Artificial Intelligence (AI) is transforming the banking and financial services sector, driving efficiency, enhancing customer experiences, and enabling innovative solutions. For CTOs and founders seeking to leverage AI in finance, understanding its applications and market impact is crucial.

Further reading:

- Kyanon Digital Named Among Top AI Development Companies in Vietnam by GoodFirms

- AI In Master Data Management (MDM): Unlock New Possibilities

- AI In Marketing: Shaping Marketing Strategies For The Future

What is AI in Banking and Finance?

Artificial Intelligence (AI) in banking and finance refers to the application of intelligent technologies to automate tasks, extract insights from large datasets, and enhance decision-making across financial operations. Rather than relying solely on manual workflows or rule-based systems, AI empowers banks and financial institutions to operate with greater speed, accuracy, and personalization.

Core technologies involved:

- Machine Learning (ML): Enables systems to learn from data and improve over time without being explicitly programmed.

- Natural Language Processing (NLP): Powers chatbots, voice assistants, and sentiment analysis.

- Predictive Analytics: Supports forecasting in areas like credit scoring, risk management, and market movements.

- Robotic Process Automation (RPA): Automates rule-based tasks such as transaction processing and data entry.

These technologies form the backbone of modern AI applications in banking-from real-time fraud detection to hyper-personalized financial advice.

AI vs. Traditional Automation

Unlike traditional automation that follows predefined rules, AI systems can recognize patterns, make predictions, and adapt their behavior as new data becomes available. This flexibility makes AI particularly well-suited for the complex, data-rich environment of financial services.

Real-world Examples

Fraud Detection & Cybersecurity

- PayPal: AI-powered fraud detection

PayPal uses AI to analyze transaction behavior, device data, and patterns in real time to detect fraudulent activities, significantly reducing financial losses. (SmartDev) - Valley Bank: Reducing false positives in Anti-Money Laundering (AML)

Valley Bank employs AI to build predictive models that more accurately flag suspicious transactions, reducing false positives by 22% and speeding up model development. (VKTR)

Credit Scoring & Risk Management

- Commonwealth Bank of Australia: Document AI for faster credit processing

The bank uses AI to automate document processing, speeding up credit approvals and ensuring compliance with regulatory requirements. (VKTR) - JP Morgan COiN: AI for contract review

JP Morgan’s AI platform automates the review of credit agreements, reducing hundreds of thousands of hours of manual work and improving accuracy. (SmartDev)

Customer Service & Personalization

- Bank of America: Erica AI virtual assistant

Erica is an AI-powered virtual assistant that provides personalized financial advice and support 24/7, handling billions of customer interactions to enhance user experience. (Dialzara)

How is AI Transforming Financial Services?

Artificial Intelligence (AI) is not just optimizing operations in financial institutions-it’s reshaping the way banks interact with customers, assess risk, and ensure compliance. From front-office automation to back-end analytics, AI is driving a shift toward smarter, faster, and more personalized banking.

- Operational Efficiency: AI automates routine tasks like document processing and transaction reviews. For example, JPMorgan’s COIN platform saved 360,000 hours of legal work per year using NLP (Medium).

- Personalized Experiences: AI analyzes customer behavior to offer real-time insights, leading to smarter product recommendations. McKinsey reports that AI-driven personalization can lift customer retention by up to 30%.

- Real-Time Risk & Fraud Detection: AI enables real-time credit scoring, anomaly detection, and anti-fraud monitoring. HSBC are already using AI to monitor millions of transactions for suspicious activity.

- Faster Compliance: AI-powered RegTech tools are helping banks meet evolving KYC/AML requirements with better accuracy and less overhead.

By embracing AI, traditional banks are closing the digital gap with fintechs – positioning themselves for faster growth and innovation.

Transform your ideas into reality with our services. Get started today!

Our team will contact you within 24 hours.

Market Trends and Leading AI Banking Solutions

Artificial Intelligence (AI) is revolutionizing the banking and finance industry, with major investments and rapid adoption shaping the future of financial services. Leading research firms such as Gartner, Deloitte, KPMG, and the World Economic Forum provide valuable insights into these trends and the top AI solutions transforming the sector.

