Artificial Intelligence (AI) is rapidly redefining the landscape of Banking, Financial Services, and Insurance (BFSI), offering unprecedented levels of efficiency, personalization, and security. From automating underwriting processes to enabling predictive risk analysis and AI banking assistants, the integration of AI in BFSI is not just a competitive advantage – it’s becoming a necessity.

As regulatory environments evolve and customer expectations rise, financial institutions must strategically adopt AI to remain agile and resilient.

This blog explores the latest trends, practical AI banking use cases, and the transformative impact of AI in the BFSI sector. Read on to uncover how your organization can lead the AI-driven future of finance.

Further Reading

- Top 10 Digital Transformation Challenges in the BFSI Industry

- Hyper Personalization in Banking: Transforming Customer Experience With AI

- Kyanon Digital Named Among Top AI Development Companies in Vietnam by GoodFirms

Introduction to AI in BFSI

AI in BFSI is revolutionizing the way financial institutions operate – enabling automation, enhancing decision-making, and delivering more personalized services at scale. The integration of AI solutions is not merely a digital upgrade – it represents a strategic shift toward intelligent, agile, and data-driven financial ecosystems.

In the BFSI sector, AI is no longer viewed as a futuristic innovation but as a strategic imperative. While early adoption focused on back-office automation and risk modeling, today’s AI banking use cases span from fraud detection and customer service chatbots to real-time credit scoring and regulatory compliance. Financial institutions are leveraging AI to not only cut operational costs but also to create differentiated, data-driven products and services. As AI capabilities mature, the competitive edge will lie not in adoption alone, but in how effectively organizations embed AI into their core financial ecosystems.

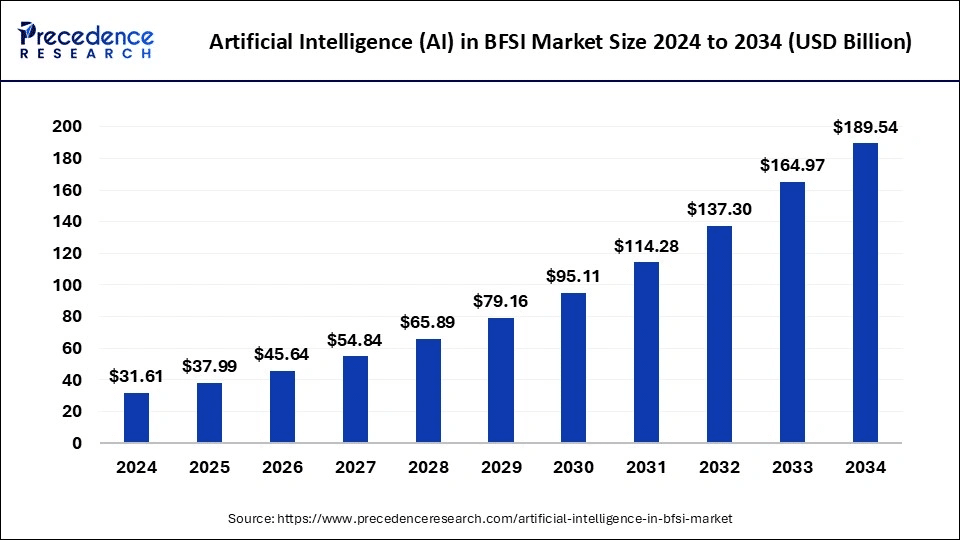

Market trends and statistics

According to Precedence Research, the AI in BFSI market is entering a phase of accelerated maturity, with global valuations rising from USD 31.61 billion in 2024 to an expected USD 38 billion in 2025. By 2034, this figure is expected to skyrocket to USD 189.54 billion, fueled by a CAGR of 19.62%. This growth trajectory is underpinned by the increasing need for automation, regulatory compliance, and enhanced customer experiences in financial institutions.

AI in BFSI is rapidly becoming a strategic cornerstone for digital transformation, enabling faster decision-making, improved cost optimization, and elevated service delivery.

