Today’s consumers live in a landscape overflowing with choices, for which they can compare prices and alternatives instantly. Retaining a customer now costs 5× less than acquiring a new one, yet traditional “earn & burn” programs no longer influence behavior.

At the same time, the 2026 Loyalty Benchmark Report indicates that global loyalty teams are shifting toward engagement (58%) and retention (20%) as primary success metrics. But technology limitations, misaligned teams, and ROI pressure remain major obstacles.

This is why modern brands are moving toward Loyalty 4.0: an intelligent, omnichannel, experience-led model built for business.

In this blog, Kyanon Digital will demonstrate how Loyalty 4.0 works, why global enterprises are rapidly adopting it, and what leaders need to know to stay competitive beyond.

Explore more of the Key Insights For Loyalty Program Success: 2026 Benchmark

Key takeaways

- Loyalty 4.0 is a strategic shift from transactional “earn & burn” to AI-powered, predictive, omnichannel loyalty that drives long-term customer relationships.

- AI and real-time data enable hyper-personalization, behavioral rewards, and proactive engagement, far beyond what traditional programs can deliver.

Customers expect relevance, seamless omnichannel experiences, and emotional value; fragmented, outdated systems can no longer meet these expectations. - Loyalty 4.0 delivers measurable ROI, boosting retention, CLV, engagement, and conversion through intelligent journeys and unified customer profiles.

- A composable, API-first architecture is essential, allowing brands to activate data across app, POS, CRM, e-commerce, and partner ecosystems.

- Every department plays a role, from C-suite to tech, data, marketing, and operations, making cross-functional alignment critical for success.

- Brands that modernize now gain a strong competitive advantage in markets where switching is effortless and differentiation is shrinking.

Further reading:

- How AI Is Redefining Customer Loyalty in SEA

- Customer Loyalty Programs Advantages For E-commerce Brands

- Turn Your Loyalty Platform Into a Revenue-Driving Engine

What Loyalty 4.0 actually is?

Loyalty 4.0 is the loyalty ecosystem that uses AI-powered real-time data, omnichannel journeys, and behavioral rewards to create adaptive, emotionally resonant customer relationships, driving retention, CLV, and measurable financial impact for modern enterprises. It is built for today’s market reality, where customers can switch brands instantly, product differentiation is shrinking, and loyalty must be earned through relevance, not just discounts.

Loyalty 4.0 is defined by four enterprise-level shifts that matter directly to C-level leaders:

- From points to intelligence: Rewards evolve beyond spend-based structures and adapt dynamically to customer behavior, intent, and emotional triggers.

- From campaigns to real-time decisions: AI predicts churn, identifies high-value moments, and triggers personalized incentives automatically.

- From channels to journeys: Recognition, rewards, and experiences follow the customer seamlessly across app, store, e-commerce, CRM, POS, and partner ecosystems.

- From cost centers to profit engines: Loyalty 4.0 links engagement to profit, CLV, margin expansion, and measurable ROI, addressing the top pain point identified in the 2026 report: proving business impact.

For leaders, Loyalty 4.0 provides what traditional loyalty cannot: a unified, intelligent system that understands individual customers, predicts behavior, and influences decisions at scale.

In Southeast Asia, where mobile-first behavior, high digital adoption, and community engagement dominate, Loyalty 4.0 becomes a strategic differentiator for brands seeking sustainable growth.

Transform your ideas into reality with our services. Get started today!

Our team will contact you within 24 hours.

