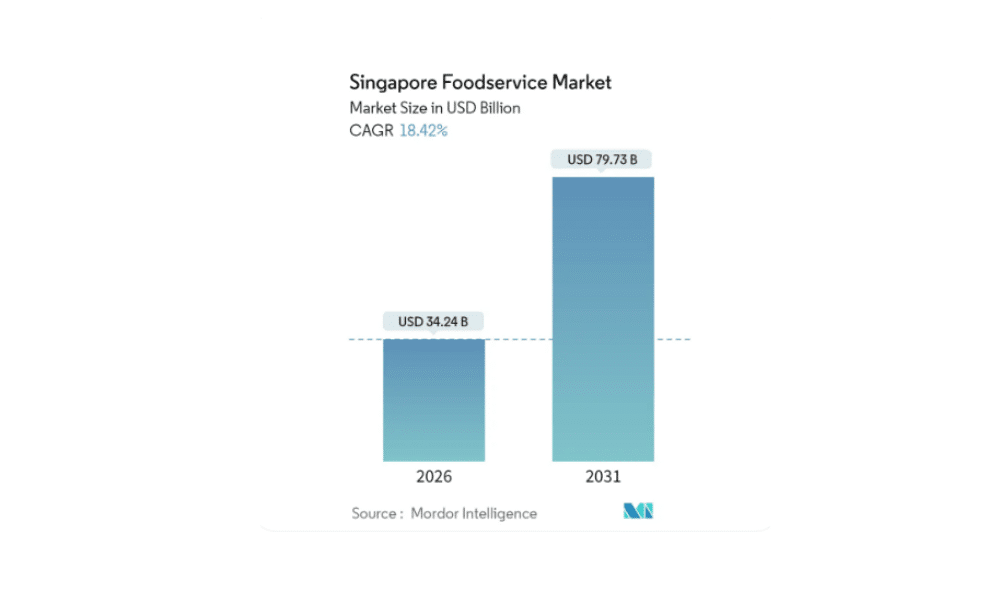

The adoption of high-performance food and beverage software is no longer a luxury but a baseline requirement for survival in Singapore’s hyper-competitive culinary landscape. As of early 2026, the industry is navigating a “perfect storm”: while the market is projected to surge at an 18.42% CAGR through 2031, over 3,000 outlets shuttered in the past year alone due to extreme labor shortages and a 15% spike in raw material costs (Mordor Intelligence).

In response, the Food Services Industry Digital Plan (IDP), launched by Enterprise Singapore and IMDA, has redefined the technological gold standard. Today’s CTOs and SaaS founders are moving beyond “off-the-shelf” apps toward custom-built, AI-integrated platforms that don’t just record transactions; they predict demand with generative AI, automate procurement via automated document reconciliation, and power unmanned retail formats.

In this article, Kyanon Digital explores the critical role of bespoke food and beverage software development in Singapore, highlighting how specialized technology partners are helping enterprises leverage government grants and AI to build resilient, high-margin operations.

Key takeaways

- Food and beverage software is now core infrastructure for survival in Singapore’s high-cost, manpower-scarce F&B market.

- The best software for the food and beverage industry is purpose-built, integrating POS, ERP, inventory, kitchen, delivery, and AI into one unified platform.

- Custom food and beverage software development delivers long-term ROI through full data ownership, scalability, and PDPA/SFA compliance.

- AI-powered F&B platforms improve margins via demand forecasting, wastage reduction, and automated back-office operations.

- Singapore’s Food Services Industry Digital Plan (IDP 2025/2026) is accelerating the adoption of smart kitchens, unmanned stores, and automation.

Further reading:

- Enterprise Software Development Services

- Software Development Outsourcing Services

- A Practical Guide To Food And Beverage Loyalty Programs

- Top 11+ Enterprise Software Development Companies in Singapore

Transform your ideas into reality with our services. Get started today!

Our team will contact you within 24 hours.

What is food & beverage software development?

According to Gartner, the food and beverage (F&B) industry requires a purpose-built technology framework to manage a highly complex product lifecycle that standard retail software cannot support.