Generative AI: Transforming the BFSI landscape

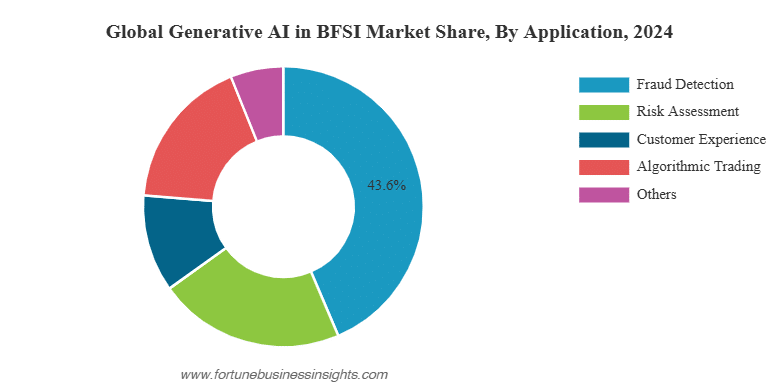

Generative AI is emerging as a transformative force within the BFSI sector, driving significant advancements in operational efficiency and customer engagement. According to Fortune Business Insights, the global generative AI in BFSI market was valued at USD 1.38 billion in 2024 and is projected to surge to USD 1.90 billion in 2025, with an impressive CAGR of 32.5% expected through 2032, indicating a robust growth trajectory.

This surge is attributed to the technology’s ability to automate complex processes, enhance decision-making, and deliver personalized customer experiences.

In the banking industry, generative AI applications are revolutionizing traditional operations. From automating customer service interactions to generating financial reports and investment analyses, these tools are streamlining workflows and reducing manual errors. Moreover, generative AI is instrumental in fraud detection and risk assessment, enabling banks to proactively identify and mitigate potential threats. As financial institutions continue to integrate these technologies, the role of AI in banking is poised to become increasingly central to strategic initiatives.

Rise of AI banking assistants and smart automation

One of the most significant developments is the rise of AI banking assistants, which are transforming the customer experience landscape. These AI-powered virtual agents handle everything from routine inquiries to sophisticated financial planning, allowing banks to provide 24/7 support while reducing the cost-to-serve.

In addition, AI is being embedded in core banking systems to enable real-time fraud detection, intelligent loan underwriting, and predictive risk management – use cases that not only improve performance but also enhance compliance with global regulatory frameworks.

Expansion across insurance and capital markets

Beyond banking, AI in BFSI sector is expanding rapidly into insurance and capital markets. Insurers are using AI for automating claims processing, detecting fraudulent activities, and implementing dynamic pricing models based on real-time data. Meanwhile, investment firms are leveraging AI-powered algorithms for high-frequency trading, portfolio optimization, and sentiment analysis.

These advanced capabilities empower institutions to make data-driven decisions and quickly adapt to market volatility, underscoring how AI is being used in finance to unlock both speed and scale.

Emphasis on ethical AI and regulatory alignment

As adoption grows, so too does the focus on governance and transparency. A growing number of financial institutions are investing in explainable AI frameworks to ensure compliance with regulatory standards and maintain public trust. Especially in regions like the EU and Asia-Pacific, where financial regulations are tightening, responsible AI practices are becoming a strategic priority.

This evolving landscape is prompting institutions to adopt AI models that are not only powerful but also ethically aligned – a critical step in ensuring long-term viability and stakeholder confidence.