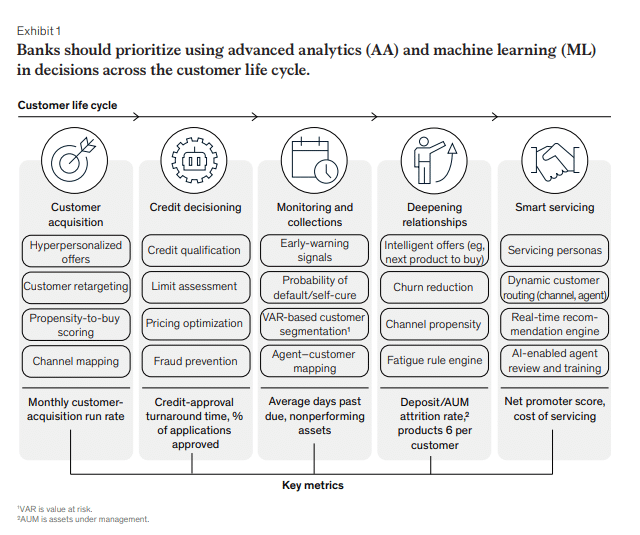

AI-Powered Services in Retail and Commercial Banking

Banks are actively embracing AI to enhance efficiency and drive innovation. Institutions are allocating significant resources to integrate AI across products and operations.

According to Gartner’s 2023 report, 67% of banking institutions have already integrated AI technologies into their operations. This widespread adoption highlights AI’s critical role in helping banks stay competitive amid fast-evolving market conditions. Key AI technologies include machine learning, natural language processing, and generative AI, which collectively enable banks to enhance customer experiences, improve product innovation, and boost operational efficiency. Gartner stresses that product leaders must strategically embed AI to maintain a competitive advantage.

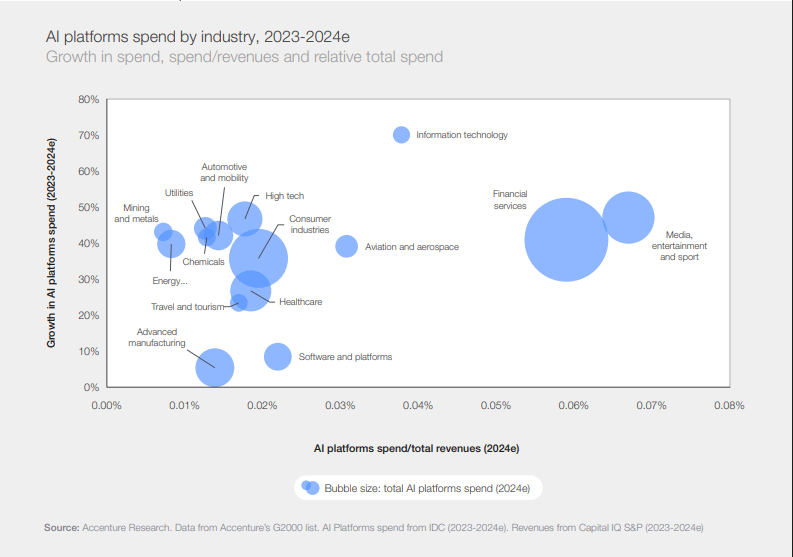

The World Economic Forum’s 2025 report reveals that financial firms invested approximately $35 billion in AI in 2023, with projections soaring to $97 billion by 2027. This surge reflects AI’s dual impact on driving efficiency and generating new revenue streams. About 70% of financial services executives expect AI to contribute directly to revenue growth in the coming years, particularly through personalized customer advice, fraud detection, and advanced risk management.

