In this article co-written with our loyalty partner Open Loyalty, we explore the landscape of loyalty in the Asia Pacific region.

Deloitte’s consumer research reveals that loyalty is key to capturing consumers’ needs and values in 2023 and beyond. Their survey shows that 70% of consumers spend more and engage more frequently with brands and retailers when they have signed up for the loyalty program than when they have not.

Moreover, loyalty programs can influence consumers’ purchase decisions across different categories, channels and occasions.

Having glanced at the worldwide picture, we now take a closer look at three select geographical regions.

1. Insights: loyalty in Vietnam, Singapore, Asia Pacific region

1.1. The loyalty landscape in Vietnam

According to Research and Markets, the loyalty market in Vietnam is expected to grow at an impressive rate, reflecting an increase from US$967.2 million in 2023 to an anticipated US$1.56 billion by 2028. This analysis offers an in-depth look at market opportunities, consumer demographics, and operational KPIs across various industry sectors. It highlights the relevance of loyalty programs as pivotal tools for businesses to enhance customer retention and engagement.

Emerging trends, such as mobile loyalty applications and value redemption rates, are set to shape the future of loyalty schemes in Vietnam’s swiftly evolving digital ecosystem. With the integration of advanced analytics, artificial intelligence, and innovative loyalty platforms, businesses are able to target a diverse consumer base with personalized offerings.

1.2. The loyalty landscape in Singapore

The loyalty market in Singapore is expected to reach US$589.7 million in 2024. In value terms, the Singapore loyalty market has recorded a CAGR of 11.8% during 2019-2023.

The Singaporean loyalty market will continue to grow over the forecast period and is expected to record a CAGR of 9.2% during 2024-2028, growing from US$533.8 million in 2023 to reach US$839.6 million by 2028, as stated by Research and Markets.

1.3. The loyalty landscape in Asia Pacific

The Research and Markets stated that the loyalty market in Asia-Pacific is expected to grow by 11.0% on an annual basis to reach US$52.05 billion in 2024.

In value terms, the loyalty market in the region has recorded a CAGR of 12.6% during 2019-2023. The loyalty market in the country region will continue to grow over the forecast period and is expected to record a CAGR of 9.6% during 2024-2028. The loyalty market in the region will increase from US$46.90 billion in 2023 to reach US$75.02 billion by 2028.

The loyalty program industry is poised for accelerated growth over the medium term in the Asia Pacific region.

From India to Australia and Japan, the adoption of loyalty programs is growing at an accelerated pace and the trend is projected to continue further over the next three to four years.

2. Challenges in the Asia Pacific and Beyond

Data privacy concerns arise with the regulation of data protection applied in many countries. Consumers, especially in developing countries, are becoming more aware of their data rights, and businesses need to ensure that their loyalty programs comply with local data protection regulations and have to think of a more creative approach for Loyalty Marketing.

Challenges for loyalty marketing in 2024 and 2025 may also include the complexity of gamification and app/website engagement point-scoring systems. Additionally, point redemption scenarios are becoming more diverse, extending beyond simply exchanging points for vouchers to include direct point-to-voucher redemption.