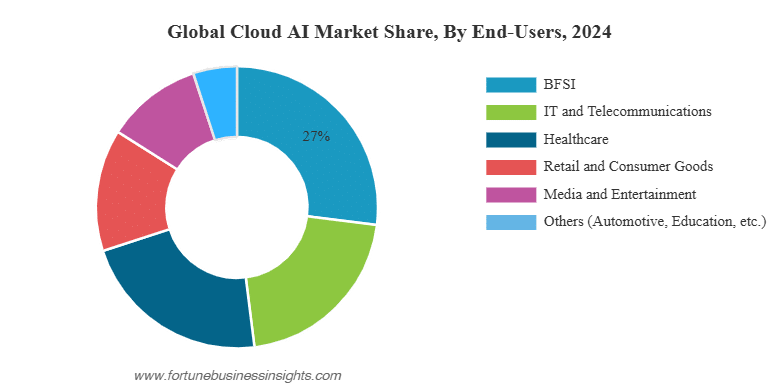

Cloud-based AI: Accelerating BFSI transformation

Cloud-based AI is emerging as a pivotal trend in the BFSI sector, offering scalability, flexibility, and cost-efficiency. Cloud-hosted AI frameworks allow banks to rapidly scale fraud detection models during peaks, run real‑time credit assessments, or spin up intelligent agents, all while complying with data sovereignty and security norms. Financial institutions are no longer hampered by on-premise limitations; instead, they benefit from continuous updates, elastic compute resources, and enterprise-grade governance that accelerates innovation and operational resilience.

As the BFSI sector continues to evolve, embracing cloud-based AI solutions will be crucial for institutions aiming to stay competitive and responsive in a dynamic market landscape.

Transform your ideas into reality with our services. Get started today!

Our team will contact you within 24 hours.

Core benefits of AI in BFSI

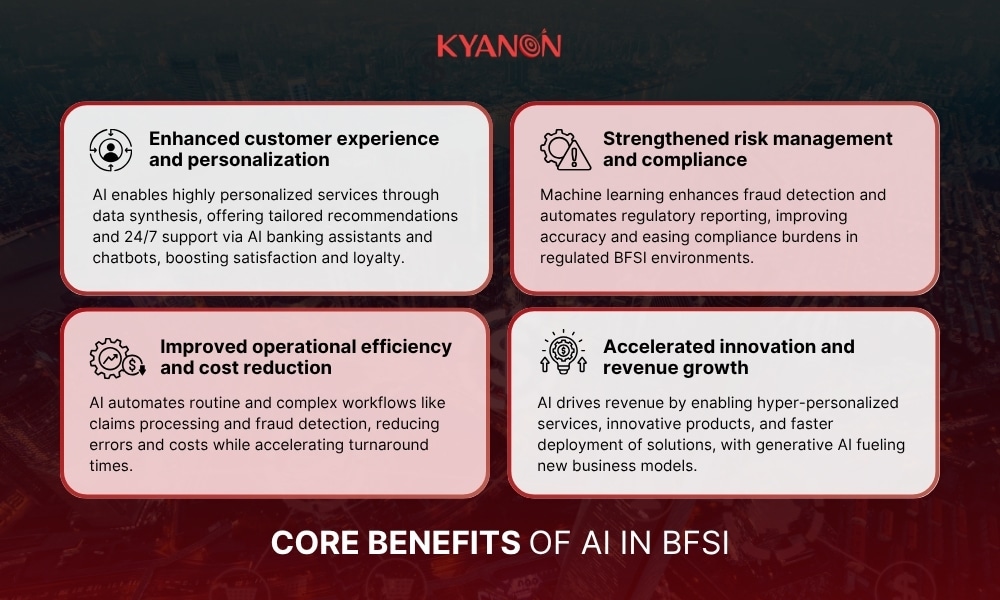

1. Enhanced customer experience and personalization

AI in BFSI enables financial institutions to deliver highly personalized and seamless customer experiences by synthesizing vast amounts of data from multiple sources. This allows banks to offer tailored product recommendations, proactive financial advice, and 24/7 support through AI banking assistants and conversational AI chatbots. Such personalization not only increases customer satisfaction but also fosters loyalty and deeper engagement across digital and human channels. By meeting evolving customer expectations, banks can differentiate themselves in a competitive market and drive growth through improved service quality.

2. Improved operational efficiency and cost reduction

Automation of routine and complex processes through AI significantly enhances operational efficiency in the BFSI sector. AI-powered systems streamline workflows such as claims processing, compliance reporting, and fraud detection, reducing manual errors and accelerating turnaround times. This leads to substantial cost savings and allows human resources to focus on strategic initiatives. For example, AI-driven fraud prevention models can analyze transaction data in real time, minimizing false positives and protecting both customers and institutions from financial losses.