Key AI Technologies and Strategic Priorities

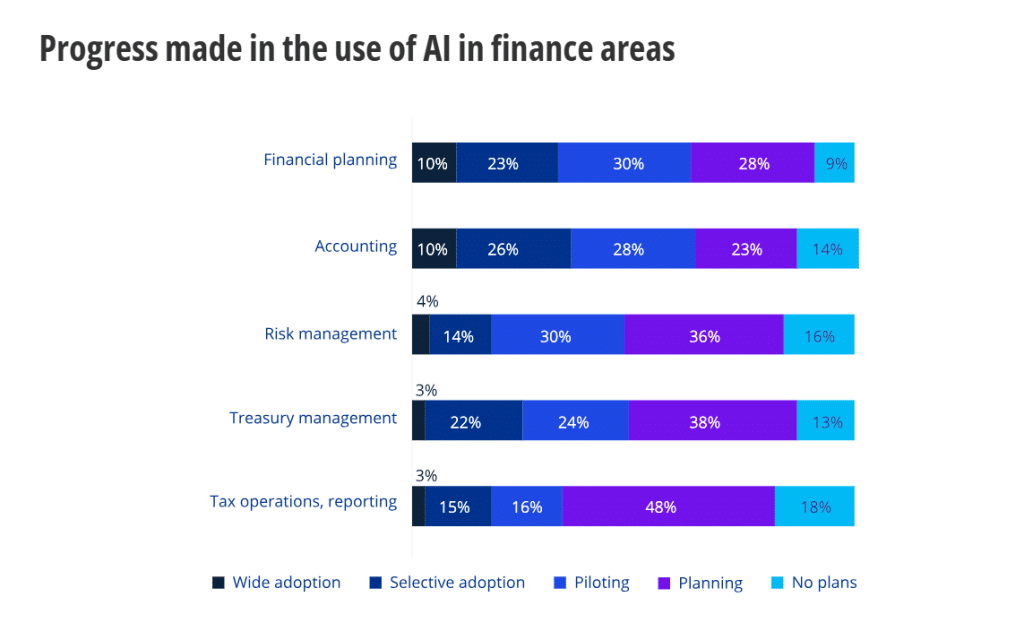

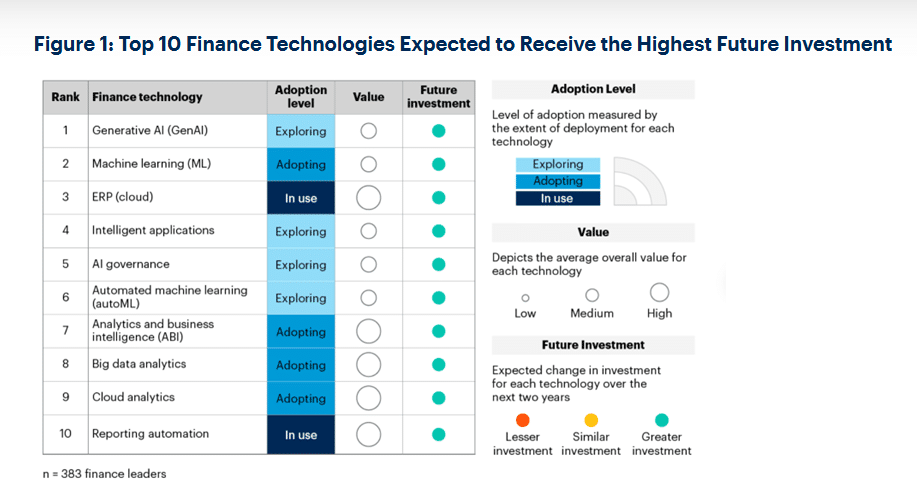

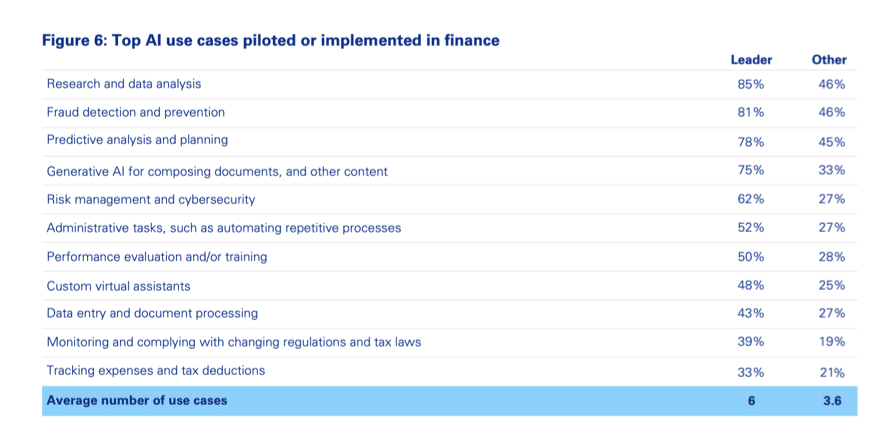

Finance leaders are prioritizing generative AI and cloud ERP to improve analytics and decision-making. Investments are shifting toward integrated, AI-driven solutions.