Food and beverage software development is the engineering of specialized, data-driven platforms designed to manage the unique lifecycle of food products, from raw material sourcing and recipe formulation to omnichannel sales and real-time logistics.

In Singapore, F&B software development plays a central role in digital transformation, enabling restaurants, cloud kitchens, and food manufacturers to operate at scale through integrated systems such as:

- Point-of-sale (POS) and order management

- Kitchen display systems (KDS)

- Inventory and supply chain management

- Mobile ordering and delivery integrations

- ERP for finance, operations, and procurement

- Customer engagement and loyalty platforms

These platforms are increasingly powered by AI and IoT to improve efficiency, reduce food waste, and meet the expectations of Singapore’s tech-savvy, mobile-first consumers.

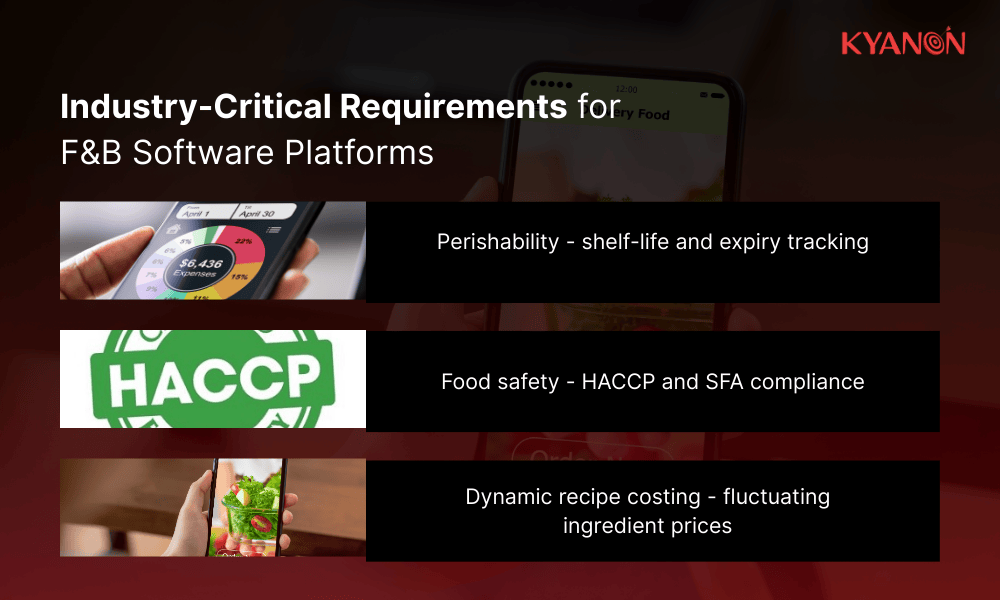

Unlike general software, F&B-specific systems must address “industry-critical” variables:

- Perishability (shelf-life tracking)

- Stringent food safety (HACCP/SFA compliance)

- Dynamic recipe costing (fluctuating ingredient prices).

Beyond food safety and recipe control, F&B businesses also operate under thin margins, high daily order volumes, and strict regulatory enforcement, especially in Singapore, where labor and rental costs are among the highest in Asia.

As a result, F&B software is no longer a support tool. It is core business infrastructure.

And that leads to a critical executive question: Should you buy an off-the-shelf platform – or build a purpose-built F&B system?