3. Strengthened risk management and compliance

AI technologies empower banks and insurers to better manage risk and meet stringent regulatory requirements. Machine learning algorithms can detect suspicious activities and predict fraudulent transactions more effectively than traditional methods, enabling proactive fraud prevention. Additionally, AI automates regulatory reporting and compliance tasks, ensuring accuracy and reducing the burden on compliance teams. This enhances overall financial stability and trustworthiness, which are critical in highly regulated BFSI environments.

4. Accelerated innovation and revenue growth

Beyond efficiency gains, AI is increasingly recognized as a strategic driver of revenue growth in BFSI. By enabling hyper-personalized services, innovative product offerings, and improved cross-selling opportunities, AI helps financial institutions unlock new business models and revenue streams.

Generative AI, in particular, accelerates the development and deployment of novel banking solutions, allowing institutions to respond swiftly to changing market demands. This shift from cost-cutting to value creation marks a maturing phase of AI adoption in the sector.

Key AI use cases in BFSI

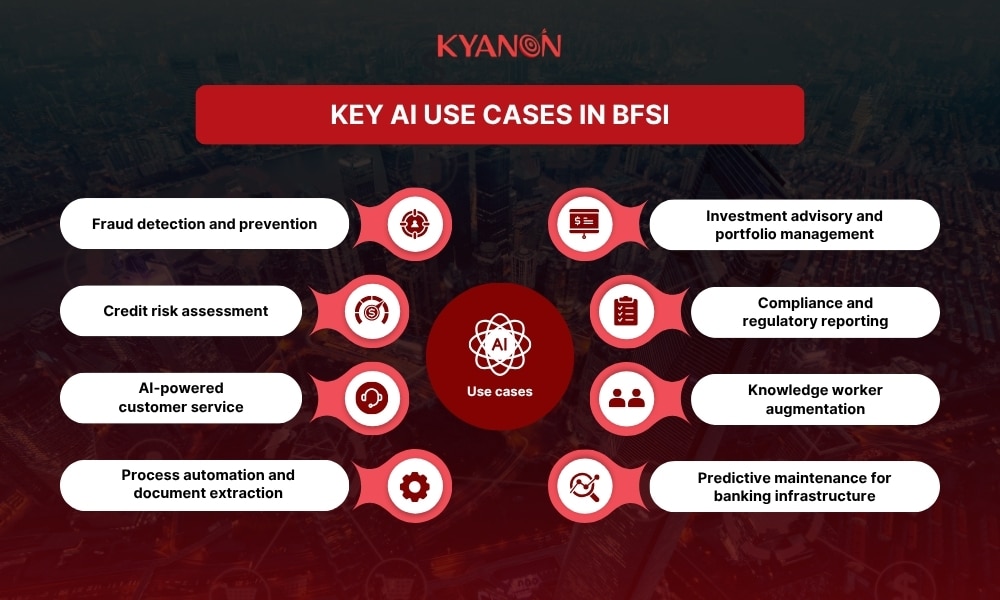

1. Fraud detection and prevention

AI plays a critical role in enhancing security by identifying and preventing fraudulent activities in real time. By analyzing transaction patterns and customer behavior, AI systems can detect anomalies such as unusual spending locations or sudden spikes in transfers, flagging suspicious activity before financial damage occurs. This proactive fraud management significantly reduces risk exposure and builds customer trust in digital banking services.

2. Credit risk assessment

Advanced AI algorithms enable more accurate and faster credit risk evaluation by analyzing a wide range of data points, including transaction history and alternative data sources. This holistic approach helps lenders make informed decisions, reduce default rates, and extend credit to underserved populations. AI-driven credit scoring models improve transparency and fairness, addressing regulatory concerns while streamlining loan approvals.