Gartner’s 2025 Finance Survey highlights that finance leaders are prioritizing investments in AI-enabled technologies such as generative AI and machine learning, alongside cloud-based enterprise resource planning (ERP) systems. Over 50% of finance executives plan significant increases in generative AI spending to enhance analytics, forecasting, and decision-making capabilities. However, challenges remain in integrating fragmented automation technologies to unlock full process value. Cloud ERP upgrades are also a major focus, as vendors incorporate AI and self-service analytics to deliver real-time insights at scale.

AI Trends in Retail and Commercial Banking

AI is enabling banks to modernize core services and personalize client interactions. From automation to compliance, AI plays a key role in both retail and commercial banking.

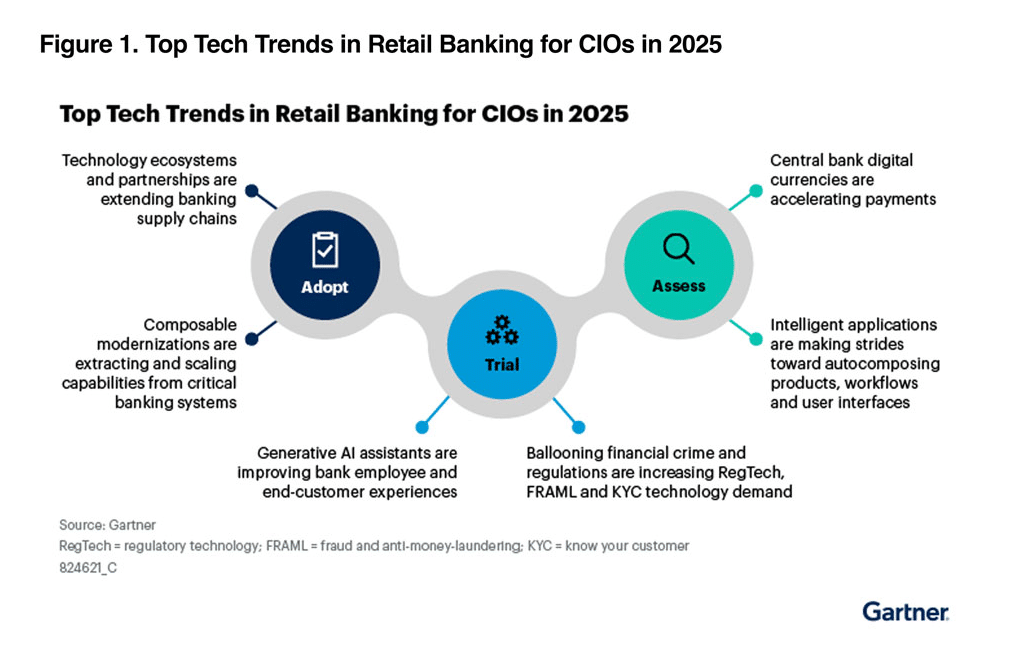

In retail banking, Gartner identifies top technology trends for 2025 centered on innovation, efficiency, and regulatory compliance. AI-powered solutions are critical enablers for digital transformation initiatives, helping banks automate compliance processes, personalize customer interactions, and optimize backend operations.

Similarly, commercial banking CIOs are focusing on AI-driven automation and analytics to improve loan processing, credit risk assessment, and customer engagement, ensuring agility in a competitive environment, as detailed in Gartner’s report for commercial banking CIOs.

Responsible AI and Regulatory Compliance

Banks are implementing Responsible AI frameworks to ensure transparency and fairness. AI ethics and regulatory readiness are becoming strategic imperatives.

Notably, Gartner predicts that by 2026, 90% of finance departments will have implemented at least one AI solution, yet fewer than 10% will reduce headcount due to AI adoption. This highlights that organizations view AI not as a replacement for human workers but as an augmenting tool that enhances capabilities while maintaining accountability.

Key elements of this responsible AI approach include:

- Explainable AI (XAI): Providing clear explanations for AI-driven decisions to promote transparency.

- Enhanced model governance and regular audits: Ensuring AI systems remain free from bias, errors, and regulatory breaches.

- Compliance with data privacy regulations such as GDPR and local laws.

In summary, financial institutions are building an AI ecosystem that drives innovation while controlling risks, positioning AI as a supportive tool that upholds customer trust, ethical standards, and legal compliance.

AI-Powered Fraud Prevention and Cybersecurity

AI is transforming fraud detection with real-time, adaptive threat intelligence. It helps banks proactively identify suspicious behavior across digital channels.