Key characteristics of Loyalty 4.0

1. AI-driven personalization

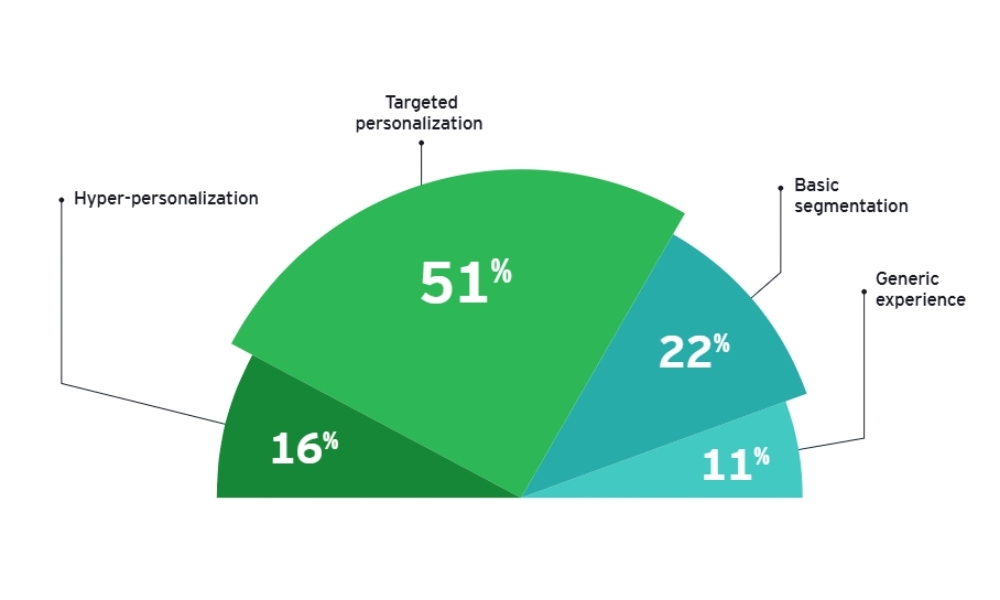

Traditional loyalty programs react after a transaction. Loyalty 4.0 predicts behavior before it happens.

With member value and personalization rising as investment priorities, companies are accelerating the adoption of advanced analytics and ML to deliver truly individualized experiences at scale.

It integrates:

- AI-powered segmentation (intent, propensity, churn risk).

- Predictive reward systems (e.g., auto-triggered incentives when a shopper is about to switch).

- Behavioral modeling (frequency, category progression, content interaction).

- Unified profiles across app, web, POS, social, and partners.

This “living system” continuously learns, optimizes, and adapts without requiring manual campaign orchestration.

Brands can deliver real-time offers, personalized journeys, and tier-specific experiences at every touchpoint. According to McKinsey, optimizing personalization can drive 40% higher engagement and significantly increase CLV compared to average players.

2. Predictive & behavioral rewards

Instead of rewarding only purchases, Loyalty 4.0 influences full-funnel behavior:

- First purchase completion

- Refill or reorder prediction

- Cross-category exploration

- Advocacy and referrals

- App usage or community participation

This is the smart behavioral incentive directly influencing revenue, with the 2025 EY Loyalty Market Study’s finding that 58% of shoppers cite their primary motivation as getting rewards when enrolling in a program, allowing businesses to reward behaviors that deliver long-term value, not just transactions, leading to sustainable profitability.

3. Connected omnichannel journeys

The 2025 EY Loyalty Market Study results show that while digital remains essential, in-store engagement is still a critical loyalty driver, especially as the U.S. saw 7,325 store closures in 2024 and an estimated 334% increase expected in 2025, forcing brands to maximize every physical touchpoint.

At the same time, the Loyalty Benchmark Report 2026 confirms that loyalty leaders prioritize engagement (58%) and financial impact (20%), yet struggle due to fragmented systems.

Loyalty 4.0 solves this with a composable, API-first architecture that unifies:

- Ecommerce

- Mobile apps (the strongest performing loyalty channel)

- POS

- CRM / CDP

- Partner ecosystems

- Marketplace integrations

Customers can earn, redeem, and engage seamlessly across all touchpoints, from digital to in-store. This omnichannel consistency strengthens brand trust, boosts enrollment, and drives measurable revenue uplift.

4. Emotional loyalty and community engagement

Modern loyalty is built not on discounts but on experiences, recognition, and community. Loyalty 4.0 enables brands to design:

- Exclusive, high-emotion experiences (events, access, early drops).

- Community-based advocacy systems.

- VIP programs that reward identity, not just spending.

- Cross-channel engagement moments that reinforce brand affinity.

This is critical in Southeast Asia, where consumers heavily value community, gamification, and mobile-first access. To stand out amid this blizzard, only cohesive, consistent, and personalized messaging stands out, and customers increasingly expect real-time updates that help them maximize the value of their purchases.

5. Unified profiles

In today’s environment, modern loyalty demands a single “source of truth”- a unified customer profile that spans every channel and interaction. The report finds that over 80% of consumers are willing to use loyalty mobile apps weekly (2025 EY Loyalty Market Study), and brands that treat identity and data as strategic assets outperform peers.

Loyalty 4.0 achieves this by integrating:

- POS systems and in-store transactions.

- Ecommerce platforms and online purchase data.

- Mobile apps and loyalty engagement channels.

- CRM systems capture relationships and service interactions.

- CDP solutions aggregating first- and zero-party data.

- Social, offline behaviors and partner-ecosystem inputs.

For businesses in Southeast Asia (SEA), this completeness and activation speed are essential. A disjointed profile or delayed trigger means missed revenue, weaker lifetime value (LTV), and weaker competitive positioning.

How Loyalty 4.0 differs from previous models

Loyalty 4.0 is the more Intelligent, predictive, omnichannel loyalty designed to understand, anticipate, and influence customer behavior.