3. AI-powered customer service

Financial institutions leverage AI banking assistants and chatbots to provide 24/7 customer support, handle high call volumes, and deliver personalized financial advice. These AI-driven tools reduce wait times, improve response accuracy, and free human agents to focus on complex queries, enhancing overall customer satisfaction and engagement.

4. Process automation and document extraction

AI automates routine workflows such as data entry, document processing, and compliance reporting. Technologies like AI-powered document extraction minimize manual errors and accelerate processing times, enabling faster loan approvals and regulatory compliance. This automation drives operational efficiency and reduces costs across banking operations.

5. Investment advisory and portfolio management

AI models analyze market trends and client profiles to generate personalized investment recommendations and optimize portfolio management. By continuously learning from market data, AI supports wealth managers in delivering tailored advice and improving client retention through data-driven insights.

6. Compliance and regulatory reporting

AI streamlines compliance by automating monitoring, reporting, and risk assessment processes. It helps financial institutions stay ahead of evolving regulations by providing real-time insights and reducing human error, thereby mitigating regulatory risks and enhancing governance frameworks.

7. Knowledge worker augmentation

AI tools assist employees by providing instant access to institutional knowledge and automating routine tasks. For example, intelligent chatbots enable staff to quickly retrieve information across departments, improving decision-making speed and operational agility within banks.

8. Predictive maintenance for banking infrastructure

AI predicts potential failures in critical banking equipment such as ATMs, minimizing downtime and maintenance costs. Proactive monitoring ensures service continuity and enhances customer experience by reducing disruptions in banking operations.

How AI is revolutionizing finance

Data-driven decision making at scale

Artificial intelligence is redefining strategic decision-making in the financial industry by enabling institutions to derive actionable insights from massive volumes of structured and unstructured data. From market trend forecasting to customer segmentation, AI empowers leaders to anticipate risks, identify growth opportunities, and optimize resource allocation with unprecedented precision. As AI in BFSI continues to mature, data becomes not just an asset – but a competitive differentiator.

Redefining customer experience through hyper-personalization

Today’s financial institutions are moving beyond generic service models by leveraging AI to deliver hyper-personalized experiences. From predictive product recommendations to tailored investment strategies, AI banking assistants can interpret user behavior, financial habits, and real-time context to provide more meaningful interactions. These capabilities demonstrate how AI is used in banking to build customer trust and long-term loyalty.

End-to-end process automation and operational agility

AI is driving full-spectrum automation across the BFSI value chain—from back-office workflows like document processing and audit trails to front-line functions such as customer service and loan approvals. Financial institutions that adopt AI-enabled automation are achieving greater agility, lowering operational costs, and minimizing human error. In the broader AI in BFSI sector, this shift is unlocking new operating models that are leaner and more responsive.

Future-proofing compliance and risk governance

As regulatory frameworks evolve, AI is playing a pivotal role in helping institutions remain compliant while reducing administrative overhead. By integrating AI into anti-money laundering (AML), fraud detection, and transaction monitoring systems, banks can identify threats earlier and ensure regulatory alignment. These advancements illustrate how AI helps banks maintain operational resilience in a complex and highly regulated environment.

Challenges and ethical considerations

Data privacy and security risks

The widespread adoption of AI in BFSI introduces significant concerns around data privacy, confidentiality, and cybersecurity. With financial institutions processing sensitive customer data through machine learning models, the risk of breaches or misuse increases. Additionally, cloud-based platforms used for AI deployment can introduce third-party vulnerabilities, requiring robust data governance frameworks. These challenges are particularly relevant when considering how AI is used in banking to automate decision-making processes and manage customer accounts.

Algorithmic bias and transparency

One of the most pressing ethical issues in financial AI systems is algorithmic bias. Biased training data can lead to unfair credit scoring, loan rejections, or investment decisions that disproportionately affect certain demographics. The opacity of many AI models makes it difficult to ensure accountability and transparency. As the AI in BFSI sector evolves, institutions must prioritize explainable AI (XAI) to ensure equitable outcomes and maintain regulatory trust.