For example, JPMorgan Chase achieved a 40% reduction in fraud losses by integrating large language models (LLMs) to analyze transaction patterns and detect anomalies more effectively. Similarly, Mastercard leverages AI to block suspicious transactions before funds are transferred, significantly enhancing customer protection and trust.

According to KPMG, AI systems have reduced fraud detection times by up to 70% through the combination of machine learning and big data analytics, while also decreasing false positive rates. This not only strengthens security but also improves the customer experience by minimizing unnecessary transaction disruptions.

Overall, the adoption of advanced AI-driven fraud prevention solutions is enabling banks to stay ahead of evolving threats, reduce operational losses, and maintain regulatory compliance-making AI a critical pillar of modern financial cybersecurity strategies.

Conclusion

The convergence of AI technologies is fundamentally reshaping banking and finance by enabling smarter automation, enhanced customer experiences, and improved risk management. Leading financial institutions are accelerating AI adoption to reduce costs, unlock new revenue streams, and stay competitive. As AI matures, strategic investments and thoughtful integration will be essential to fully harness its potential while managing risks such as data privacy and cybersecurity.

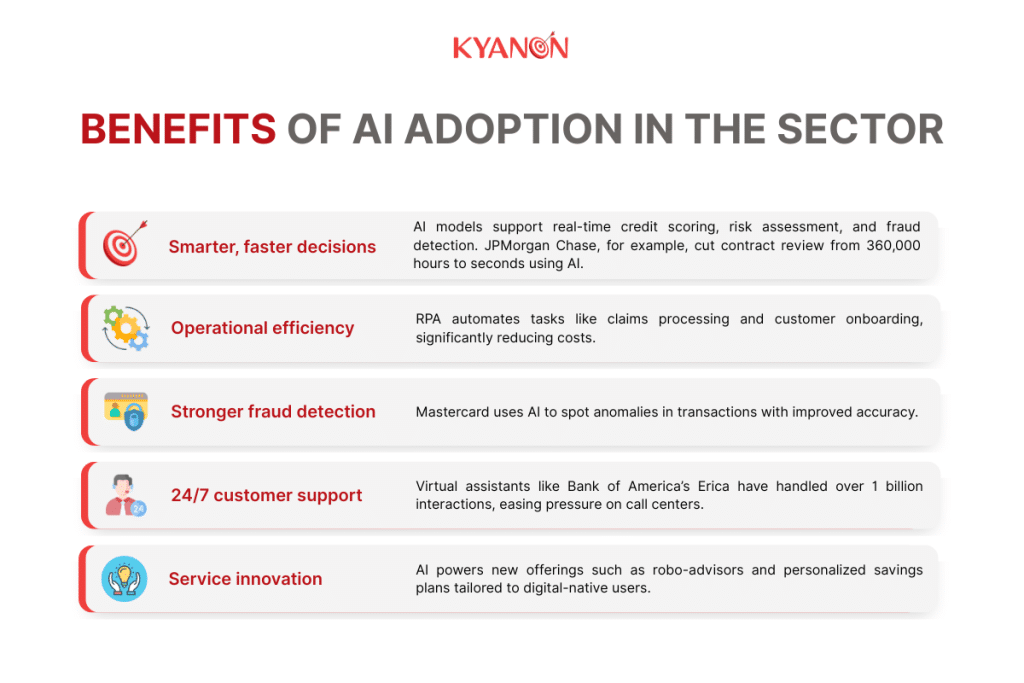

Key Benefits and Challenges of AI Adoption in the Sector

1. Benefits

AI brings measurable value across financial services by improving speed, accuracy, and personalization.

- Smarter, faster decision-making: AI models analyze thousands of variables in real time to support credit scoring, risk evaluation, and fraud detection. For instance, JPMorgan Chase uses AI to review legal documents, cutting contract review time from 360,000 hours to seconds (Business Insider).

- Cost efficiency through automation: Robotic Process Automation (RPA) reduces manual tasks in claims processing, customer onboarding, and transaction monitoring-lowering operational costs significantly.

- Enhanced fraud prevention: Mastercard’s Decision Intelligence uses AI to analyze transaction patterns and detect anomalies with higher accuracy (Mastercard).