Quick comparison table

|

Generation |

Focused on | Limitations | Value today |

|

Loyalty 1.0 |

Basic points, discounts, punch cards | Transactional, generic rewards; no data utilization |

Minimal differentiation in saturated markets |

|

Loyalty 2.0 |

Co-branded cards, coalition programs, early CRM | Fragmented systems, siloed data, limited personalization |

Useful for scale but outdated for modern expectations |

|

Loyalty 3.0 |

Mobile apps, gamification, digital tiers | Campaign-heavy, manual optimization; reactive rather than predictive |

Still relevant but insufficient for real-time engagement |

| Loyalty 4.0 | AI-driven personalization, omnichannel journeys, predictive engagement | Requires unified data, cross-team alignment, and composable architecture |

High ROI: deeper emotional loyalty, higher LTV, measurable financial impact |

Why move now?

- Consumers demand relevance: Digital-first shoppers expect real-time personalization, seamless app experiences, and emotional value, not generic points.

- Switching is easier than ever: With endless alternatives, loyalty becomes a competitive advantage only when it is predictive and experience-led.

- Loyalty programs must prove ROI: Benchmark data shows financial impact and engagement are now the top KPIs for loyalty leaders.

- Technology finally enables it: AI, real-time data activation, unified profiles, and composable architectures make modern loyalty execution achievable at scale.

What to consider depending on your role?

Loyalty transformation affects every part of the organization. While Loyalty 4.0 is an enterprise-wide shift, each role has different priorities, risks, and success metrics.

Quick comparison table

| Role | Top priorities in Loyalty 4.0 | Key questions to ask |

| C-suite (CEO, COO, CMO, CCO) | ROI, retention, CLV growth, competitive differentiation, omnichannel strategy | Is loyalty driving measurable financial impact? |

| Marketing & loyalty leaders | Engagement (58%), personalization, emotional loyalty, mobile-first experience | Are we truly personalizing or just automating? |

| Product & CX teams | Seamless journeys, frictionless signup, app/store integration, experience-led rewards | Is our loyalty experience meaningful and enjoyable? |

| Technology leaders (CTO, CIO) | Composable architecture, real-time data, unified profiles, cross-system integration | Are we built for real-time intelligence, not silos? |

| Data & analytics teams | Predictive modeling, CLV scoring, churn triggers, value-based rewards | Are we predicting needs or just reporting them? |

| Operations & retail teams | In-store execution, POS readiness, staff enablement, omnichannel consistency | Is our store experience aligned with digital loyalty? |

Top 6 KPI’s to measure the success of a loyalty program

Measuring loyalty performance requires a balance of financial impact, engagement health, and long-term customer value. Below are the six KPIs most widely used by loyalty leaders, validated by real industry benchmarks.

1. Customer retention rate (CRR)

Retention is one of the strongest indicators of loyalty success, which is a foundational KPI for measuring program effectiveness, as it shows whether customers stay longer with the brand.

Why it matters: Returning customers are significantly more profitable and represent long-term brand affinity.

2. Repeat purchase rate (RPR)

Tracks how frequently members buy again after their initial purchase, directly reflecting program stickiness and buying momentum.

Why it matters: Higher RPR = more predictable revenue cycles.

3. Redemption rate (RR)

Measures how often members redeem earned rewards. According to the Loyalty Benchmark Report 2026, redemption is where members “feel value,” and low redemption weakens trust and program stickiness.

Why it matters: High redemption = perceived value, strong engagement.

4. Loyal customer rate (LCR)

Indicates what percentage of your customer base qualifies as “loyal” (based on tiers, engagement, or defined thresholds).

Why it matters: Helps track the growth of your high-value segment.

5. Participation & engagement rates

Engagement is the most commonly tracked success metric: According to the Loyalty Benchmark Report 2026, 20.6% of brands use engagement as the primary indicator of loyalty health, more than any other metric.

Includes:

- Active members

- App logins

- Tier progression

- Reward usage

Why it matters: Engagement predicts long-term loyalty better than transactions alone.

6. Customer lifetime value (CLV)

CLV is a critical financial KPI, considered the most important long-term metric, directly representing the financial impact of loyalty efforts.

Why it matters: Demonstrates whether your program is growing high-value customers, not just giving out rewards.