Regulatory uncertainty and compliance pressures

While AI offers operational efficiency, it also introduces legal ambiguity. Regulations such as the EU’s AI Act and evolving regional guidelines challenge firms to navigate compliance across jurisdictions. Financial services companies must reconcile the dynamic nature of AI technologies with the static nature of traditional risk and compliance protocols. Understanding how AI helps banks stay compliant requires not only technical expertise but also a multidisciplinary approach to governance.

Over-reliance and workforce displacement

Automation driven by AI can streamline repetitive tasks but also raises concerns about job displacement. While some roles will evolve toward higher-value activities, others may become obsolete. Ethical leadership in the BFSI sector must balance innovation with workforce development initiatives, ensuring that technology augments – not replaces – human expertise. This ethical commitment is central to building public trust and sustaining long-term adoption of AI in finance.

Addressing trust and ethical AI adoption

To scale AI responsibly, BFSI organizations must embed ethics at every stage of the AI lifecycle – from design and deployment to monitoring and refinement. This includes fostering cross-functional governance teams, auditing AI decisions, and establishing ethical KPIs. How AI can be used in finance must always be weighed against how it should be used.

BFSI-specific solutions

AI is rapidly transforming the BFSI landscape by enabling tailored, efficient, and secure digital solutions across the entire value chain.

The table below outlines key AI/ML use cases specifically designed to address the unique demands of the banking, financial services, and insurance sectors.

|

Use Cases |

Business Process | AI/ML Solution Description |

Benefits/KPIs |

| 1. Intelligent credit risk assessment | Credit management | AI models analyze financial history, transaction behavior, and alternative data to predict creditworthiness dynamically. | Lower default rates, real-time decisioning, tailored risk scoring |

| 2. AI-powered financial advisory services | Wealth management | Robo-advisors use predictive analytics and market data to offer personalized portfolio recommendations and investment strategies. | Reduced advisory cost, enhanced client experience, improved AUM |

| 3. AI-enabled claims processing & underwriting | Insurance claims & policy admin | NLP and computer vision assess submitted documents and image-based evidence for auto-adjudication and policy recommendations. | Faster claims cycle, reduced fraud, operational efficiency |

| 4. Real-time fraud & anomaly detection | Financial security | ML models detect suspicious patterns in real-time using transaction, location, and device behavior data. | Reduced fraud losses, improved compliance, minimized false positives |

| 5. Workflow automation for customer onboarding | KYC & compliance | AI-enabled workflow automation accelerates KYC checks using biometric ID verification, document parsing, and cross-platform validation. | Reduced onboarding time, improved regulatory compliance, cost savings |

| 6. Predictive Loan Default Modeling | Loan Management | ML algorithms forecast probability of default (PD) by evaluating cash flow trends, customer interactions, and macroeconomic indicators. | Better NPL management, data-driven loan approvals, minimized credit loss |

| 7. Personalized banking services | Customer experience | AI recommends contextual services such as loans, cards, and savings plans based on user behavior, life events, and predictive intent modeling. | Increased customer engagement, higher cross-sell ratio, personalized CX |

| 8. Conversational AI for support & retention | Customer service | AI banking assistant with NLP capabilities provides 24/7 support, handles queries, offers product recommendations, and routes complex issues to agents. | Lower support costs, higher CSAT, 24/7 multilingual availability |

| 9. Regulatory intelligence automation | Risk & compliance monitoring | AI continuously scans regulation updates and cross-checks internal compliance documentation and processes for alignment. | Reduced audit risk, real-time compliance checks, reduced manual workload |

| 10. AI in investment risk analysis | Asset & portfolio management | AI models simulate market conditions, assess portfolio volatility, and optimize asset allocations based on client goals and macroeconomic indicators. | Lower portfolio risk, improved returns, faster rebalancing |

For a more accurate AI service, please reach out to the Kyanon Digital team directly.