- 24/7 customer engagement: AI-powered chatbots like Bank of America’s Erica have handled over 1 billion interactions, offering consistent support and reducing call center load.

- New service innovation: AI unlocks new business models-from personalized savings plans to robo-advisors-attracting digital-native customers.

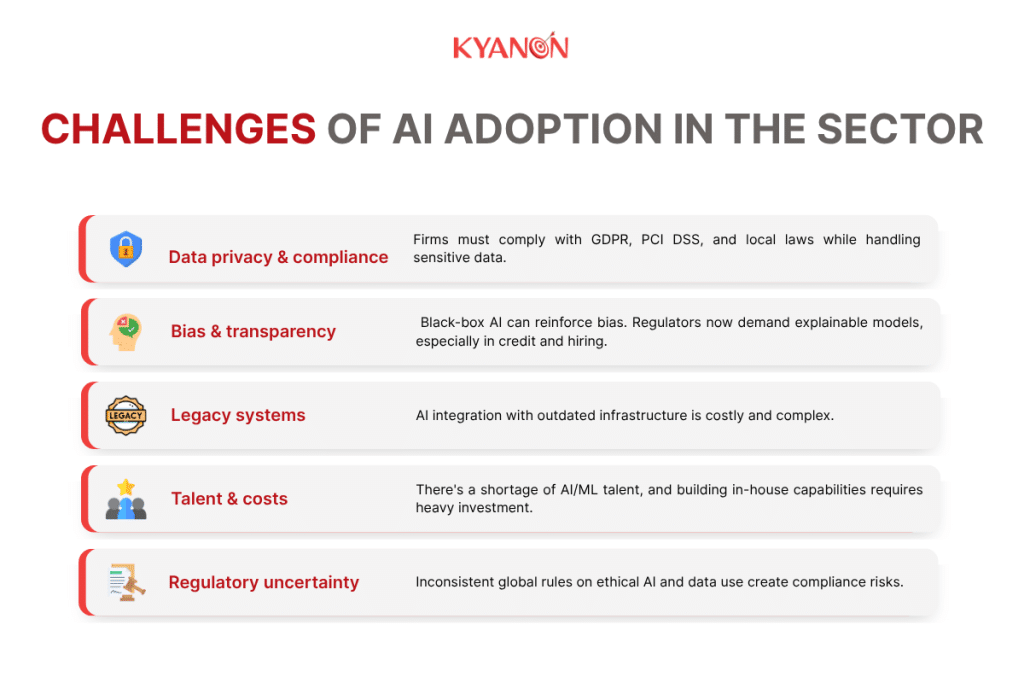

2. Challenges

Despite the clear advantages, implementing AI in finance comes with strategic and operational hurdles:

- Data privacy and compliance: Financial firms must navigate regulations like GDPR, PCI DSS, and local banking laws while leveraging sensitive data.

- Bias and explainability: Black-box algorithms risk reinforcing discrimination if not properly governed. Regulators increasingly require transparent AI systems, especially for lending and hiring.

- Legacy infrastructure: Integrating AI with outdated core systems is complex and resource-intensive, often slowing innovation.

- Talent and cost barriers: AI/ML specialists are in short supply, and developing in-house AI capabilities demands significant investment.

- Regulatory uncertainty: Varying global standards around ethical AI, data usage, and model validation pose additional risks.

Top AI Use Cases in Banking and Financial Services

Artificial intelligence is reshaping the financial industry, going far beyond simple automation to touch nearly every aspect of banking operations. The integration of ai and finance technologies is enabling banks and financial institutions to enhance security, improve customer service, streamline compliance, and personalize offerings. Below are some of the most impactful banking ai use cases transforming the sector today.

Fraud Detection

Fraud detection remains one of the most critical applications of ai and banking. According to Feedzai‘s 2025 AI Trends in Fraud and Financial Crime Prevention report, over 90% of financial institutions now use AI-powered solutions to detect fraud in real time, including transaction fraud, scam detection, and anti-money laundering (AML) efforts. AI models excel at identifying unusual patterns and anomalies across billions of transactions, helping banks like HSBC and JPMorgan Chase reduce losses and stay ahead of increasingly sophisticated fraud tactics. The report also highlights that AI augments human expertise by increasing fraud investigation efficiency by 43%, allowing experts to focus on complex cases.