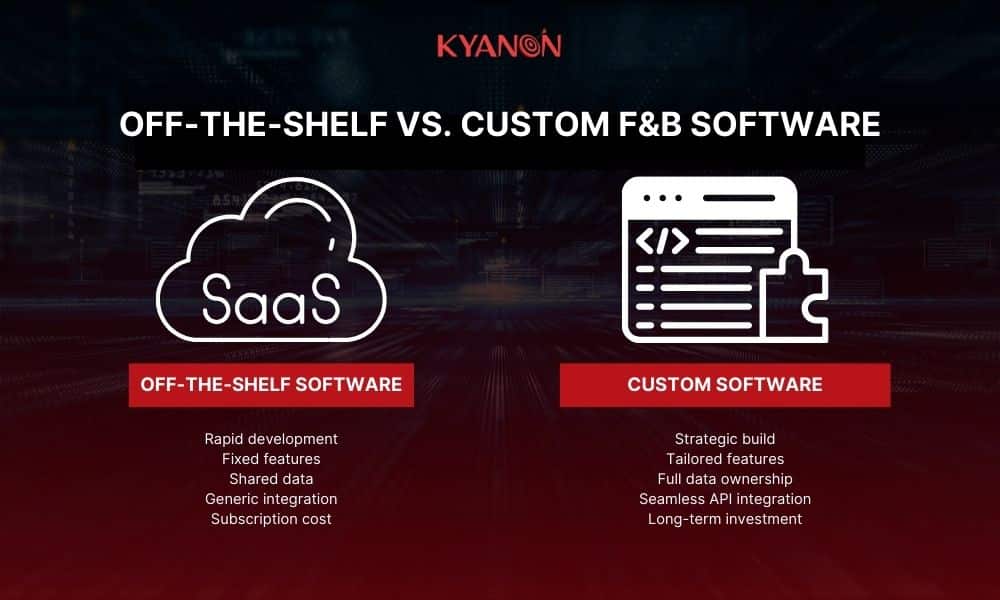

Custom vs. off-the-shelf F&B software: A strategic decision framework for Singapore enterprises

For Singaporean enterprises, the choice between buying and building often determines long-term operational resilience. Below is an executive-level breakdown to help founders evaluate the best path forward.

Quick comparison table of off-the-shelf (SaaS) and custom F&B development

|

Feature |

Off-the-shelf (SaaS) | Custom F&B development |

|

Upfront cost |

Low (monthly subscriptions) |

Higher initial investment |

|

Deployment |

Instant (plug-and-play) |

3-6 months (strategic build) |

|

Integrations |

Limited to vendor ecosystems |

Seamless (API-first for PayNow, Grab, ERPs) |

|

Scalability |

Tier-based (pay more as you grow) |

Infinite (owned architecture) |

|

Data ownership |

Managed by vendor |

Full control & sovereignty |

|

Compliance |

General security |

PDPA & SFA specific readiness |

| Best for | Startups & single-unit cafes |

Enterprise chains & central kitchens |

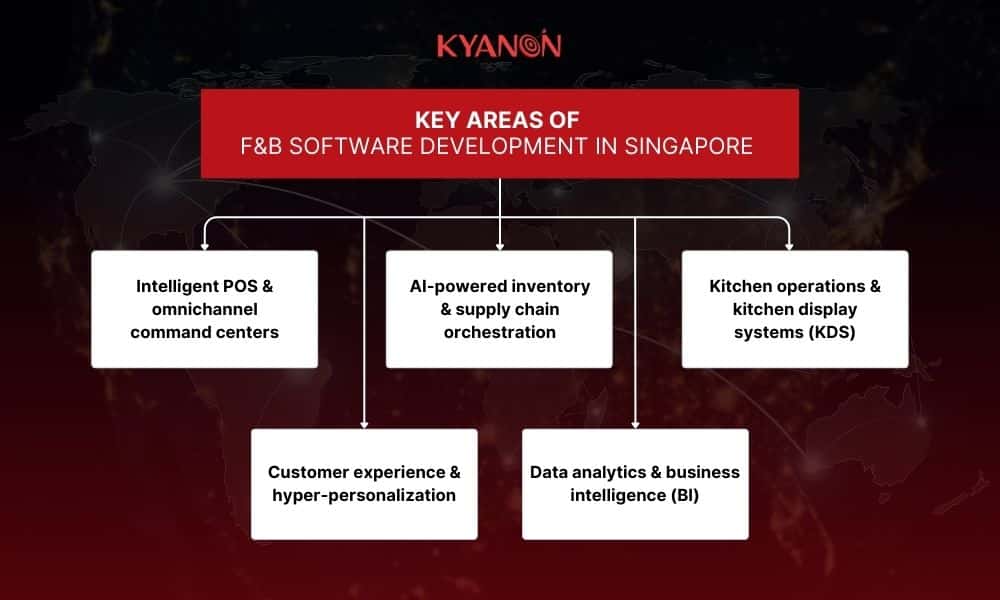

Key areas of food & beverage software development in Singapore

To achieve the manpower-lite and high-efficiency targets set by the IMDA Food Services Industry Digital Plan (IDP), software development must move beyond siloed apps. In 2026, the focus for Singaporean F&B enterprises is on creating a unified digital nervous system.