Success stories of implementing AI in BFSI

As leading institutions in the banking, financial services, and insurance (BFSI) sector, JPMorgan Chase and Capital One have consistently pioneered the adoption of emerging technologies to drive innovation and efficiency. Their strategic investments in artificial intelligence reflect the broader industry shift toward intelligent automation and personalized digital experiences. These success stories highlight how top-tier financial organizations are harnessing AI to solve complex operational challenges and elevate customer engagement at scale.

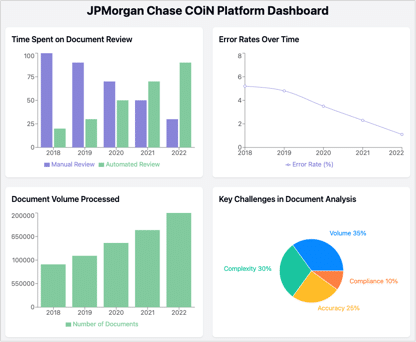

JPMorgan Chase: Automating legal review with COiN

JPMorgan Chase has successfully leveraged artificial intelligence in BFSI through its proprietary Contract Intelligence (COiN) platform. This AI-powered system analyzes legal documents and extracts essential data points, reducing the time spent on document review from 360,000 hours annually to just seconds.

By integrating natural language processing and machine learning, JPMorgan has streamlined internal operations, enhanced compliance accuracy, and mitigated human error in legal workflows. This demonstrates how AI in BFSI sector can be applied to optimize high-volume, complex tasks previously reliant on manual processes.

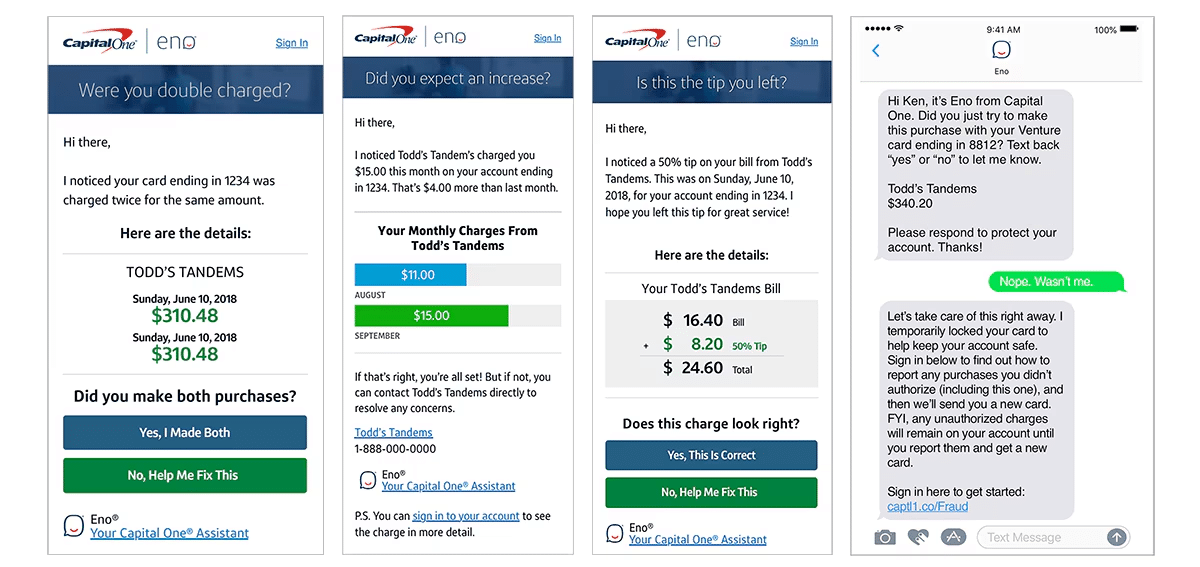

Capital One: Enhancing customer experience with AI assistants

Capital One’s deployment of AI-driven digital assistants represents a pioneering use case of AI banking assistants at scale. The company developed Eno, a chatbot that assists customers with account inquiries, transaction monitoring, and fraud alerts via text and mobile platforms. Eno uses contextual AI to proactively notify users of suspicious charges, subscriptions, and potential late fees – enhancing real-time customer engagement and satisfaction.