Customer Service

In the realm of customer experience, ai and financial services leverage AI chatbots and virtual assistants to provide instant, personalized support. Solutions like Bank of America’s Erica and Capital One’s Eno use natural language processing to handle routine queries, offer financial tips, and improve service availability around the clock. McKinsey emphasizes that these AI-driven tools reduce operational costs while boosting customer satisfaction and engagement, making them a staple in modern banking ai strategies.

Credit Scoring and Loan Processing

AI is revolutionizing credit scoring by incorporating alternative data sources such as employment history and utility payments, expanding credit access to underserved populations. Startups like Zest AI and Upstart utilize machine learning models to assess creditworthiness more accurately and efficiently. KPMG‘s analysis underscores that AI-powered credit risk models accelerate loan approvals and improve risk management, driving financial inclusion and reducing default rates.

Compliance Automation

Regulatory compliance is a complex and costly challenge for banks. AI simplifies this through automated Know Your Customer (KYC) processes and continuous transaction monitoring. Companies like Clari5 deploy real-time AI analytics to detect fraudulent activities and ensure adherence to regulatory frameworks at scale. Gartner reports that AI-powered compliance automation reduces manual workloads and enhances accuracy in reporting, enabling banks to meet stringent regulations more effectively.

Risk Management

AI-driven predictive analytics empower financial institutions to monitor market trends, assess credit risk dynamically, and optimize portfolios proactively. McKinsey highlights that AI models enable faster, data-driven decisions with improved accuracy, helping banks mitigate risks in volatile markets and adapt to changing economic conditions.

Personalized Banking

Hyper-personalization is another powerful benefit of ai and finance. By analyzing customer behavior and preferences, AI delivers tailored product recommendations, budgeting insights, and proactive alerts that foster deeper customer loyalty. Accenture notes that AI-enabled personalization not only enhances customer satisfaction but also increases cross-selling opportunities and revenue growth.

Why Choose Kyanon Digital for AI Software Development Services?

When it comes to implementing AI in banking and financial services, choosing the right technology partner is critical. Kyanon Digital brings a strategic blend of technical expertise, industry know-how, and long-term vision.

Proven Expertise

With over a decade of experience in digital consulting and custom software development, we’ve successfully delivered scalable AI solutions for leading players in the BFSI sector. Our teams understand the nuances of financial security, compliance, and system integration.

End-to-End AI Solutions

From AI strategy and data architecture to model development and deployment, we offer full-cycle delivery. Whether you’re building a credit scoring engine or an AI-powered support bot, we guide you from MVP to scale-with continuous optimization.

Trusted by Global Clients

We’ve helped financial institutions reduce fraud incidents by 40%, increase loan approval efficiency by 30%, and enhance customer retention with personalized AI engagement. Our client base spans Vietnam, APAC, and North America.

Scalable and Ethical AI

We prioritize transparency and fairness in AI development. Our models are built with explainability in mind and are designed to integrate with existing infrastructure-without disrupting business-as-usual.

A Strategic Innovation Partner

Kyanon Digital doesn’t just build software-we help shape your long-term digital roadmap. We collaborate seamlessly with your in-house tech and data teams, offering 24/7 support and flexible engagement models tailored to your pace of growth.

Contact us now!

References

- KPMG Global AI in Finance Report, KPMG

- AI in Finance: Top Use Cases and Real-World Applications, SmartDev

- 5 AI Case Studies in Banking, VKTR

- 5 AI Customer Service Success Stories in Banking, Dialzara

- How JPMorgan Uses AI to Save 360,000 Legal Hours a Year, Medium

- Why AI-enabled customer service is key to scaling telco personalization, McKinsey

- Harnessing the power of AI to fight financial crime, HSBC

- Emerging Tech Impact Radar: Artificial Intelligence in Banking, Gartner

- Artificial Intelligence in Financial Services, World Economic Forum

- Gartner Finance Survey Reveals the Top 10 Technologies for Future Investment in Finance, Gartner

- Gartner® Report – Top Technology Trends in Retail Banking for CIOs 2025, Digital Realty

- Top Technology Trends for Commercial Banking CIOs for 2025, Gartner

- More than 50% of Fraud Driven by AI and Hyper-Realistic Impersonations, but Banks also use Generative AI to Fight Back, Feedzai

- Artificial Intelligence in Risk Management, KPMG

- AI-powered decision making for the bank of the future, McKinsey

- Generative AI for customer growth, Accenture