The financial services industry, also known as BFSI (Banking, Financial Services, and Insurance), is undergoing a period of unprecedented transformation. According to McKinsey, driven by the rise of disruptive technologies, evolving customer demands, and a surge in competition from tech-savvy FinTech startups, BFSI institutions are embracing digital transformation at an accelerated pace.

This digital transformation journey, however, is not without its challenges. BFSI institutions face a complex landscape of hurdles that can impede their progress and hinder their ability to deliver a truly digital and customer-centric experience.

In this blog post, Kyanon Digital will explore the top 10 digital transformation challenges in the BFSI industry, along with potential solutions and strategies to overcome them. By understanding these obstacles and implementing effective solutions, BFSI institutions can unlock the full potential of digital transformation and thrive in the competitive financial landscape.

1. The digital transformation in the BFSI industry

The BFSI sector is revamping its digital landscape across the globe to enable more personalized and secured banking and financial services for customers. Faster cloud-adoption followed by the use of generative AI, machine learning (ML), autonomous systems, privacy enhancing computing and internet of things in the BFSI sector indicate that a digital transformation has begun.

Gartner predicted that the BFSI’s expenditure on IT will exceed USD 623 billion in 2023. Furthermore, the spending on software by the BFSI sector will exhibit the largest growth with an increase of 13.5% in 2023. IT spending by global enterprises is expected to see a five-year compound annual growth rate (CAGR) of 6.5%, to reach an estimated USD 761 billion by 2025. However, even though the BFSI sector is undergoing major transformation, there are some factors which are impeding this growth.

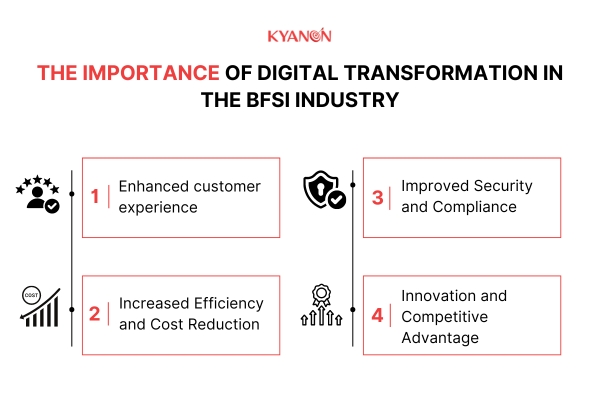

2. The importance of digital transformation in the BFSI industry

The BFSI industry is undergoing a critical transformation driven by the urgent need to adapt to a rapidly changing landscape. Digital transformation is no longer a choice, but a necessity for survival and growth in this competitive environment. Here’s why it holds such importance.

2.1. Enhanced customer experience

- Personalization: Digital transformation allows BFSI institutions to leverage data and AI to personalize financial products and services for each customer. This creates a more relevant and engaging experience, leading to higher satisfaction and loyalty

- Convenience and Accessibility: Digital platforms offer 24/7 access to banking services, making them more convenient and accessible for customers. This includes mobile banking apps, online portals, and chatbots for quick inquiries.

- Seamless Omnichannel Experience: Customers expect a consistent experience across all touchpoints, whether it’s online, mobile, or in-branch. Digital transformation allows BFSI institutions to create a unified and seamless omnichannel experience

2.2. Increased Efficiency and Cost Reduction

- Automation: Repetitive tasks can be automated using robotics process automation (RPA) and other technologies, freeing up employees to focus on more complex tasks and customer service.

- Streamlined Operations: Digital tools can optimize back-office processes, reducing operational costs and improving overall efficiency.

- Data-Driven Decision Making: Data analytics provides valuable insights that can be used to improve decision-making, resource allocation, and risk management

2.3. Improved Security and Compliance

- Enhanced Security: Advanced cybersecurity solutions can be implemented to protect customer data from cyberattacks and fraud.

- Regulatory Compliance: Digital tools can help BFSI institutions comply with ever-evolving regulations and reporting requirements.

- Fraud Detection: Machine learning can be used to identify and prevent fraudulent activities more effectively.

2.4. Innovation and Competitive Advantage

- Faster Product Development: Digital tools can accelerate the development and launch of new financial products and services.