Intelligent POS & omnichannel command centers

In 2026, POS is no longer just a cash register; it is an omnichannel command center. Modern development focuses on:

- API-first delivery integration: Native, real-time syncing with GrabFood, Foodpanda, and Deliveroo to eliminate tablet hell and menu discrepancies.

- Unified payment orchestration: Seamlessly processing PayNow, digital wallets, and “Tap to Pay” via a single interface, reducing transaction friction.

- Offline-first resilience: Ensuring that outlets in high-density areas (like Orchard or the CBD) can continue processing orders even during local network outages.

AI-powered inventory & supply chain orchestration

With food costs rising, predictive inventory management is the most significant margin-saver for Singaporean businesses.

- Automated document reconciliation: Leveraging LLMs and OCR to digitize physical delivery orders and invoices instantly, a primary focus of the 2025 IDP refresh.

- Ingredient-level wastage tracking: AI models that forecast demand based on weather, local events (like the F1 Grand Prix), and historical sales to prevent over-ordering.

- Central kitchen ERPs: Specialized modules for multi-outlet logistics, managing batch production, and internal stock transfers with full traceability.

Kitchen operations & kitchen display systems (KDS)

Digitalizing the back of house (BOH) is critical for operational consistency.

- Dynamic order routing: Intelligent KDS that routes specific items to designated stations and synchronizes prep times so all components of an order are ready simultaneously.

- Advanced automated cooking integration: Software that interfaces directly with smart kitchen hardware to monitor temperatures and automate dispensing, reducing the need for highly skilled manual labor.

Customer experience & hyper-personalization

In a viral dining era, software must turn one-time visitors into loyal advocates.

- Agentic AI chatbots: Moving beyond basic FAQs to handle complex reservations, multilingual inquiries, and personalized menu recommendations 24/7.

- Phygital loyalty programs: Integrated rewards systems that recognize customers whether they order via a mobile app, a self-checkout kiosk, or in person.

Data analytics & business intelligence (BI)

CTOs are prioritizing platforms that turn big data into actionable insights.

- Menu engineering insights: Real-time dashboards that identify high-margin vs. high-volume dishes to optimize menu design.

- Labor optimization tools: Predictive scheduling that aligns staff shifts with forecasted peak periods, drastically reducing idle labor costs.

Trends driving development in Singapore

To win in Singapore’s digital-first economy, CTOs are no longer just looking for features; they are looking for information gain and operational velocity.

Agentic AI revolution in guest experience

The post-pandemic shift toward online ordering has evolved into a sophisticated digital-first economy.

- Conversational commerce: With the “ChatGPT moment” for physical services arriving in 2026, Singaporeans now expect to interact with restaurants via Agentic AI across WhatsApp, TikTok, and Instagram.

- Hyper-personalization: Leading brands are deploying generative AI assistants that help customers design personalized meals via mobile apps, turning generic orders into high-fidelity data points.

The rise of manpower-lite operations

Singapore’s persistent labor shortage, highlighted by the 3,000+ outlet closures in 2024/2025, remains the #1 driver for automation (CNA).

- Unmanned retail & smart kiosks: Development of autonomous grab-and-go modules in high-traffic areas like the CBD and Changi Airport, using vision-recognition AI to eliminate checkout lines.

- Automated kitchens: Software-controlled robotics that handle high-volume prep to maintain consistency with less human intervention.

Government-led transformation: The 2025/2026 IDP

The Singapore government remains the most influential architect of the industry’s digital future. In July 2025, Enterprise Singapore and IMDA launched the Refreshed Food Services Industry Digital Plan (IDP), which introduces five high-impact categories for SMEs:

- Advanced automated cooking equipment: Smart systems with pre-programmed recipes and automatic dispensing.

- Automated document reconciliation: Using LLMs and OCR to digitize invoices and POs, a massive win for back-office efficiency.