3. Goals in the Asia Pacific and Beyond

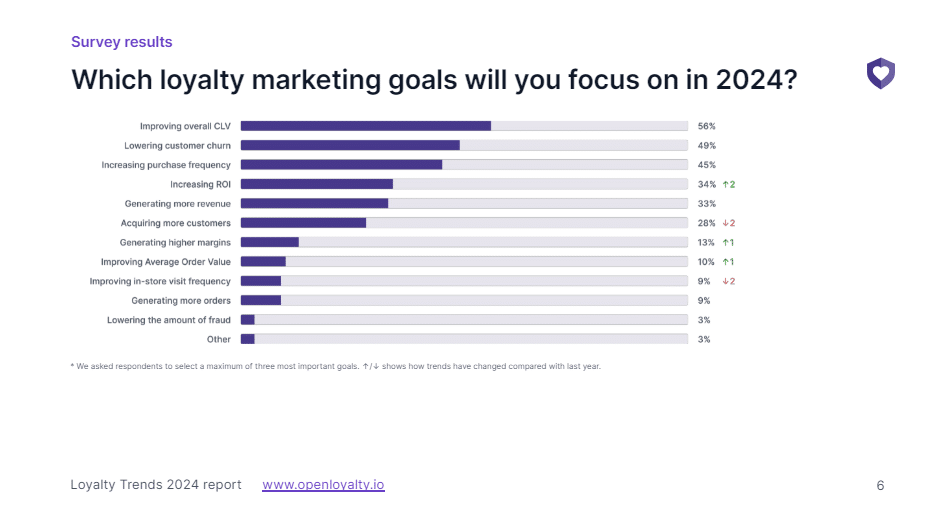

The Open Loyalty’s Loyalty Trends 2024 interviewed 100+ loyalty experts from around the world. According to them, the most important loyalty program goals are:

- Improving overall Customer Lifetime Value;

- Lowering customer churn;

- Increasing purchase frequency;

- Increasing ROI.

Compared to the previous year, the top 3 trends stay the same. The ROI of loyalty marketing becomes more pressing and takes over customer acquisition in the fourth place. Combined, these signs indicate that the loyalty experts’ focus is on keeping and maximizing the value of current customers.

Beyond that, the most important challenges noted by the experts in open-ended questions are: reducing the marketing budget and optimizing customer acquisition costs, a bigger focus on retaining existing customers as they are safe spots for the business, and using loyalty programs as a key tool for collecting customer data in a cookieless world.

4. Solutions or how to prepare

Loyalty programs are increasingly recognized as essential tools for businesses navigating market slowdowns and recessions. They are viewed as crucial strategies for achieving success, aligning with rising customer demand for savings. As such, the anticipated growth of these programs reflects their importance in meeting consumer needs and driving business performance.

Compared with previous years, we see that AI, automation, and personalization have everyone’s attention, no matter the industry.

- Gamification and Experiential Rewards: Gamification elements and experiential rewards will continue to gain traction, making loyalty programs more engaging and entertaining for participants. Interactive challenges, competitions, and exclusive events can create memorable experiences that foster stronger emotional connections with brands.

- Data Privacy and Security: With growing concerns about data privacy and security, loyalty programs will need to prioritize transparent data practices and robust security measures. Implementing clear consent mechanisms, secure data storage, and compliance with regulatory frameworks will be essential to maintaining consumer trust and loyalty.

- AI integration: The integration of AI in loyalty programs is poised to revolutionize customer engagement and retention strategies. By leveraging predictive analytics and segmentation, AI enables the creation of targeted offers and communication strategies, reducing churn and optimizing margins through data-driven insights. This shift towards AI-driven personalization emphasizes the importance of showcasing tangible ROI and fostering collaborations with partners to maximize benefits. Moving forward, hyper-personalization will be key, with tailored campaigns and micro-segment targeting becoming the norm, replacing traditional one-size-fits-all approaches.

- Centralized loyalty: Centralized marketing loyalty is said to be trending in upcoming years. This is a strategy that aims to create a unified and consistent customer experience across all the channels and touchpoints of a business. It involves integrating the data, processes, and technologies that support the loyalty programs and campaigns of a business, and using them to deliver personalized and relevant offers, rewards, and communications to the customers. By doing so, a business can increase customer satisfaction, retention, and loyalty, as well as optimize its marketing performance and return on investment.

5. Kyanon Digital and Open Loyalty

Kyanon Digital is currently a strategic partner with Open Loyalty, a leading provider of loyalty program solutions. This collaboration brings together Kyanon Digital’s expertise in digital innovation and Open Loyalty’s robust loyalty platform to deliver cutting-edge solutions for businesses seeking to enhance customer engagement and retention.

Together, this empowered combination aims to enhance businesses with advanced loyalty program capabilities, enabling them to drive sustainable growth and maximize customer lifetime value.

Contact us for consultation about loyalty from top experts in the industry.