This example illustrates how AI is used in banking to not only automate support but also build trust and deepen customer relationships through intelligent, responsive services.

Kyanon Digital: Your AI-as-a-Service Partner for BFSI Innovation

Why Kyanon Digital?

We’re a Tech Partner, Not a Recruiter

We build your team strategically, aligning talents with your software vision and roadmap, not just job requirements. With ongoing upskilling and expert support from our Center of Excellence, your talent stays ahead of challenges and delivers results.

Comprehensive Talent Ecosystem

Kyanon Digital talent ecosystem encompasses over 50,000 technology professionals

- Internal Talent Core: 300+ professionals

- K-Fresh Program: Nurturing Future Digital Leaders from 18 Universities in Vietnam

- External Talent Network: 15,000+ premium candidates

- Partner Network: 1,000+ trusted partners

Your One-Stop Talents Impact Solution

We manage from talent acquisition to HR management for your tech workforce, freeing your team to focus on core business and innovation.

Conclusion

AI in BFSI is no longer a future trend – it’s a present-day imperative. By enhancing fraud detection, streamlining operations, and enabling hyper-personalized services, AI is reshaping how banks and financial institutions operate in an increasingly data-driven world. As AI investment accelerates, organizations must align adoption with strategic goals while navigating ethical, regulatory, and cost-related complexities. Success lies in implementing scalable, BFSI-specific AI solutions that balance innovation with compliance.

At Kyanon Digital, we specialize in delivering AI-as-a-Service solutions tailored for the BFSI sector. Whether you’re exploring AI for the first time or scaling enterprise-wide initiatives, our team of experts is ready to help you unlock strategic value from your AI investments.

Ready to future-proof your BFSI operations with AI? Contact Kyanon Digital today to explore customized AI solutions designed to accelerate your business growth.

Key Takeaways

- AI in BFSI is now a strategic necessity, driving innovation, efficiency, and competitive advantage across the sector. Adoption is accelerating due to the need for hyper-personalization, real-time insights, and scalable cloud-based solutions.

- AI empowers fraud prevention, workflow automation, credit scoring, and compliance management.

- Ethical concerns like data privacy and bias must be addressed through responsible, governance-driven AI practices.

- Sector-specific solutions and success stories from leaders like JPMorgan and Capital One highlight AI’s measurable ROI in BFSI.

References

- 10 AI Use Cases in Banking Operations Explained, Cloud4C

- How Artificial Intelligence Is Reshaping the Financial Services Industry, EY

- AI Use Cases in Banking and Finance, LeewayHertz

- AI for Banking: Benefits, Risks & Use Cases, AlphaBOLD

- Artificial Intelligence (AI) in BFSI Market, Precedence Research

- AI in Banking: 2025 Trends, Devoteam

- Generative AI in BFSI Market, Fortune Business Insights

- Artificial Intelligence (AI) in BFSI Market, Global Market Insights

- Ushering in the New Era of BFSI with AI, Microsoft

- The AI Evolution in Banking, Finconecta

- Cloud AI Market, Fortune Business Insights

- Cloud AI Market, MarketsandMarkets

- Artificial Intelligence in Financial Services, World Economic Forum

- How AI is Changing Corporate Finance, Workday

- How Artificial Intelligence is Transforming the Financial Services Industry, Deloitte

- Data Analytics Trends 2025 in Financial Services, LinkedIn

- Challenges & Ethical Considerations of AI in Banking, LinkedIn (Dr. Mythili A.G.)

- The Legal and Ethical Challenges of AI in the Financial Sector, Medium

- AI Solution Startups for BFSI, CIO Tech Outlook

- AI-Enabled Workflow Automation in BFSI, Infraon

- Case Study: JPMorgan Chase’s COiN, LinkedIn (Jorge Chirinos)

- Artificial Intelligence at Capital One, Emerj

- The Future of the Intelligent Assistant, Capital One