- Automated end-to-end operation lines: Integrating BOH from cooking to packing.

- Automated self-checkout systems: Identifying food via RFID or smart vision.

- Unmanned stores: Fully automated “order-prep-checkout” setups.

Sustainability & circularity (ESG)

Under the Singapore Green Plan 2030, F&B software must now include:

- Food waste management systems: IoT sensors and AI that track wastage in real-time to optimize production volumes.

- Energy efficiency monitoring: Smart ERP modules that manage the energy load of central kitchens and cold chains.

Business benefits of food & beverage software development

Modern food and beverage industry software is designed to remove the biggest operational bottlenecks across different business models. In Singapore, where labor is scarce, rents are high, and compliance is strict, digital systems are now essential for scale and profitability.

Below is a clear framework showing how different F&B models use software to solve their most critical challenges.

Types of F&B businesses that benefit most

Quick overview table

|

Business type |

Main challenge | Software focus | Business impact |

|

Quick service & fast casual (QSR) |

High rent, labor shortage, peak-hour congestion | Self-checkout, smart POS, digital ordering |

Faster service, higher throughput, protected margins |

|

Central kitchens |

Scaling production with limited manpower | ERP, AI document automation, production systems |

Lower admin workload, smoother outlet expansion |

|

Cloud kitchens |

Managing multiple delivery platforms | Unified order management system |

Fewer order errors, faster fulfillment |

|

Food manufacturers & caterers |

Food safety, export compliance, traceability | IoT-enabled ERP, compliance systems |

Stronger compliance, safer production |

| Enterprise F&B groups |

Disconnected POS, ERP, and CRM systems |

Unified digital platform |

Better visibility, smarter planning, stronger loyalty |

Quick service & fast casual (QSR)

QSR brands in Singapore use self-checkout and smart POS systems to reduce queues, serve more customers during peak hours, and protect margins in high-rent locations.

- With QSR accounting for roughly 67% of food service revenue and nearly half of residents consuming takeaway meals at least once a week, software has become the core engine driving operational performance and scalable growth.

- Business impact: By integrating self-checkout and smart POS, brands mitigate the high cost of labor. Mordor Intelligence notes that digital adoption in this sector is essential to maintain margins in high-rent districts like Orchard Road, where 26.3% of total F&B sales now originate from online or digital transactions.

Central kitchens

Central kitchens use AI-powered document automation and production systems to streamline operations, reduce manual workload, and scale outlet supply without increasing admin teams.

- Automated systems streamline the cook-chill process and inventory management, ensuring that as the number of outlets grows, the cost per meal remains optimized through bulk-processing efficiency.

- Business impact: AI-powered document automation and ERP systems allow central kitchens to scale without a linear increase in admin headcount. This is critical as the industry faces a -2.7% CAGR restraint due to rising raw material costs and supply chain disruptions.

Cloud kitchens

Multi-brand cloud kitchens use unified order management platforms to handle all delivery channels in one system, improving order accuracy and speeding up fulfillment.

Cloud kitchens are projected to be the fastest-growing segment in Singapore, with a 20.05% CAGR through 2031 (Mordor Intelligence).

- Ghost kitchens leverage software to offer lower prices and faster delivery, maintaining an average order value (AOV) of approximately US$13.34 while operating with significantly lower overhead than traditional dine-in venues.

- Business impact: Unified order management is a survival requirement for cloud kitchens. With the number of online delivery users reaching 2.8 million in Singapore, these platforms handle high-frequency surges from GrabFood, Foodpanda, and Deliveroo (which saw a 40% increase in order volume over recent years).

Food manufacturers & caterers

Food manufacturers use IoT-enabled ERP and traceability platforms to strengthen food safety control, simplify audits, and support export-ready compliance.

As Singapore pushes its “30 by 30” food security goal, food manufacturers are adopting IoT-enabled ERPs to ensure export-ready compliance and food safety.

- The use of advanced analytics and IoT sensors in production helps manufacturers achieve 25% higher gross margins through better inventory control and modular ingredient systems.