- Open Innovation: Digital platforms enable collaboration with FinTech startups to foster innovation and bring new solutions to market quicker.

- Meeting Evolving Customer Demands: Digital transformation allows BFSI institutions to adapt to changing customer needs and preferences, ensuring they stay competitive in the long run.

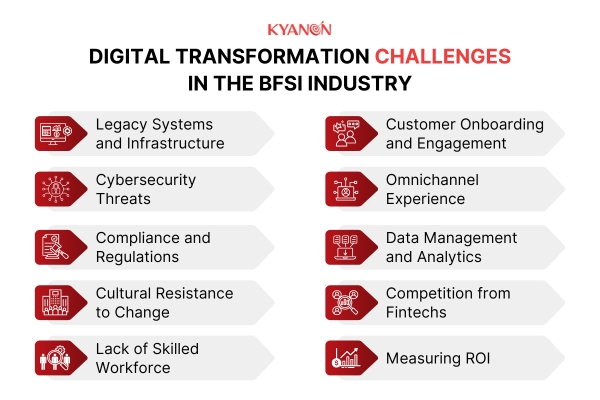

3. Digital transformation challenges in the BFSI industry

The BFSI industry (Banking, Financial Services, and Insurance) is undergoing a period of tremendous change fueled by digital transformation. While this transformation offers immense opportunities, it also presents significant challenges that institutions must overcome to remain competitive. Here’s a breakdown of some key challenges faced by the BFSI industry.

3.1. Legacy Systems and Infrastructure

Many BFSI institutions are burdened by outdated core banking systems and infrastructure. These legacy systems are often inflexible, siloed, and struggle to integrate with modern technologies, hindering innovation and agility (McKinsey & Company)

3.2. Cybersecurity Threats

The BFSI industry is a prime target for cyberattacks due to the vast amount of sensitive customer data it holds. The increasing sophistication of cyberattacks demands robust and constantly evolving cybersecurity measures (World Economic Forum)

3.3. Compliance and Regulations

Regulations surrounding data privacy, cybersecurity, and anti-money laundering are constantly evolving, requiring BFSI institutions to invest significant resources in compliance (Deloitte)

3.4. Cultural Resistance to Change

Implementing digital transformation often requires significant changes within the organization’s culture. Employees may resist new technologies or processes, making it crucial to foster a culture of innovation and continuous learning (PwC)

3.5. Lack of Skilled Workforce

The BFSI industry needs a workforce equipped with the skills to manage, develop, and maintain digital solutions. Addressing this skills gap requires investing in training programs and attracting talent with expertise in data analytics, cybersecurity, and artificial intelligence (The Financial Brand)

3.6. Customer Onboarding and Engagement

Creating a seamless and secure digital onboarding experience for new customers is crucial. Additionally, fostering ongoing customer engagement with new platforms and digital services is a continuous challenge (Accenture)

3.7. Omnichannel Experience

Customers expect a consistent and personalized experience across all channels, whether they interact with the BFSI institution online, through a mobile app, or in a physical branch (Capgemini)

3.8. Data Management and Analytics

Extracting valuable insights from the vast amount of customer data collected by BFSI institutions requires robust data management and analytics capabilities. This includes ensuring data quality, security, and compliance with regulations (IBM)

3.9. Competition from Fintechs

FinTech startups are emerging as strong competitors, offering innovative financial products and services with greater agility than traditional institutions. BFSI institutions need to adapt and potentially collaborate with Fintechs to stay ahead (EY)

3.10. Measuring ROI

Demonstrating the concrete return on investment (ROI) of digital transformation initiatives can be challenging due to the long-term nature of some investments. Developing clear metrics to track progress and success is crucial (Harvard Business Review)

4. Kyanon Digital: Your tech partner for digital transformation success

Kyanon Digital can empower BFSI institutions navigating digital transformation challenges. They offer solutions for legacy system modernization, robust cybersecurity, and compliance management. Kyanon Digital can also help address cultural resistance through change management strategies and create user-friendly customer onboarding experiences. Their expertise in omnichannel strategy and data management helps BFSI institutions deliver a seamless customer experience and leverage data-driven insights.

Contact Kyanon Digital today for consultancy from top experts in the BFSI industry!