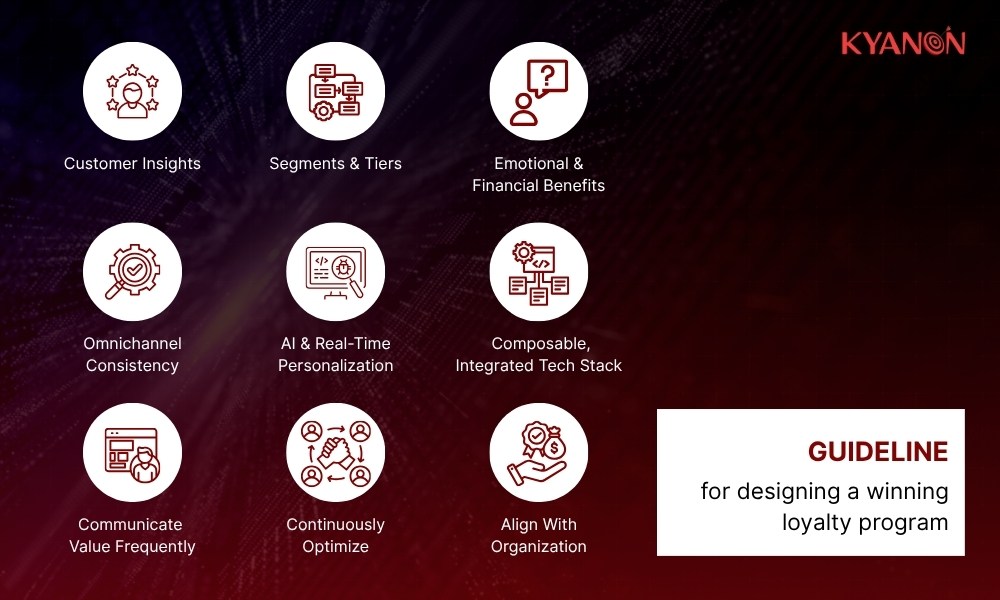

Guide-to-guide for the winning loyalty program design

- Start with customer insights: Build your program around what customers value and how they behave.

- Create clear segments & tiers: Use data to design meaningful, motivating tiers, not just more points.

- Blend emotional and financial benefits: Combine rewards with exclusivity, experiences, and recognition.

- Ensure omnichannel consistency: Let customers earn, redeem, and engage across app, web, store, and partners.

- Use AI & real-time personalization: Trigger relevant offers and journeys based on behavior and intent.

- Adopt a composable, integrated tech stack: Connect POS, CRM, CDP, mobile, and e-commerce in one ecosystem.

- Communicate value frequently: Send timely, personalized updates that help customers use their benefits.

- Continuously optimize with data: Track redemption, engagement, churn signals, and financial impact.

- Align the entire organization: Marketing, tech, operations, and retail must work together for loyalty success.

Case study: ACB’s transformation with Kyanon Digital

Asia Commercial Bank (ACB), one of Vietnam’s leading digital banks, wanted to move beyond a traditional points-based program and evolve toward Loyalty 4.0, a more personalized, real-time, and relationship-driven loyalty ecosystem.

Challenge

ACB’s existing on-prem loyalty system faced key limitations:

- Difficult to scale as transactions and membership grew

- High availability is required for millions of daily banking interactions

- Strict security and compliance needs

- Fragmented data and limited real-time engagement

- Complex integration with core banking systems

To advance toward AI-ready and omnichannel loyalty, ACB needed a stronger, more modern foundation.

Solution

Kyanon Digital modernized ACB’s loyalty platform to support next-generation features:

1. Strengthened infrastructure for scale & reliability

- Faster system performance

- High-availability & disaster recovery

- Enhanced security and compliance

2. Optimized on-prem environment

- Intelligent caching for speed

- Automated deployments

- Real-time monitoring for 24/7 stability

3. Powered by Open Loyalty

As an exclusive Open Loyalty partner, Kyanon Digital enabled:

- Faster issue resolution

- Access to advanced features

- A more flexible, API-first loyalty architecture

4. Improved loyalty experience

- Better UI/UX

- Real-time reward calculation

- New engagement mechanics

Results

ACB now benefits from a loyalty system that is:

- Scalable for nationwide growth

- Secure & compliant

- Real-time & reliable

- More engaging for customers

- Ready for Loyalty 4.0 personalization and omnichannel journeys

Read more: Enhancing & Maintaining ACB’s Loyalty System with Open Loyalty

Why choose Kyanon Digital for your loyalty 4.0 transformation?

Enterprise-grade loyalty expertise: We help leading brands shift from points-based programs to AI-driven, relationship-focused Loyalty 4.0 ecosystems.

- End-to-end capabilities: Strategy, UX, mobile, loyalty engines, CDP/CRM integration, and AI personalization, all delivered in one unified approach.

- Composable, scalable architecture: Built on microservices and API-first frameworks to support real-time data, omnichannel earning/redemption, and rapid feature rollout.

- Regional execution strength: Teams across Singapore, Vietnam, Thailand, and Malaysia bring both cost efficiency and deep local market insight.

- Data-driven impact: We focus on measurable outcomes with higher CLV, retention, engagement, and marketing efficiency.

Loyalty 4.0 is now a strategic advantage, not a nice-to-have.

Kyanon Digital helps enterprises build modern loyalty systems that strengthen relationships and drive long-term growth.

Contact us to start your Loyalty 4.0 journey today!