- Business impact: Automated traceability simplifies the rigorous audit processes required by the Singapore Food Agency (SFA). For manufacturers, software reduces the licensing complexity, which currently acts as a -2.1% drag on industry growth.

Enterprise F&B groups

Large F&B groups use unified digital platforms to connect POS, ERP, and CRM into a single system, enabling better visibility, planning, and cross-brand customer engagement.

- Chained outlets are outperforming independent stalls in terms of growth rate (18.62% vs 16.85%), largely due to their ability to invest in integrated technology stacks that provide superior visibility into regional performance.

- Business impact: Connecting POS, ERP, and CRM into a single data lake prevents brand cannibalization, a risk that can impact CAGR by -1.8% in multi-brand groups. Unified systems allow these groups to use data insights to raise average order values by 35–40% through personalized cross-brand loyalty programs.

Choosing the right F&B software development partner in Singapore

Choosing the right food and beverage software development partner in Singapore is critical for grant funding, regulatory compliance, secure payments, and scalable multi-outlet growth.

- IMDA & grant alignment: Prioritize partners experienced with the Refreshed Food Services Industry Digital Plan (IDP 2025) to maximize funding eligibility through PSG and EDG grants.

- Composable architecture (MACH): Ensure your partner builds microservices-based, API-first platforms that allow modular upgrades without a full system rebuild.

- Local compliance expertise: Verify proven experience with PDPA data protection and SFA digital food safety logging requirements.

- Singapore trinity integration: Confirm native integration with PayNow, GrabFood/Foodpanda, and enterprise ERPs such as SAP and Oracle.

- 24/7 local support SLA: Choose a partner that provides on-site or immediate remote support for mission-critical operations.

- Security & cyber protection: Look for partners certified under Singapore’s Cyber Essentials framework to safeguard sensitive customer and payment data.

- Scalability & DevOps maturity: Ensure the firm operates CI/CD pipelines and cloud DevOps practices to support regional APAC expansion.

Case study: How Kyanon Digital built an AI-powered loyalty platform for a leading beverage brand

Kyanon Digital partnered with a leading beverage engagement platform to build a modern, data-driven loyalty ecosystem that captures real-time consumer behavior and transforms it into personalized engagement to strengthen customer retention and brand positioning in a competitive beverage market.

Key challenges

- Weak ability to capture real-time consumption behavior, limiting responsiveness to customer actions.

- Friction in the onboarding process leads to drop-offs before engagement.

- No centralized system to unify data from QR scanning, receipts, or IoT devices for rewards and insights.

- Lack of an automated CRM strategy for personalized reward distribution and re-engagement.

Solution delivered by Kyanon Digital

- Designed a data-driven loyalty engagement platform with advanced CRM, real-time analytics, and intelligent targeting.

- Enabled seamless consumer acquisition via QR code scanning to reduce onboarding friction.

- Built mobile-friendly onboarding flows to convert new users into registered members.

- Implemented real-time consumption tracking through receipt scanning and IoT interactions.

- Developed automated CRM flows for rewards and retargeting based on actual behavior.

Results & business impact

- Enhanced consumer engagement with intuitive entry points and consistent interaction across physical and digital touchpoints.

- Improved visibility into consumption behavior, enabling data-backed decision-making.

- More effective personalization and campaign targeting through automated CRM segmentation.

- Strengthened customer retention and loyalty via timely rewards and personalized offers.

- Enabled the brand to operate a scalable, intelligent engagement platform that turns real-time data into meaningful actions and sustainable growth.

Read more: AI-Powered Loyalty Engagement Platform For A Leading Beverage Brand

Conclusion

In Singapore’s digital-first economy, food and beverage software is a long-term growth enabler. From restaurant chains and cloud kitchens to food manufacturers, modern F&B businesses rely on digital platforms to scale faster, operate more efficiently, and stay compliant in a high-cost market.

Companies that adopt digital-first operations gain a clear competitive edge through better productivity, smarter data, and stronger customer engagement.

The future of F&B belongs to businesses that treat software as core infrastructure.

Contact Kyanon Digital now to consult on custom food and beverage software or mobile app development, built for scale, compliance, and long-term growth in Singapore and APAC.